Regulation and compliance

Regulation and compliance

-

Questions surrounding Eric Blankenstein, a senior CFPB official whose racially charged writings from over a decade ago have led to calls for his resignation, have been referred to the agency's watchdog.

October 16 -

Federal regulators have issued answers to frequently asked questions on appraisal regulations.

October 16 -

Nomura Holding America and affiliates agreed to pay a $480 million penalty to resolve U.S. claims that the bank misled investors in marketing and selling mortgage-backed securities tied to the 2008 financial crisis, according to the Justice Department.

October 16 -

The departing CEOs of Fannie Mae and Freddie Mac oversaw significant cultural and operational shifts that made the housing finance system safer and more responsive to market needs, but a tough job lies ahead for their successors.

October 16 -

The consumer bureau’s interim chief told an industry conference that “regulation by enforcement is done.”

October 15 -

As the mortgage industry confronts tight margins, shifting market share and regulatory uncertainty, a new leader emerges at the Mortgage Bankers Association.

October 14 -

It's a critical time in Washington, with many key institutions in the mortgage and housing industries getting new leaders. At the Mortgage Bankers Association, there's a renewed focus on maintaining effective influence with decision makers on initiatives like housing finance reform, innovation and the evolving needs of home buyers.

October 14 -

From discussing the future of mortgage tech to debating the shifting sands of political policies, here's a preview of the big issues, topics and ideas when the industry gathers in the nation's capital for the Mortgage Bankers Association's Annual Convention & Expo.

October 12 -

The uproar over the incendiary writings of a Consumer Financial Protection Bureau official have led to calls for his removal, but the agency’s interim chief says he won’t “let any outside group dictate who works here.”

October 11 -

Ocwen is putting plans in place to realize $100 million in savings using resources from its acquisition of PHH Corp., which has just closed.

October 4 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

Senate Democrats on Wednesday called for acting CFPB Director Mick Mulvaney to reveal the vetting process that led to the hiring of a political appointee whose past incendiary writings have caused an uproar at the agency.

October 3 -

The senior Democratic lawmaker said the CFPB chief and the Trump administration "are doing everything in their power to roll back consumer protections."

October 2 -

The head of the National Treasury Employees Union said the appointment of Eric Blankenstein to a senior role “reflects poorly on CFPB management.”

October 2 -

Eric Blankenstein, a political appointee overseeing fair-lending policy at the agency, said in an email to staff that his blog posts from 14 years ago that used a racial epithet “reflected poor judgment.”

October 1 -

A judge denied the settlement terms in a TCPA lawsuit against Ocwen Financial Corp. over concerns that the proposed $17.5 million payment was insufficient.

October 1 -

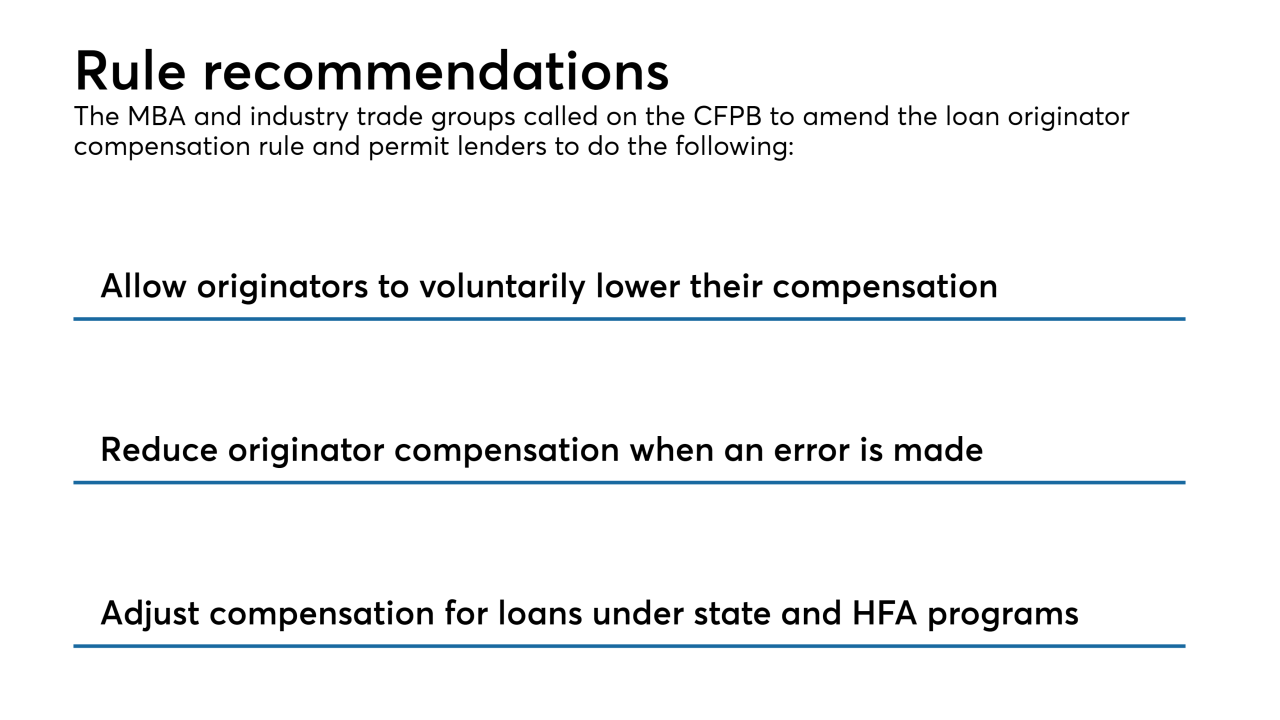

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

Gov. Jerry Brown signed a bill Sunday to streamline housing development around BART stations and ease the Bay Area's epic affordable housing problem at the expense of local officials' decision-making powers over land use.

October 1 -

During the foreclosure crisis, thousands of Floridians turned to Mark Stopa for help in saving their homes.

October 1 -

What started as a single senior official at the CFPB voicing concerns about blog posts written 14 years ago by Eric Blankenstein, a top agency political appointee, is rapidly becoming a rising chorus of discontent.

September 30