-

The company reported nearly $23 million in losses for the second quarter, but that was an improvement on a quarter-to-quarter basis.

August 7 -

After an initial fizzle, the stock at one point was trading above the original expected price range.

August 6 -

Insurance claims and claims expenses were 503% above 1Q and 1,075% over 2Q19.

August 6 -

The delinquent loan inventory more than doubled compared with the prior year.

August 5 -

The common stock for the new parent of Quicken Loans is expected to start trading on the New York Stock Exchange on Thursday.

August 5 -

PREIT, which owns a number of large malls, is trimming the salaries of its CEO and chief financial officer while suspending dividend payments as part of a deal with its lenders to stave off default as the coronavirus pandemic continues to take its toll on the troubled company.

August 4 -

The year-over-year increase came as homebuying picked up and the company's mortgage lending business boomed.

August 3 -

The company's servicing segment recorded a pretax loss of $251 million over the period.

July 31 -

Even with the second quarter's market disruption, Redwood Trust still regained profitability.

July 31 -

While low interest rates drove up new insurance written, the increased defaults stymied overall performance.

July 30 -

The government-sponsored enterprise reported net earnings of $2.55 billion, up from $461 million in the first quarter.

July 30 -

The private equity megalith's mortgage trust made a second-quarter net income of over $17.5 million and $85.2 million in core earnings.

July 30 -

The investors seeking to take over CoreLogic plan to solicit support from fellow shareholders to replace nine directors, after the company refused to engage in talks over their $7 billion proposal to take it private.

July 29 -

CEO Douglas Gordon credited the relationship between Waterstone Financial and the mortgage subsidiary for the boost in net income.

July 28 -

The company's second-quarter net income was $116 million, with mortgage banking revenue of $239 million.

July 28 -

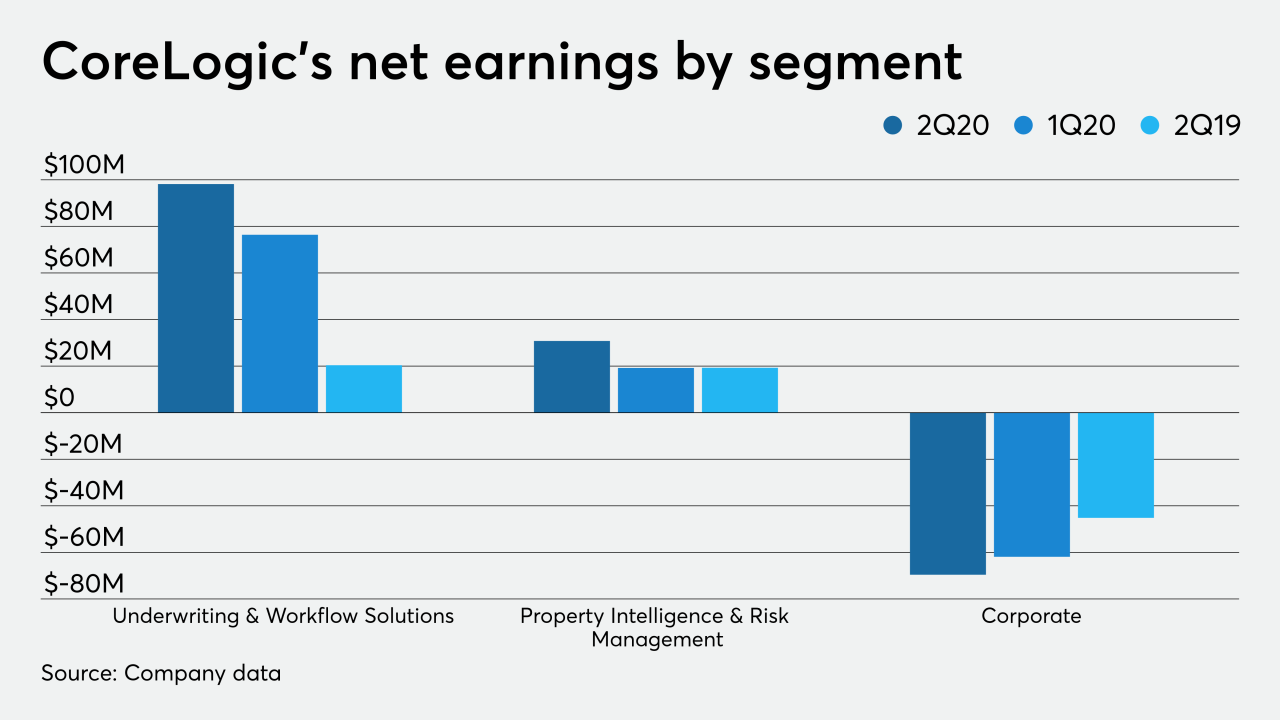

Other moves it is undertaking include business divestitures and increased dividends while defending against a takeover attempt.

July 23 -

The company lost $8.9 million in the second quarter, but its origination and servicing businesses were profitable.

July 22 -

Fannie Mae could be worthless to public shareholders, according to its newest analyst.

July 22 -

The domestic mortgage insurer could have a portion of its equity sold as an initial public offering if the China Oceanwide transaction were to be terminated.

July 21 -

The technology company reiterated its call for the hostile bidders to raise their $65 per share offer.

July 20