Regulation and compliance

Regulation and compliance

-

A bipartisan group of ex-inspectors general is pushing Senate leaders to quickly confirm Christy Goldsmith Romero to chair the Federal Deposit Insurance Corp. despite scheduling delays and the upcoming election.

August 13 -

Pandemic era changes to credit reporting have dangerously distorted credit scores for mortgage borrowers. The market is in worse shape than we realize, writes a former Federal Housing Finance Agency director.

August 13 -

The change in medical debt reporting initiated by the three credit bureaus did not go far enough as 15 million Americans are still impacted, the groups led by the National Consumer Law Center said.

August 12 -

A study shows a need for brokerages to transform their operations, finding that 79% of them will become unprofitable when the National Association of Realtors' settlement reduces commission rates.

August 8 -

The Treasury, CFPB and Federal Trade Commission are joining forces to warn consumers about predatory practices in financing solar energy panels.

August 7 -

The litigation involved more than 100 loans, many insured by the Federal Housing Administration, with volume totaling approximately $55 million.

August 5 -

The Consumer Financial Protection Bureau has received more than 11,000 comment letters on its proposal on personal financial data rights, but banks say the agency should ensure that more fintech partners take on their fair share of the rule's compliance burden.

August 4 -

Industry participants say more direct communication between fintechs and federal regulators could help avoid bad outcomes. Some underused legal tools could help bridge the gap.

August 2 -

Nine federal regulatory agencies are requesting comment on a rule that would create data standards for supervisory information collected and submitted to financial regulators.

August 2 -

The Federal Reserve chair said Fed researchers continue to explore central bank digital currencies to stay current on international payments developments, but emphatically denied that the central bank is considering creating one of its own.

July 31 -

Changes to the regulatory regime surrounding the Federal Home Loan banks should be carefully calibrated so as to do no damage to their successful support for housing and the provision of liquidity to members.

July 30 -

In a new survey of bank executives from IntraFi, 90% of respondents said instances of check fraud have increased in recent years and half want law enforcement to make check fraud a bigger priority to stop criminals from stealing checks in the mail.

July 29 -

While the federal banking agencies are not changing any current rules, they issued a joint statement Thursday cautioning banks about risks in third-party deposit partnerships. They are also seeking public input on bank-fintech partnerships more generally.

July 25 -

Federal Deposit Insurance Corp. Vice Chair Travis Hill has called for a full reproposal of the Basel III endgame capital standards, emphasizing the need for joint advancement by all three major federal banking agencies and an additional comment period for industry feedback.

July 24 -

Not every audit will save a dollar, but paying for check-ups will stem further expenses, industry veterans say.

July 23 -

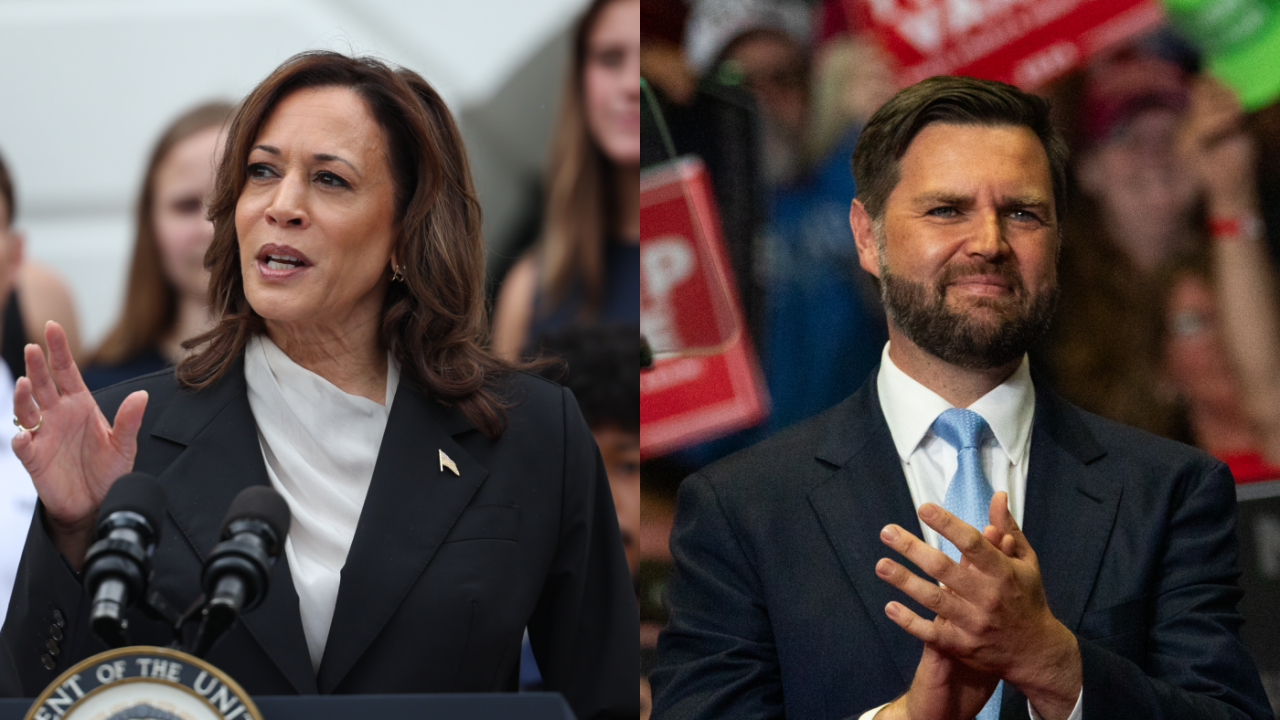

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

Vice President Kamala Harris, the most likely choice to replace President Joe Biden on top of the Democratic presidential ticket in November, has a long and complicated history with the banking industry.

July 21 -

With the landmark Supreme Court decision overturning Chevron USA v. National Resources Defense Council, much of the rule making by the Federal Reserve Board, the SEC, HUD and other agencies is now open to attack, writes the Chairman of Whalen Global Advisors.

July 19 -

The guidance is largely unchanged from what the agencies proposed last year. It directs institutions to craft policies that consider a wide array of potential shortcomings.

July 18 -

Acting Comptroller of the Currency Michael Hsu said the OCC will review its 2020 interpretation of preemption under the Dodd-Frank Act and explore more direct engagement, tailored federal regulation and supervision of nonbank fintechs.

July 17