-

The outperformance of mortgage-backed securities versus U.S. Treasuries has extended for a third straight month into November, buoyed in part by a decline in volatility.

December 2 -

Developer Stephen Ross' firm is among a trio of sponsors securitizing part of a $1.245 billion loan for another office tower development in New York's Hudson Yards submarket.

November 29 -

The two deals continue a late-year surge of private-label RMBS deal volume totaling $8.37 billion priced since Oct. 1.

November 25 -

For the private-label mortgage-backed securities market to grow, regulators need to focus on collateral management in addition to changes to data disclosure rules.

November 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21 -

Blackstone Real Estate Partners is securitizing a new $343 million commercial mortgage that financed the parent firm’s recent acquisition of a portfolio of Southern California apartments.

November 21 -

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

There's been chatter that investors are shying away from Fannie Mae and Freddie Mac mortgage-backed securities because Congress may not enact housing finance reform. Be skeptical of those claims.

November 19

-

Lenders have bundled more than $18 billion worth of non-QM, private-label loans into bonds this year that they then sold to investors, a 44% increase from 2018 and the most for any year since the securities became common post-crisis.

November 18 -

JPMorgan Chase may be leading the next trend for banks seeking to shift risk away from their mortgage portfolios — if regulators give Wall Street the green light.

November 13 -

The sponsors of the Class A structure, deemed a “trophy asset” by Kroll Bond Rating Agency, are placing $825 million of a $1.2 billion whole loan into a transaction dubbed CPTS 2019-CPT.

November 12 -

Tom Marano, a former Bear Stearns banker, was apparently well compensated following the housing crisis for heading up ResCap and Ditech, both of which went into bankruptcy.

November 11 -

Sixty percent of the loans were underwritten with just 12- or 24-month bank statements, according to ratings agency reports.

November 5 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

Early payment mortgage defaults went to the highest level in nearly a decade, particularly among loans included in Ginnie Mae securities, a Black Knight report said.

November 4 -

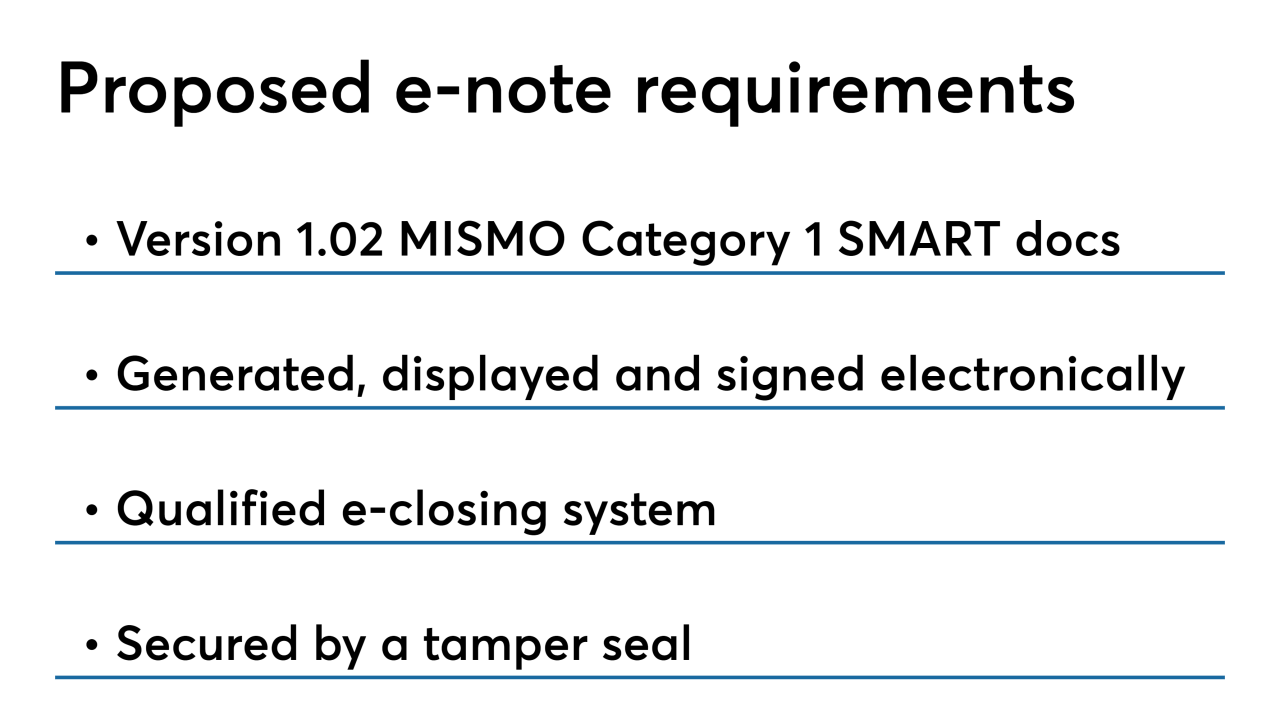

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

Mosaic Solar Loan Trust 2019-2 is bringing to market $208 million in asset-backed securities that are secured by residential solar consumer loans.

October 28 -

The acquisition of the Ditech forward mortgage business will double New Residential's year-to-date origination volume in the fourth quarter alone, and further double that next year.

October 25 -

First-lien, prime residential mortgages are securing the Visio 2019-2 Trust, which will raise $202,682,000 from the market, and which has collateral that was funded by the Mortgage Pass-Through Notes, Series 2019.

October 24