-

For potential higher-end homebuyers, the pandemic was merely a pause, but for those seeking affordable properties — often people of color — it created yet another barrier.

June 23 -

How the mortgage and housing industries react to the current civil rights moment could shape policies and bridge the homeownership divide for the Black community.

June 19 -

As protesters continue to take to the streets to express outrage over racial injustice and inequality, banks — for the first time — will commemorate the date that marks the end of slavery in the U.S.

June 16 -

Though outlawed by the Fair Housing Act in 1968, the racist housing practice perpetuated a wealth gap for Black people still widening today.

June 12 -

IBM called for rules aimed at eliminating bias in artificial intelligence to address concerns which range from identifying faces in security-camera footage to making determinations about mortgage rates.

January 21 -

The Department of Housing and Urban Development has proposed an overhaul of an Obama-era rule meant to guide local jurisdictions in how they comply with the Fair Housing Act.

January 7 -

The two Democrats sent a letter "raising grave concerns about whether the bureau is fulfilling its statutory obligations."

December 18 -

Better.com saw huge growth in mortgages to traditionally underserved customer bases in 2019 and believes digital applications led to the avoidance of discriminatory lending.

December 17 -

Despite assurances by Director Kathy Kraninger that the agency is cracking down on discrimination, it has not filed an enforcement action or sent a Department of Justice referral on a fair-lending violation in two years.

December 17 -

House Democrats described the disparate impact standard as "the most important tool" for enforcing the Fair Housing Act.

November 22 -

Eric Blankenstein, who resigned from the Consumer Financial Protection Bureau in May after the discovery of his racially charged writings, was named acting executive vice president of Ginnie Mae.

November 8 -

Gentrification and rapid home price growth have intensified the loss of wealth the African-American community experienced post-crisis, widening the chasm between what white and black borrowers can afford, Redfin found.

October 17 -

Institutions that offer fewer than 500 open-end lines of credit will get another two-year exemption from reporting requirements under the Home Mortgage Disclosure Act.

October 10 -

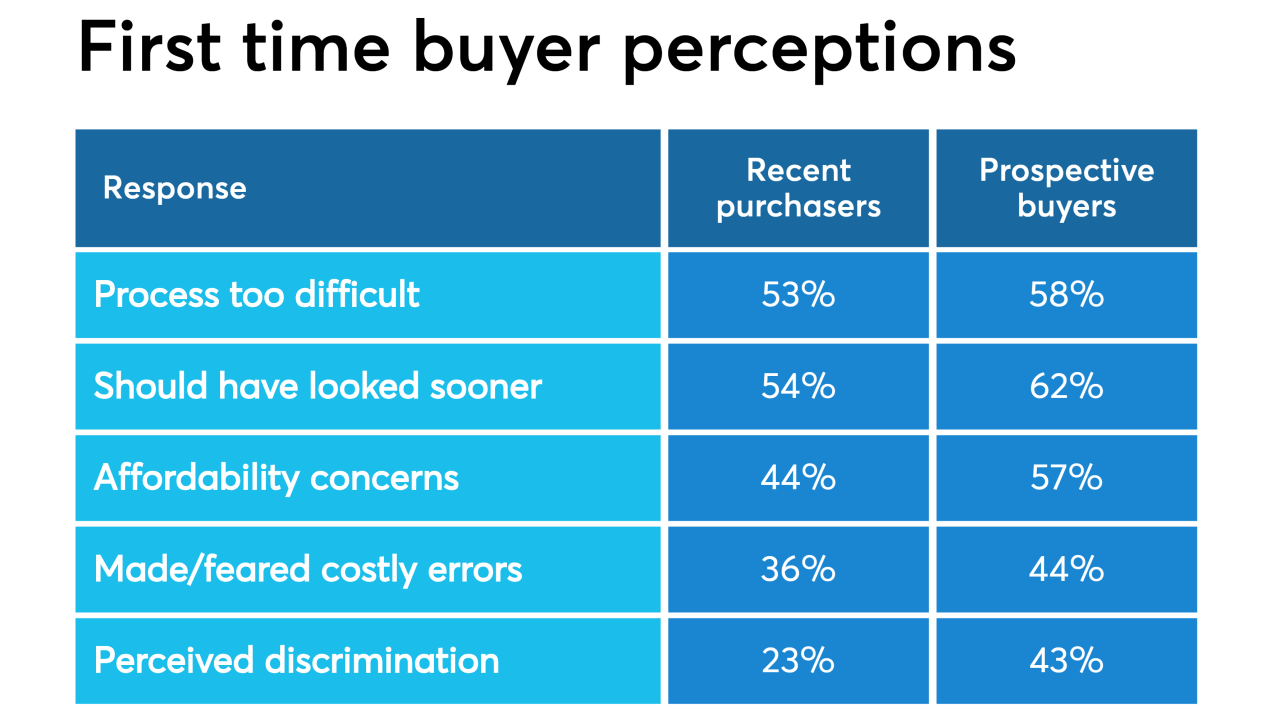

More than half of recent, as well as prospective, first-time homebuyers said purchasing a house was more difficult than it should be, according to a survey for Framework.

September 25 -

California Attorney General Xavier Becerra filed a brief Thursday in support of Oakland's lawsuit against Wells Fargo, alleging that the bank illegally discriminated against minority borrowers.

September 13 -

With its proposal to restrict disparate-impact claims, the Trump administration seems determined to solve a problem that does not exist.

September 6

-

The agency says the "disparate impact" standard needs to be amended to align with a recent Supreme Court ruling. But consumer advocates say the change would make it more difficult for borrowers to allege discrimination under the Fair Housing Act.

August 16 -

Under a proposal yet to be officially unveiled, plaintiffs relying on the so-called “disparate impact” doctrine would have to show a more direct link between a lender’s policy and discriminatory effect.

July 31 -

Eric Blankenstein, now at HUD, is under fire for asking a subordinate to defend him after it was revealed he wrote racially charged blogs 14 years earlier.

July 29 -

The bill, similar to legislation that passed the chamber last year, would permit the inclusion of items such as rent and telecom payments to help consumers build their credit profiles.

July 25