-

The Federal Housing Finance Agency is planning on finalizing its proposed capital requirements for the government-sponsored enterprises this summer, the agency's acting director said Wednesday.

March 28 -

While reinsurers are becoming more comfortable with the risk it is offloading, the GSE wants to maintain control of the workout process for loans that go bad.

March 27 -

Costs, process, privacy: Here's a look at some key digital mortgage drivers and obstacles identified by experts at this year's MBA Technology Solutions Conference.

March 27 -

The bank was fined $25 million for what the Office of the Comptroller of the Currency said was an inability to provide the discounts to all who were eligible.

March 19 -

The Federal Housing Administration is returning to manual reviews of higher-risk loans it insures because it's finding that a growing share have lower credit scores, higher debt-to-income ratios, or both.

March 18 -

Mortgage brokers need to consider bringing their business into new locations to overcome limitations like competition and a finite number of possible customers.

March 15 JW Surety Bonds

JW Surety Bonds -

Wells Fargo CEO Tim Sloan said that the megabank has worked to address past issues and is equally committed to preventing new problems from arising, despite reports suggesting otherwise.

March 11 -

Mr. Cooper Group took a net loss of $136 million in the fourth quarter after lower rates hurt the mark-to-market value of its larger mortgage servicing rights portfolio harder than its peers.

March 7 -

Policymakers could improve independent mortgage banks' financial stability by giving these companies improved access to liquidity, according to the Mortgage Bankers Association.

February 25 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

Ginnie Mae should not overreact in supervising smaller, more diversified mortgage bankers, but rather scale its approach in line with the concentration of risk that different-sized servicers pose.

February 13 Community Home Lenders of America

Community Home Lenders of America -

A security breach that left 24 million mortgage documents unprotected on a server is rekindling concerns about the risks posed by fourth parties.

February 13 -

MGIC Investment Corp. responded to the broad-based roll out of "black box" pricing engines from the other mortgage insurers by bringing its version to market.

January 17 -

Radian and Essent will make their "black box" mortgage insurance pricing methods live on Jan. 21, leaving MGIC as the only company yet to announce its adoption.

January 14 -

There is no banking crisis, but the president’s actions are threatening to create one.

December 24IntraFi Network -

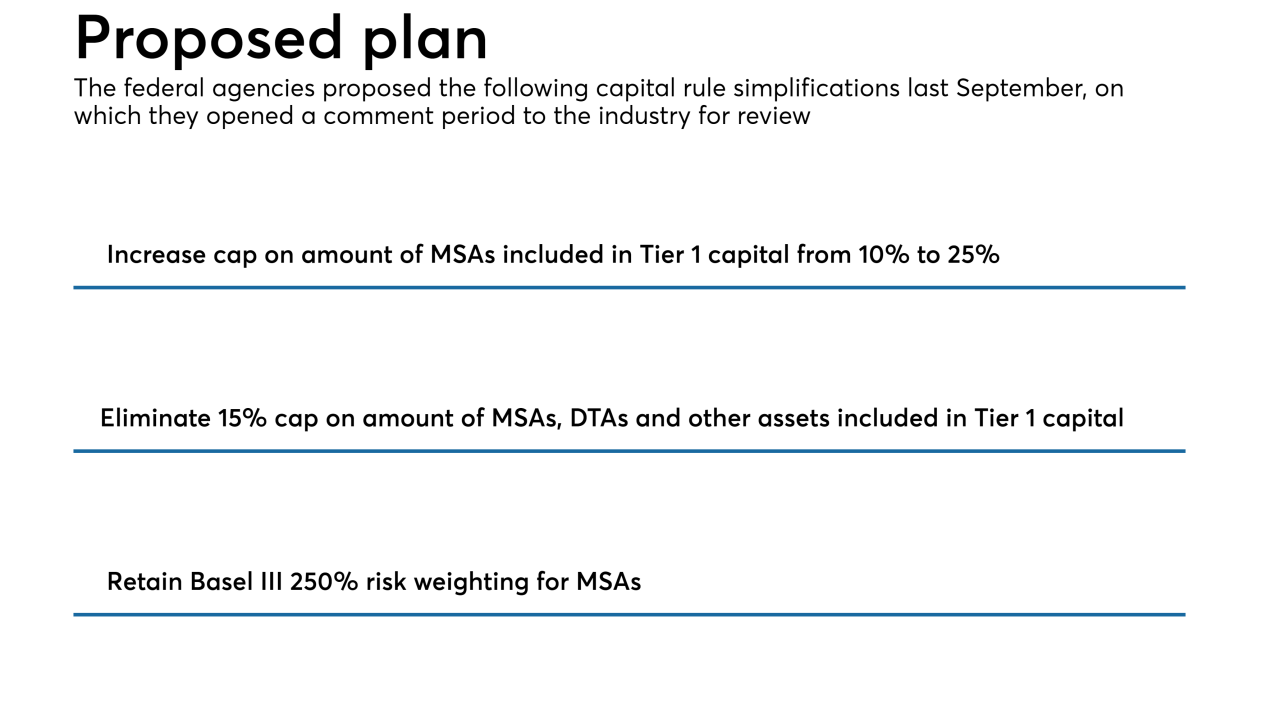

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13 -

Fannie Mae and Freddie Mac charged lenders slightly lower guarantee fees in 2017 for mortgages with riskier characteristics, according to a Federal Housing Finance Agency report.

December 10 -

Wire fraud is considered a consumer and title agent issue, but the millions of dollars it's diverting from home purchase transactions make it an issue mortgage lenders need to address, too.

December 5 CertifID

CertifID -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26