-

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

PIMCO Mortgage Income Trust tabled plans to launch an initial public offering this week following a steep stock market decline Monday.

May 15 -

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

May 14 -

While prepayment speeds on agency mortgage-backed securities rose in April, that increase should be short-lived as further significant interest drops are not expected, said a report from Keefe, Bruyette & Woods.

May 13 -

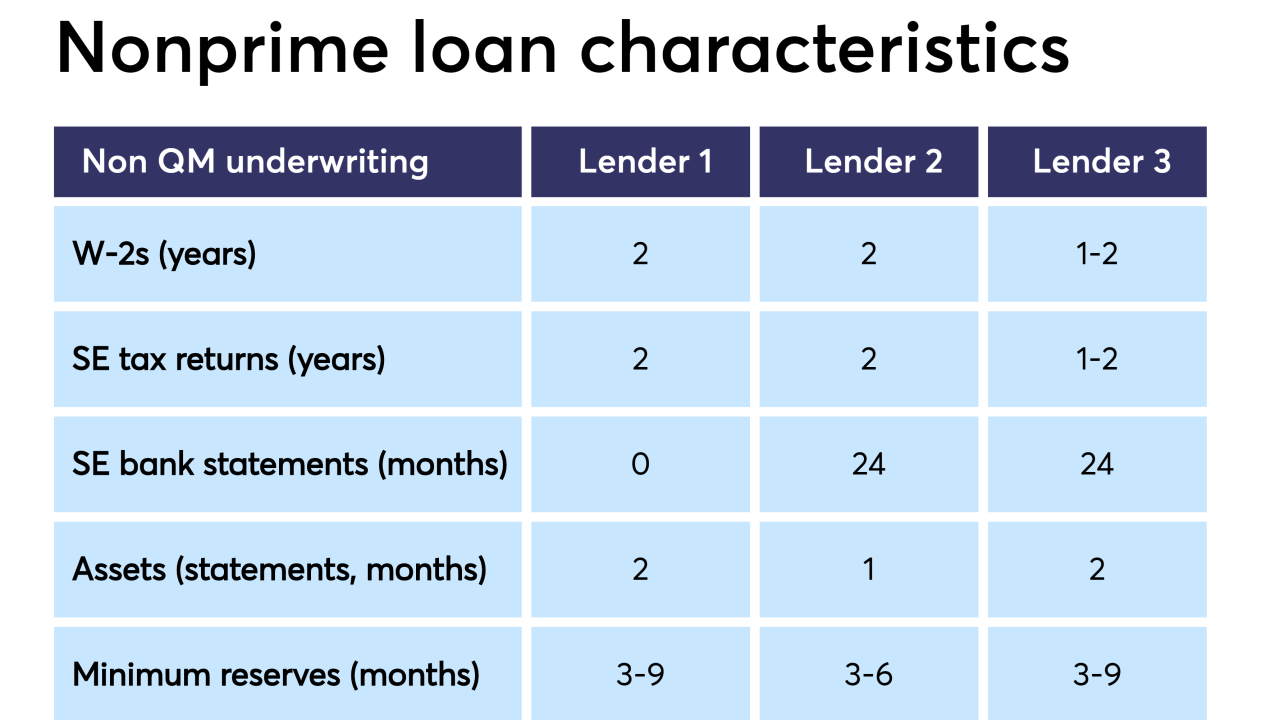

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

With nearly $90 million added in the past two months, Goldman Sachs marched closer to its $1.8 billion consumer-relief mortgage settlement with the U.S. Department of Justice.

May 2 -

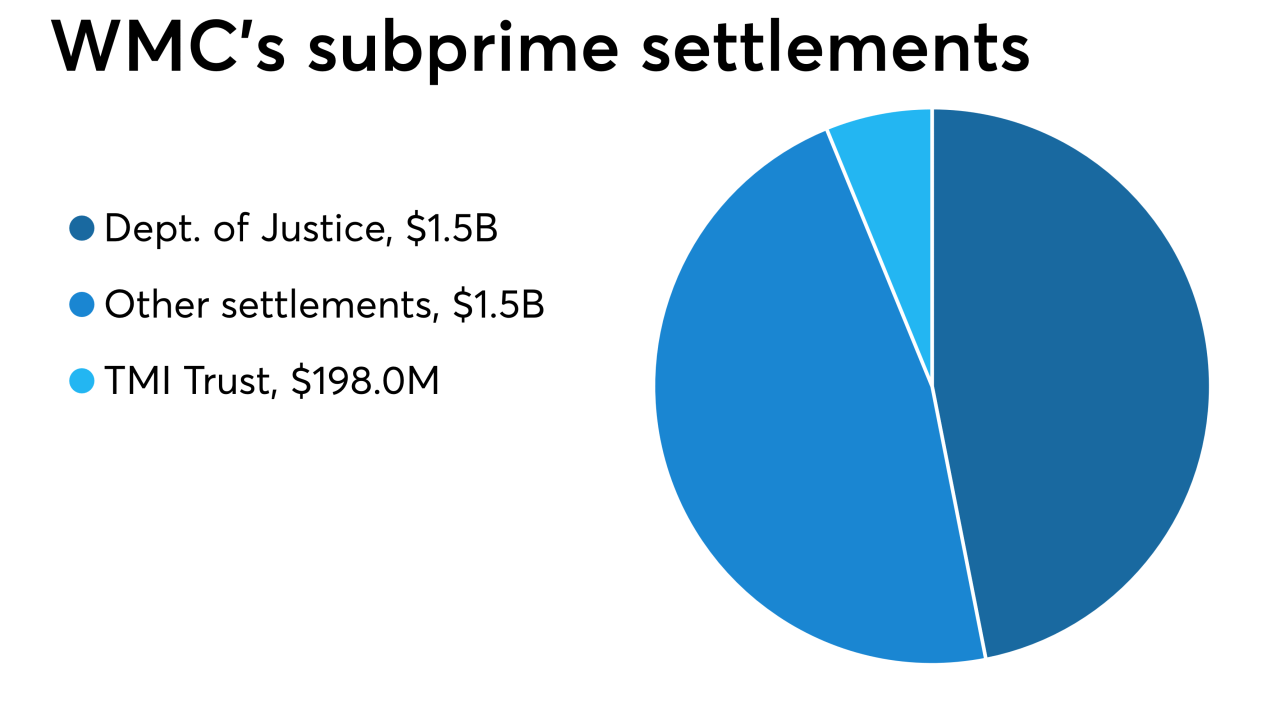

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

An industry working group might seek legislation to eliminate the need for investor consent in the shift to a new benchmark interest rate. But any legislative fix is almost certain to be challenged because choosing an alternative to Libor will inevitably favor one party in a transaction over another.

April 21 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12