-

Jefferies is housing the initial round of $300 million in loans under a repurchase agreement with four lenders, as well as with the trust established for the transaction in Jefferies’ standing as the repo seller.

July 22 -

Verus Securitization Trust 2019-INV2 is backed by investor loans secured by 1,042 rental properties. The loans were originated by 76 different lenders.

July 16 -

Occidental Management is sponsoring a single-asset, single-borrower deal through JPMorgan backed by the fee simple interest from receivables of a lease-buyback arrangement with Sprint Corp.

July 16 -

A Nomura Holdings Inc. unit will repay customers about $25 million to settle U.S. regulators' allegations that it failed to supervise traders who made false statements in negotiating sales of mortgage securities.

July 15 -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

Some commercial mortgage-backed securities due next year could have difficulty refinancing due to the recent Ridgecrest earthquake, according to a new Morningstar report.

July 11 -

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

Despite rising delinquency levels, borrower performance on the underlying mortgages in GSE credit-risk transfer securitizations is strong enough to warrant ratings upgrades to more than half of nearly 1,200 outstanding note classes.

June 28 -

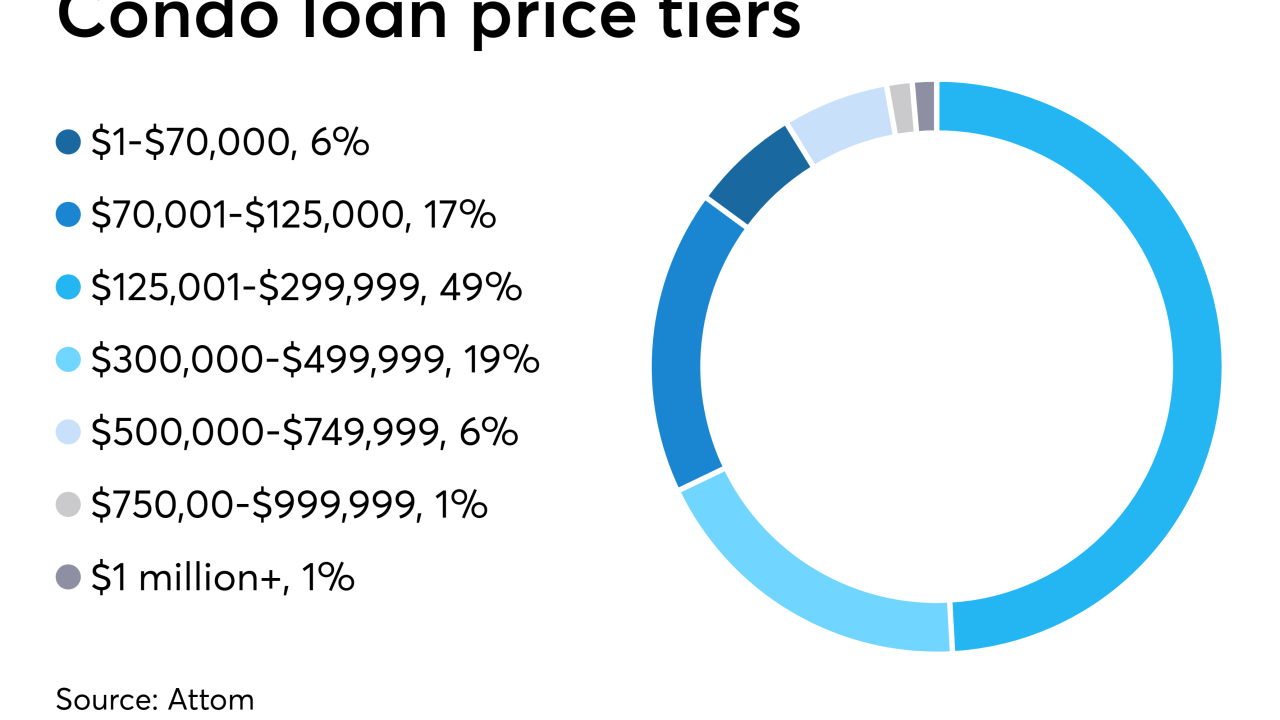

Making low-balance loans with poor economies of scale is tough in a market with slim margins, but it could have its rewards.

June 27 -

The deal is backed by an underlying pool of 1,724 fixed-rate mortgages originated by Blackstone-owned Finance of America Mortgage.

June 26 -

The publicly traded real estate investment firm is backing the securitization via Citi with 156 properties in 28 states.

June 25 -

Because automated valuation models have not been subjected to a stressed housing market, their increased use holds negatives and positives for residential mortgage-backed securities credit quality, a Moody's report said.

June 24 -

Blackstone's real estate affiliate and property management firm SITE Centers Corp. acquired the 12 centers across seven states in 2014.

June 21 -

The loan covering single-tenant distribution/fulfillment centers is the largest obligation in the transaction being rated by four agencies.

June 20 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

Alternative investment manager Pretium plans to buy Deephaven, a residential mortgage-backed securities issuer that operates outside the qualified mortgage market, from Varde Partners.

June 18 -

S&P says investors are asking more questions about how rising levels of self-storage property collateral is affecting conduit CMBS transactions.

June 17 -

Cerberus affiliate FirstKey Mortgage will pool outstanding first- and second-lien loans totaling $277.7 million drawn from 1,732 seasoned and performing HELOCs.

June 14 -

OBX 2019-INV2 is a private-label RMBS pool of 1,087 of agency-eligible investor-property loans.

June 12