-

Under a new policy, a company subject to a civil investigative demand will learn from the agency about what conduct the probe is targeting and what legal provisions the firm may have violated.

April 23 -

Sen. Sherrod Brown, D-Ohio, said "the best place for me to continue fighting for Ohio and for the dignity of workers ... is to stay in the U.S. Senate."

March 7 -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

The bureau wants to further remove the threat of legal liability for firms that test products benefiting consumers, but the attorneys general say the agency cannot provide immunity from state law.

February 12 -

House Financial Services Chairwoman Maxine Waters said the merger is a direct result of a regulatory relief bill that was signed into law in May.

February 7 -

The combined bank will move into a more demanding supervisory class under the Fed’s regime, but analysts also see a regulatory upside from the deal.

February 7 -

Fixing the housing finance system is "the last piece of unaddressed business from the financial crisis," according to a summary of to-do items released by the Banking Committee's chairman.

January 29 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

The newly sworn-in director’s first public remarks seemed to contrast with the approach of her predecessor, Mick Mulvaney, who at times questioned the role of the agency.

December 11 -

Kraninger's nomination was lauded by industry groups, but vigorously opposed by consumer groups and Democratic lawmakers.

December 6 -

A motion to limit debate on the nominee to run the consumer bureau passed along strictly party lines, setting the stage for her to be confirmed as early as next week.

November 29 -

Kathy Kraninger, who may get a confirmation vote as early as this week, has suggested a similar vision to that of the agency’s current acting chief. But some see signs she could bring a different approach to the job.

November 27 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

Regulators typically write rules before applying them. But the CFPB is attempting the reverse.

November 11 -

Several Senate, House and gubernatorial battles are of interest to financial firms. Here is a spotlight on specific contests, with updates as they become available.

November 6 -

The federal agencies said in a recent statement that “guidance does not have the force and effect of law,” but two trade groups say that standard should be more binding.

November 6 -

The battle gaining the most attention Tuesday night will be which party controls the House next year. But other key races will help determine the makeup of the Senate Banking Committee.

November 4 -

Protecting consumers from intrusive cold calls and fax-spamming is having adverse effects on the mortgage industry as the Federal Communications Commission fails to reasonably interpret language under the Telephone Consumer Protection Act, according to the Mortgage Bankers Association.

October 25 -

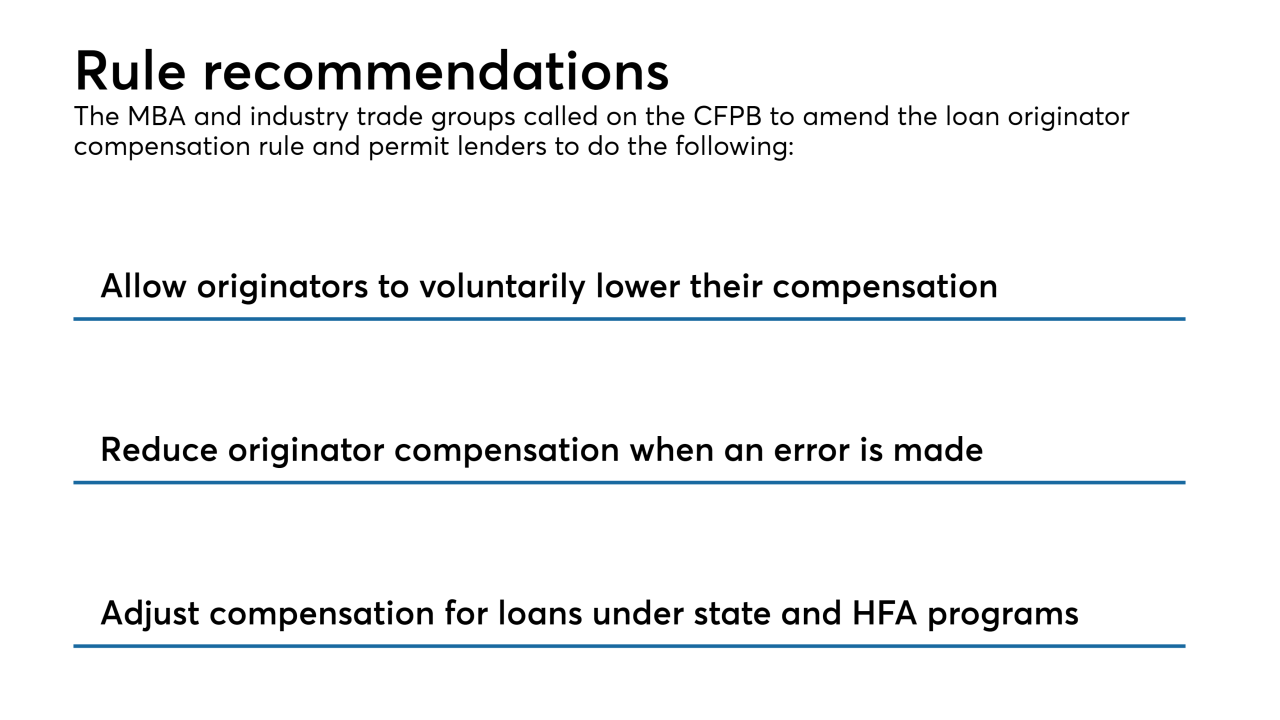

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1