-

Though multifamily housing starts are projected to slightly moderate this year and next, production levels are expected to remain in a steady range considered normal, according to the National Association of Home Builders.

January 12 -

The new cap on the mortgage interest deduction should help the first time home buyer market by forcing sellers to lower prices, at least in the near term.

January 10 -

Consumer confidence in the housing market during December was better than it was 12 months prior but weaker than in November.

January 8 -

Homeowners can tap into more home equity than ever before, but deciding between a home equity line of credit and cash out refinance mortgage has gotten more complicated following recently passed tax reforms.

January 8 -

Manhattan home resales fell in the fourth quarter as buyers wavered ahead of the expected tax overhaul and stood firm in their refusal to overpay.

January 4 -

Employees at HarborOne Bank and its Merrimack Mortgage Co. subsidiary will see their minimum wage rise to $15 per hour, the latest company to accelerate plans to hike salaries.

December 28 -

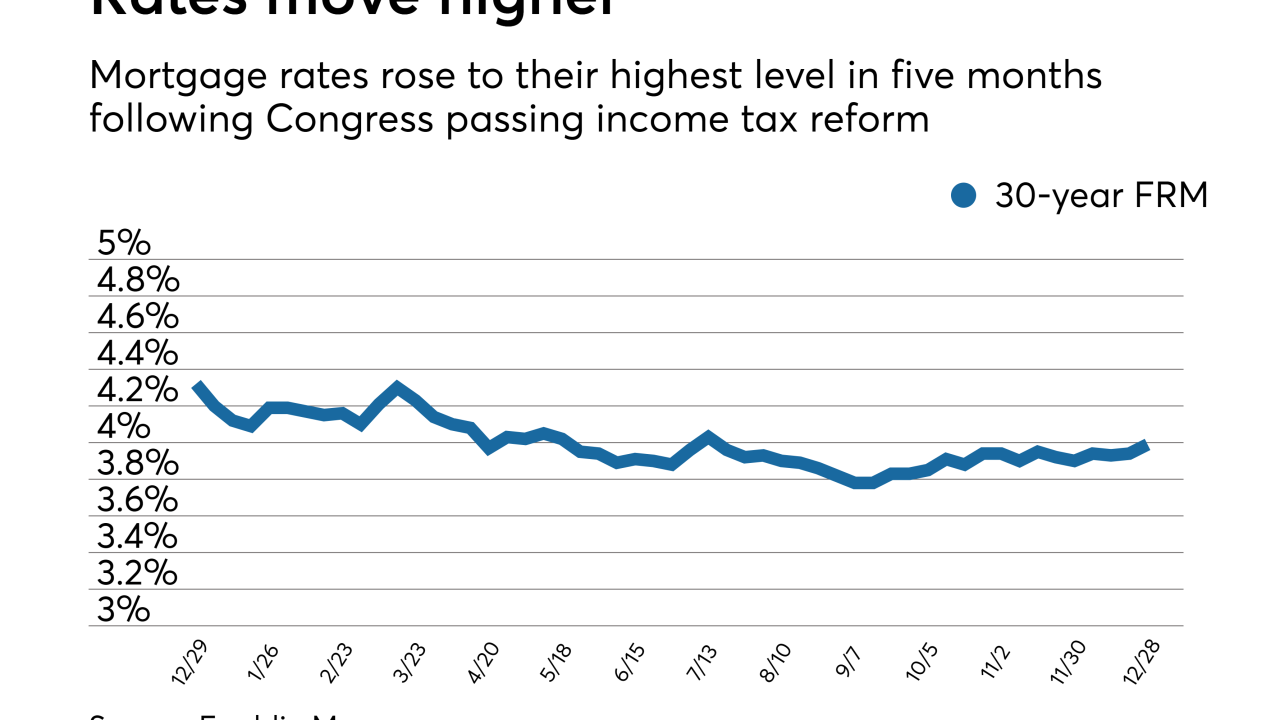

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

They aren't creating new products, but some lenders are advising cash-strapped customers in high-tax states to tap home equity or other credit lines to prepay property taxes before the new tax law kicks in.

December 28 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing banks’ risk.

December 26 -

The legislation and public perceptions of it are expected to play a major role in 2018 elections that will determine whether Republicans retain control of Congress.

December 22 -

The tax reform bill Congress sent to President Trump's desk this week is likely to prompt at least a short-term spike in mortgage rates.

December 21 -

Sales of previously owned homes rose in November to an almost 11-year high, indicating demand picked up momentum heading into the end of the year.

December 20 -

The Senate approved the final tax reform plan 51-48 early Wednesday, the second-to-last obstacle before sending it to President Trump for his signature.

December 20 -

The House vote moved a sharp reduction in the corporate tax rate for banks and other businesses to within a few steps of becoming law.

December 19 -

New Jersey's home values in some markets could take a 10% hit under the tax overhaul nearing a vote in Congress, according to a new report.

December 19 -

With tax reform close to the finish line, bankers are still clear winners from the compromise worked out between House and Senate negotiators. But the bill includes some caveats that might give institutions pause.

December 18 -

Regulatory changes that would put an end to state and local tax deductions could prompt many homeowners in high-tax states to consider relocating, a Redfin survey shows.

December 11 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

While consumer optimism about the nation's housing market returned to near-record levels in November, it could be tested in December as they digest the impact of tax reform.

December 7