-

The lower mortgage interest deduction cap in House Republicans' tax bill would create a disincentive for existing homeowners to sell and add to already tight housing inventory concerns, according to Black Knight.

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

A provision in the tax bill passed by the House of Representatives would only intensify the housing crunch by crippling affordable housing construction, developers and local government officials say.

December 1 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29 -

The Senate tax reform proposal could force servicers to pay tax upfront on income that is currently tax deferred, according to the Mortgage Bankers Association and the Consumer Mortgage Coalition.

November 28 -

Mortgage closing costs average nearly $4,900 nationwide. But in some states, those fees can reach or exceed five figures. Here's a look at the areas where it costs the most to close a mortgage.

November 21 -

Sales of previously owned U.S. homes rose to a four-month high, indicating demand was firming at the start of the quarter as the impact from the late summer hurricanes faded, according to a National Association of Realtors report.

November 21 -

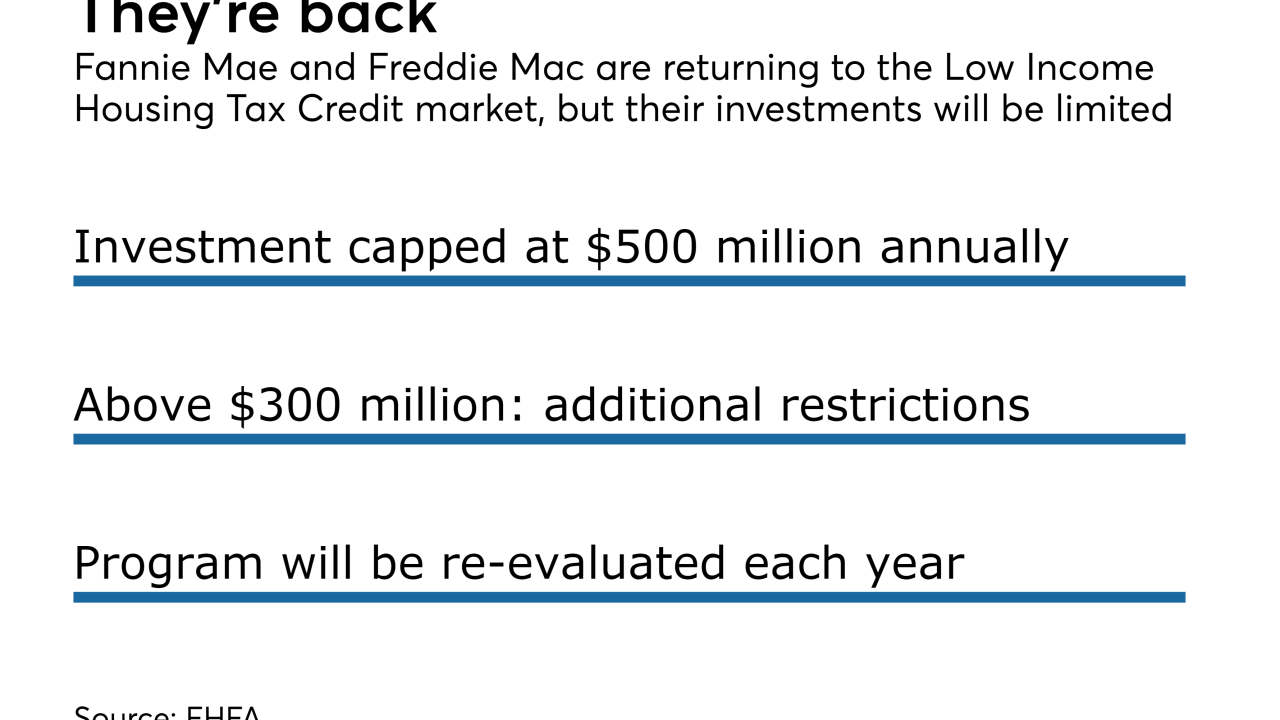

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

November 16 -

Housing advocates are pressing Senate Republicans to expand the low-income housing tax credit program while pushing back against a House GOP plan that would eliminate financing for half of all affordable housing units.

November 14 -

Transfer taxes, settlement services and other home buying fees can vary wildly from state to state. Here's a look at the 10 states where home buyers need the least amount of cash to cover their closing costs.

November 14 -

As Congress debates tax reform and which deductions to remove, a majority of homeowners from both parties worried that rising property taxes could force them to sell.

November 13 -

The Senate tax proposal released Thursday would cap the mortgage interest deduction for properties worth $1 million, a reversal from the House plan that would have limited the deduction to $500,000.

November 9 -

The elimination of private activity bonds “would throw gasoline on a housing shortage," said John Chiang, California's treasurer.

November 9 -

The treatment of local property taxes and the mortgage interest deduction in the House Republicans' tax plan would cause homeowners in high-cost states like California to incur much higher tax bills.

November 8

-

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 8 -

Pricey U.S. housing markets, from the New York suburbs to California's coastal cities, could take a direct hit under the tax-reform bill released by House Republicans.

November 3 -

A House Republican tax proposal that infuriated housing groups and sent homebuilder stocks sliding would only have a modest impact on the market for new homes and could end up being a net positive for the industry, according to Keefe, Bruyette & Woods analysts.

November 3 -

Top banking executives called the Republican tax plan an important first step toward tax reform and economic stimulus, but questions immediately arose about whether trade-offs and complexities in the bill would undercut it.

November 2 -

Hopes that tax reform might soften a weakening of the mortgage interest deduction were quickly dashed as the GOP plan landed a double punch on the incentive cherished by the mortgage and housing industries.

November 2