Regulation and compliance

Regulation and compliance

-

A Government Accountability Office report warns the Office of the Comptroller of the Currency to clarify which records from the Basel Committee on Banking Supervision should be treated as federal records and thus retained according to the Federal Records Act.

January 29 -

Rocket denied the allegations, saying the lawsuit is a retread of a case the Consumer Financial Protection Bureau filed that was quickly dismissed.

January 28 -

State regulators say proposed changes by the Federal Reserve that would make state bank examiners the primary boots on the ground will make bank examinations faster, but could cause some issues to go overlooked.

January 27 -

The regulator, in an audit with the Department of Homeland Security, found almost 6,000 ineligible non-American tenants in the units it supports.

January 26 -

Observers said the Supreme Court likely will allow Federal Reserve Gov. Lisa Cook to remain at her post while she challenges her purported removal by President Donald Trump. But her continued presence would slow, rather than stop, the president's quest for a voting majority on the central bank board.

January 22 -

The Federal Deposit Insurance Corp. Thursday finalized a framework for banks to appeal supervisory determinations, replacing the agency's existing appeal committee with an independent three-member panel, one member of which must have industry experience.

January 22 -

The Supreme Court Wednesday appeared skeptical of the Justice Department's argument that removal of a Federal Reserve governor is unreviewable or that the president's preference for Fed governors outweighs the harm to the Fed from curbing the central bank's political independence.

January 21 -

The Consumer Financial Protection Bureau has backed off enforcement and supervision of consumer protection laws, leaving states to fill the void — and potentially creating a "patchwork" of state laws that banks will have to comply with.

January 21 -

Representatives of both insurers and policyholders point out multiple flaws in the new laws and additional proposed bills.

January 20 -

Treasury Secretary Scott Bessent said Tuesday morning that banks should focus on the sweeping deregulation the administration has enacted as the industry pushes back on President Trump's proposed 10% credit card interest rate cap.

January 20 -

The ex-employee was accused of violating conflict of interest rules and submitting falsified documents for $1.7 million worth of loans in her six-month tenure.

January 19 -

A pair of fair housing attorneys fired by the Department of Housing and Urban Development testified the agency has stopped enforcement of those laws.

January 16 -

The Bureau of Labor Statistics reported Tuesday morning that consumer prices rose 0.3% in December, with annual inflation stuck at 2.7%, lending credence to the Federal Reserve's cautious stance toward interest rates heading into 2026.

January 13 -

Continuing to retreat from Biden-era rules, the Consumer Financial Protection Bureau and Department of Justice withdrew a 2023 advisory opinion that had cautioned about denying credit to immigrants.

January 12 -

The Senate allowed the nomination of a permanent director of the Consumer Financial Protection Bureau to lapse, giving acting Director Russell Vought more time to lead the agency on a temporary basis.

January 9 -

The rule, effective July 7, puts into place requirements similar to those for banks, except nonbanks do not have to make community investments or grants.

January 8 -

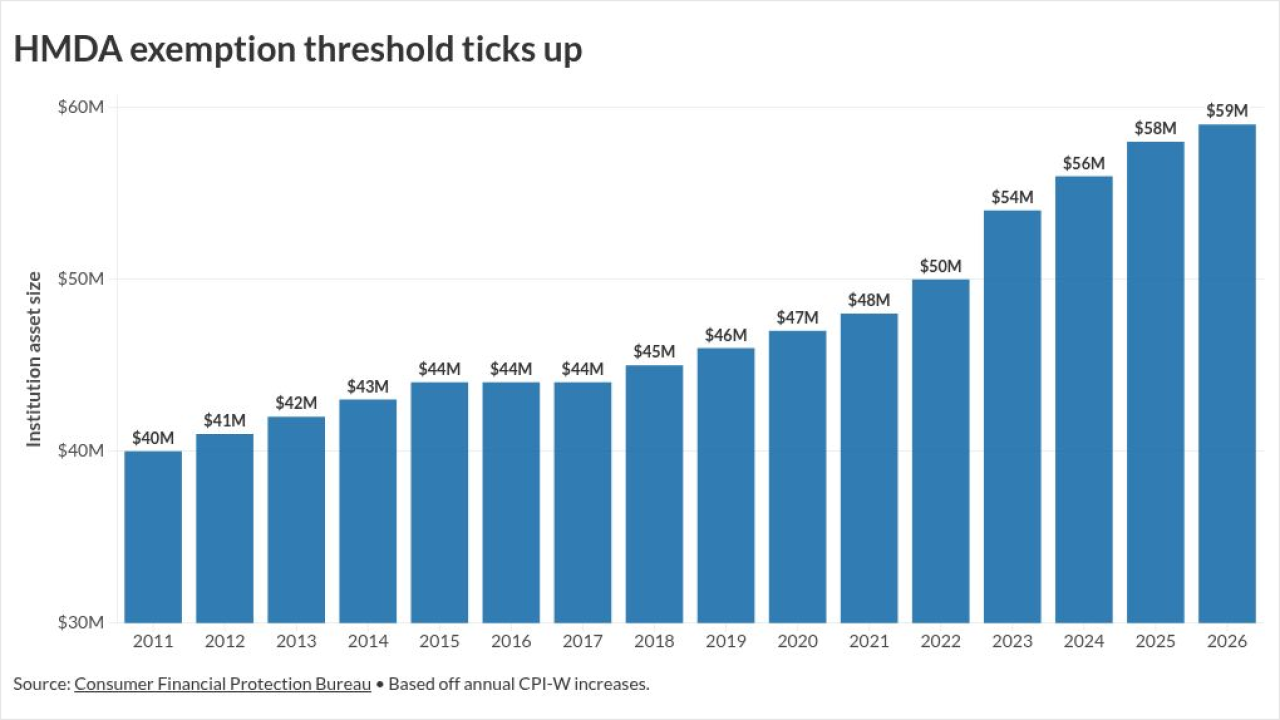

Originators with less than $59 million in assets don't have to share their loan data with CFPB, as the semi-shuttered regulator continues mortgage oversight.

January 8 -

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

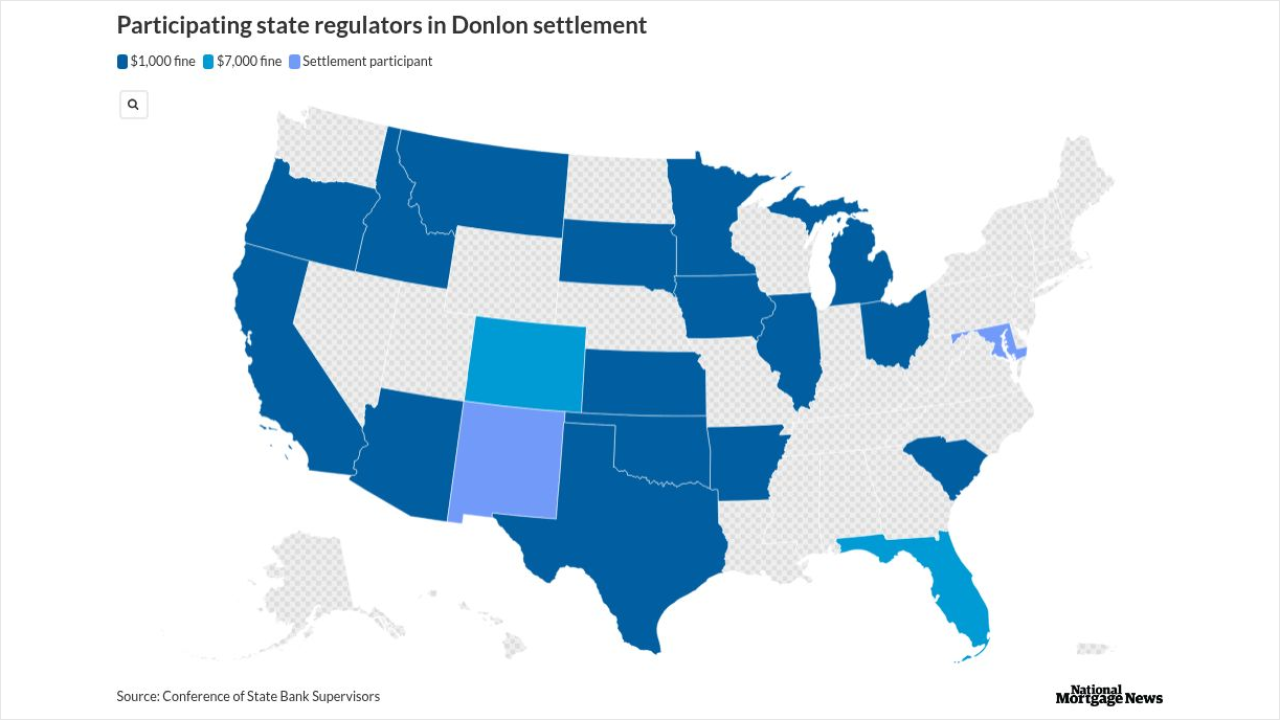

Following the resignation of CEO Patrick Donlon as the result of a settlement, Yield Solutions Group has taken operational control of Trusted American Mortgage.

December 31 -

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

December 30