-

The government-sponsored enterprises transferred $5.5 billion of credit risk on $174 billion of mortgages in their portfolios during the first quarter.

July 26 -

Borrowers with variable-rate debt affected by Federal Reserve rate hikes showed they could handle December's 25-basis-point increase, but that could be changing as short-term rates continue to rise.

July 20 -

The Office of the Comptroller of the Currency told a somewhat familiar story Friday about the industry's risk environment.

July 7 -

If HSBC reaches an agreement with the government, it could give an early indication of how the Trump administration will levy financial penalties.

July 5 -

Canadian officials are working to slow a rapid rise in home prices that's being attributed to tight inventory levels in the country's largest cities and is threatening to create a housing bubble.

June 23 -

The House Financial Services Committee approved several bills Thursday designed to boost the private flood insurance market.

June 21 -

From vendor choice to valuations, here's a look at the key differences between Fannie and Freddie's upfront rep and warrant relief strategies.

June 21 -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

New entrants in mortgage servicing are rethinking how business is done, creating more division between holders of mortgage servicing rights and the entities that actually manage loans.

June 13 -

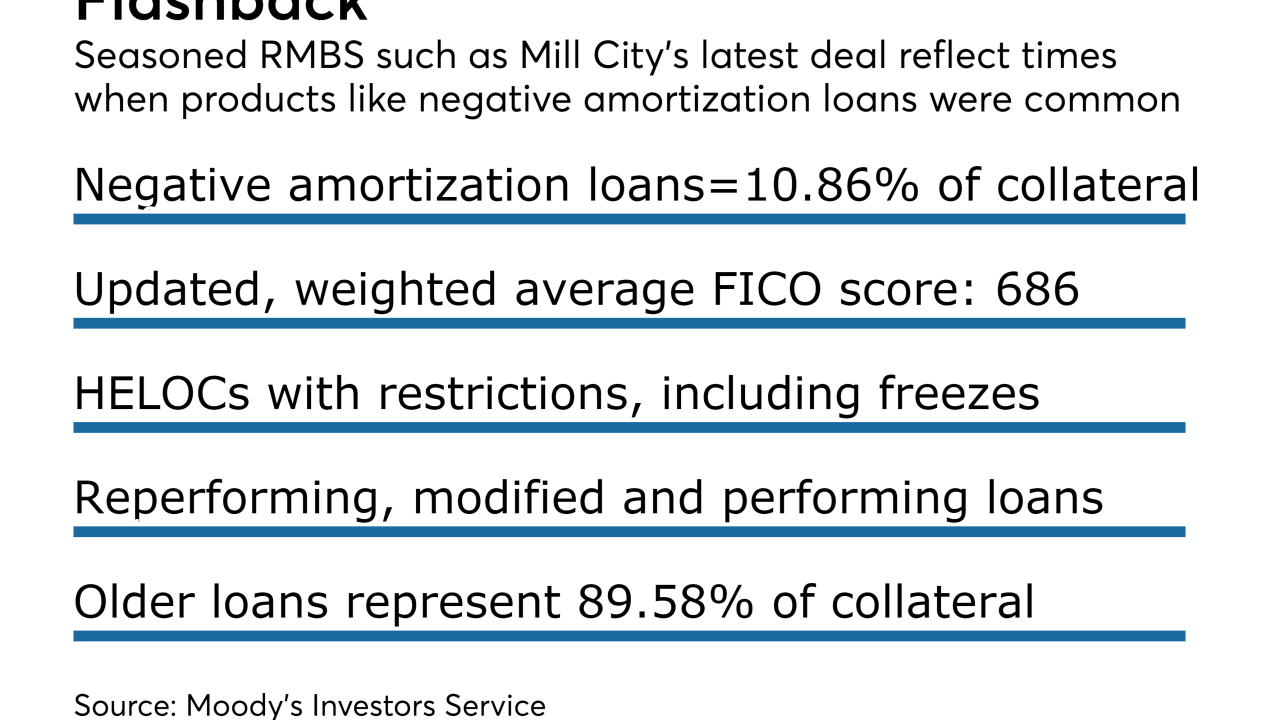

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

The share of mortgaged properties underwater is inching down toward 6% but in certain areas like Las Vegas the percentage is more than twice as high, according to CoreLogic.

June 9 -

Not only is the uninsured sector growing, but the Bank of Canada is seeing some riskier mortgages within that area as it studies recent disruptions in the market.

June 8 -

Celebrated by cable TV shows and touted by get-rich-quick gurus, home flipping is coming back with a vengeance across the U.S.

June 8 -

Kroll Bond Rating Agency reports rapidly rising losses on loans secured by commercial properties in Texas and in Houston, driven locally by high vacancy in the office market.

June 6 -

From pockets of growth in a shrinking refi market to the possibility of REITs buying agency risk-sharing securities, here's a look at recent market shifts that major industry players are focused on right now.

June 5 -

Fannie Mae's credit risk sharing transactions since 2013 have grown to the point where the total for the unpaid principal balance transferred has reached $1 trillion.

June 1 -

Auditors performing a review of Ocwen Financial padded time sheets and claimed excessive and improper expenses, including lengthy travel and meals at strip clubs and casinos, according to a lawsuit filed against Fidelity Information Services.

May 30 -

Maryland Gov. Larry Hogan has signed a bill that will expedite foreclosures of vacant and abandoned properties this fall.

May 26 -

This is a good time for bank risk managers and bank regulatory examiners to evaluate the effects of a deepening retail crisis on the financial services sector.

May 22 MRV Associates

MRV Associates -

As financial institutions look closer at the increasingly detailed consumer credit data available, they are learning consumers are more apt to pay off personal loans before mortgages, auto loans and credit cards.

May 17