-

Despite the increase, adjustments to single-family loan terms aimed at making payments more affordable remain historically low at the government-sponsored enterprises. But they could grow in line with forbearance expirations soon.

September 24 -

The move marks one of the first actions the two government-sponsored enterprises and the Federal Housing Finance Agency have taken to make a pandemic-related loss mitigation option open-ended.

September 24 -

The difference between purchase contract prices and valuations was consistently wider than in white neighborhoods, according to a recent analysis of 12 million appraisals from the Uniform Collateral Data Portal.

September 21 -

The company will return to selling pieces of its credit exposure to private investors during the last three months of the year, but is still evaluating its strategy for 2022.

September 20 -

Changes proposed this week stand to reverse the effect of the Trump-era rule, which disincentivized Fannie Mae and Freddie Mac from making such deals, according to critics.

September 17 -

The Department of Housing and Urban Development increased the share of reverse mortgage assets it will give community organizations a first crack at, in line with goals of the Biden administration.

September 16 -

Required use of the Federal Housing Administration’s Catalyst platform may accelerate data collection on valuations from a government agency that’s insuring nearly one-fifth of all purchase loans.

September 16 -

The move generally gets a thumbs up from industry participants, but what can happen in the long-term is uncertain.

September 15 -

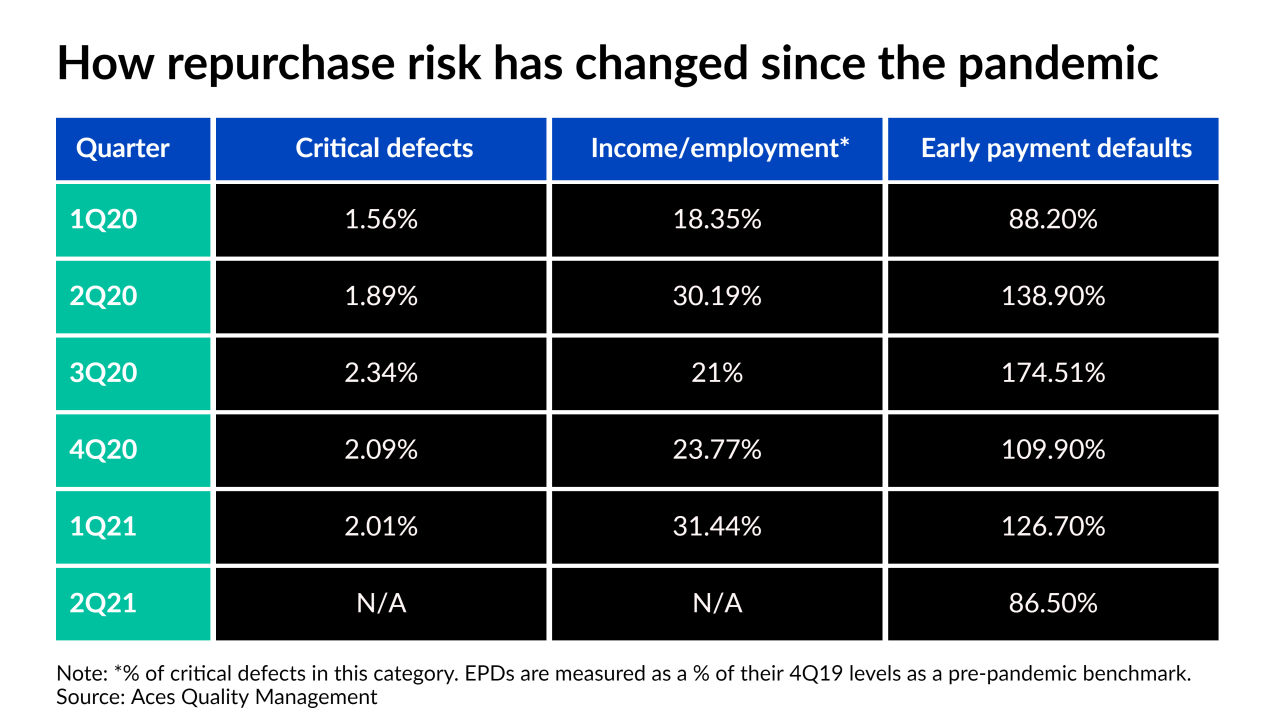

Critical defects fell as well, but the percentage that are related to income or employment concerns set a new record, surpassing the one set in the second quarter of last year.

September 15 -

Fitch Ratings’ second quarter numbers suggest even those facing some of the highest repayment hurdles may have been motivated enough by economic improvement to exit before many expirations were due.

September 14 -

The move suggests the government bond insurer doesn’t expect to see loan performance return to normal levels until next summer.

September 13 -

The technology could help firms that have had less access to automation and generally have conducted trades used to hedge loan pipelines by phone.

September 10 -

While overall volume was down in August, it remained historically strong, particularly in the securitized market for home equity withdrawal loans made to borrowers age 62 and up.

September 9 -

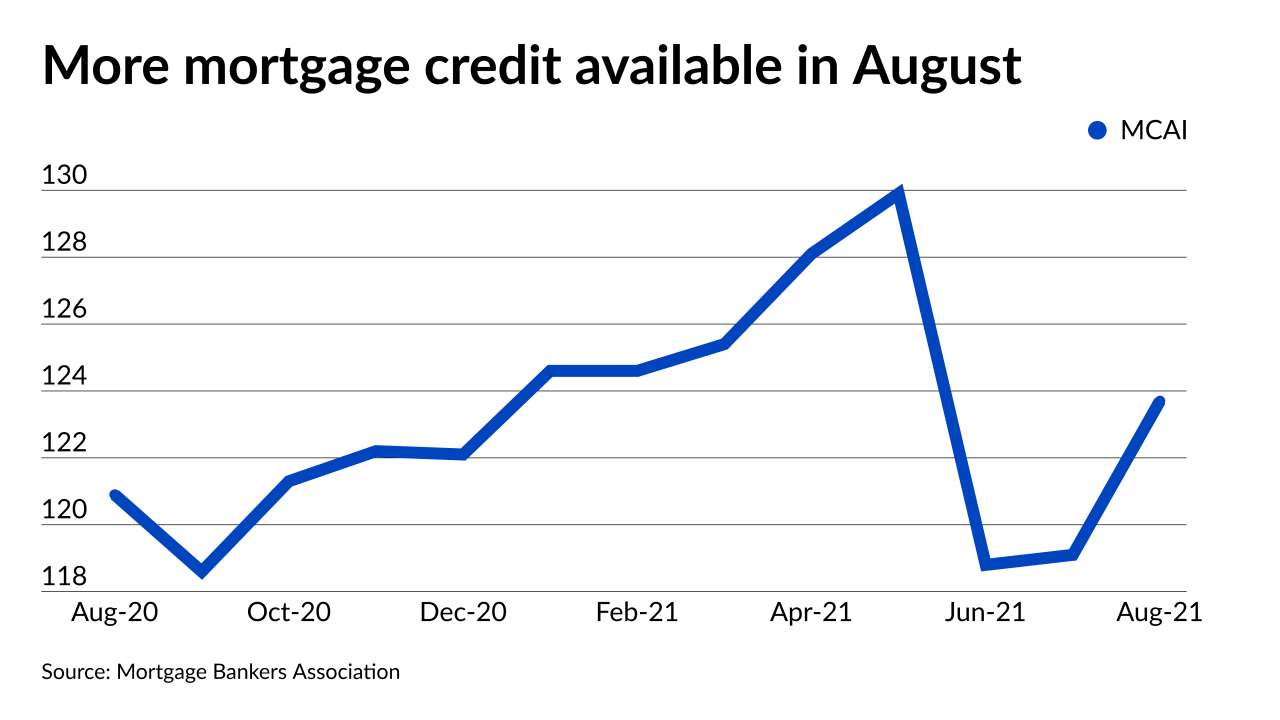

But refinance volume was constrained in recent weeks and many of the new offerings are aimed at low income borrowers, the Mortgage Bankers Association said.

September 9 -

The government-sponsored enterprises and their regulator are building on broader efforts by the Biden administration to close racial gaps in homeownership rates.

September 7 -

The government bond insurer allowed lenders to become “eIssuers” a little over a year ago, and the move contributed to a large surge in electronic notes this year.

September 7 -

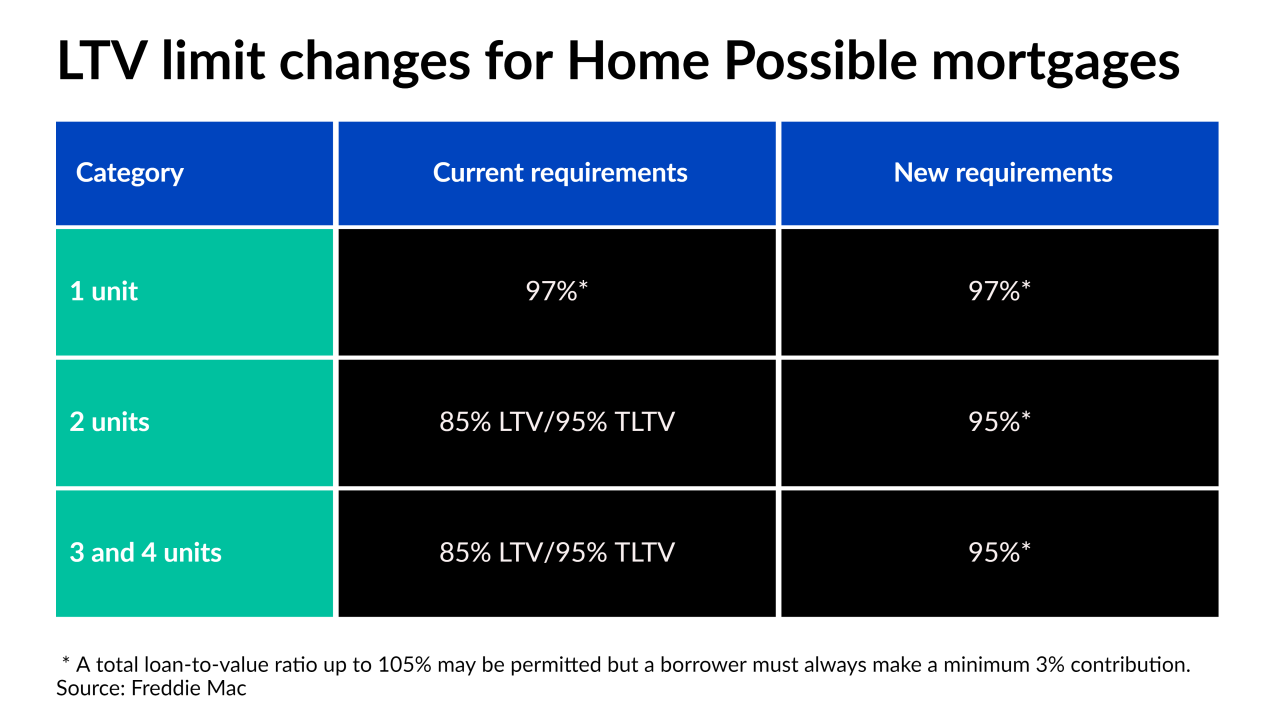

The changes could help one of the Biden administration’s affordable housing goals, which is aimed at making wealth-building through owner-occupied, 2- to 4-unit properties more attainable.

September 3 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

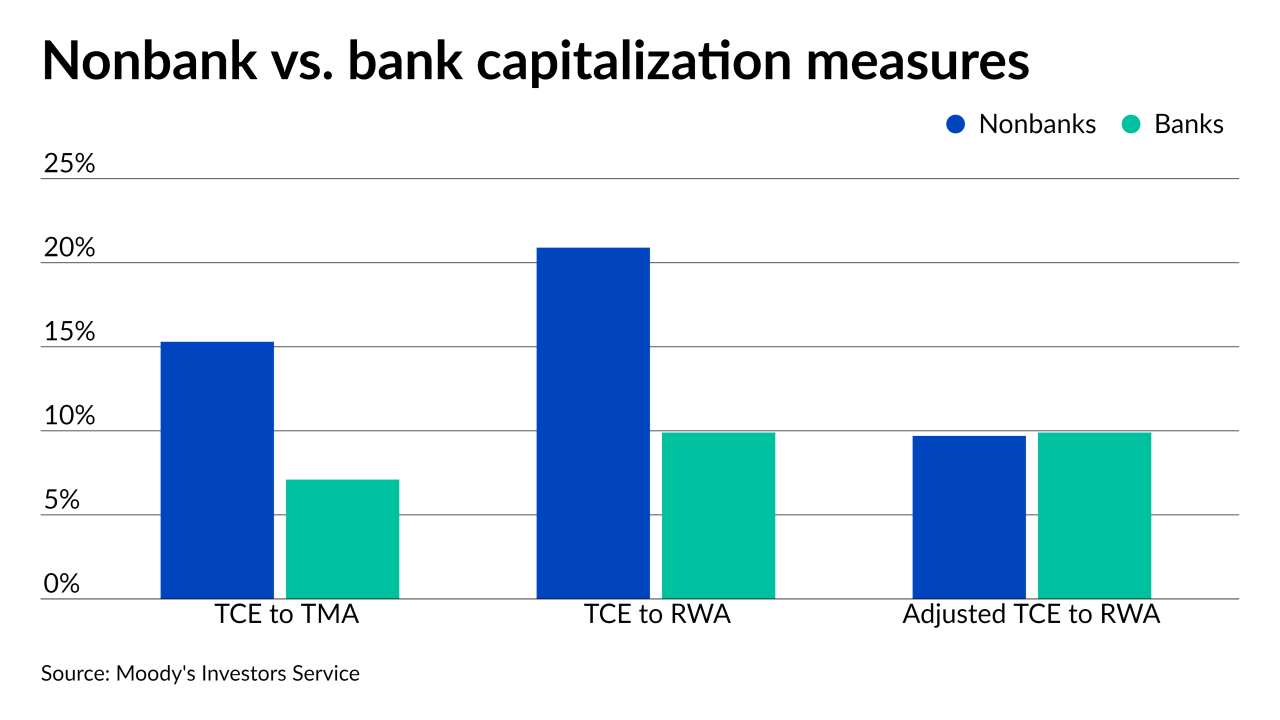

By some current measures, nonbank capitalization looks strong compared to banks, but the way a Ginnie Mae proposal aims to assess the value of mortgage servicing rights would change that, Moody’s Investors Service reported Tuesday.

August 31 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20