Technology

Technology

-

The speed of money movement represents the future - success for those who deliver, challenges for those who don't

November 3 -

Valon Technologies Inc., a startup that operates a digital mortgage-servicing platform, raised $43.9 million in equity funding from investors including affiliates of Starwood Capital Group and Freedom Mortgage.

November 3 -

With today’s generation of home buyers so rooted in a digital world, how will the financial services industry need to change to meet their needs? What new consumer technology will they need to adopt to meet consumers where they are? How will those approaches differ from how things have been done historically in the industry? Join us in a discussion with Blend’s Founder, Nima Ghamsari as we chat through how banks and financial institutions need to think through these questions.

-

Rocket, already the nation's No. 1 lender, is looking to increase market share

October 29 -

If lenders build this technology, data suggests that borrowers will come walking out of the cornfields for it — but Congress needs to pass the SECURE Act first.

October 29 -

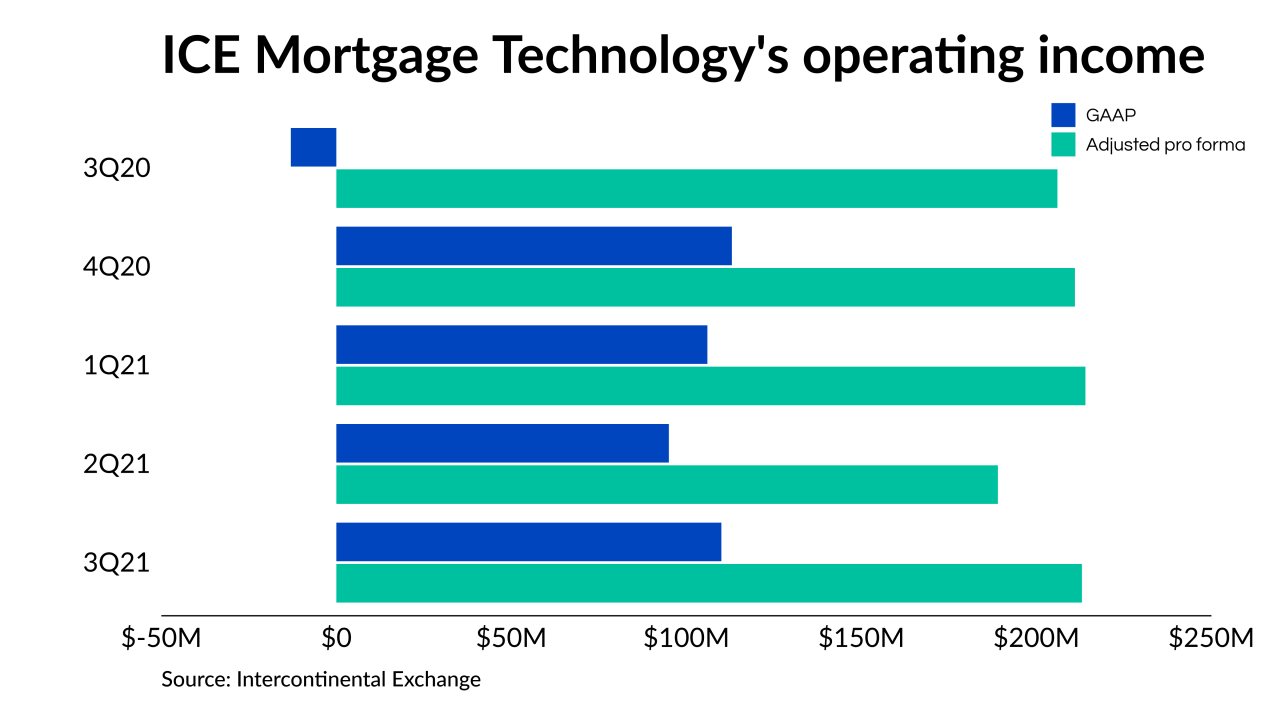

The company is making progress on a focus shift to recurring revenues from transactional activities.

October 28 -

The credit bureau's $638 million deal to buy the ID verification firm is its second M&A agreement in a little over a month to broaden its line of products and services that help customers combat fraudsters and identity thieves.

October 27 -

The MI Estimated Rate Quote application programming interface is built upon the JSON standard, used in server-to-mobile communications.

October 26 -

The average of 8% of total expenses that lenders put toward technology has a value, but it shows up more in broader organizational goals and productivity, the study found.

October 26 -

The two fintechs’ venture looks to solve the long-standing problem of connectivity as the barrier to full lending digitization.

October 21 -

The deal is the investment company’s second since it launched on Sept. 28.

October 20 -

The changes include a relationship tracking engine that details interactions between real estate agents and mortgage brokers.

October 20 -

The financial services technology provider will leverage multiple data sources to verify borrower salaries at a “flip of a switch.”

October 20 -

The company blamed its decision to stop new acquisitions for the rest of the year on the labor shortages roiling the U.S. economy.

October 18 -

After permitting remote appraisals on an interim basis during the pandemic, Fannie Mae and Freddie Mac will accept them outright starting in early 2022, the acting head of the Federal Housing Finance Agency said.

October 18 -

The multichannel lender plans to expand its footprint in the non-agency market as a result of the majority shareholder investment in the company changing hands.

October 18 -

The transaction fills in gaps in each company's capabilities for serving their customers, monetizing data for SimpleNexus, and mobile capabilities for LBA Ware.

October 18 -

The system is being rolled out to Motto Mortgage franchisees first and then to the broader mortgage broker market in January.

October 18 -

Join Janet King, Arizent VP of Research and Brian Elkins, Senior Director of Strategy at Monigle for a discussion of a new, prescriptive framework that helps banks and other financial institutions identify why customers choose to bank with one financial institution over another. Developed in conjunction with creative experience agency Monigle, the Humanizing Customer Experience research from American Banker draws on more than 5,000 customer responses to show what matters most in customer experience and ranks which financial institutions do it best. Join this discussion to learn more about how you can optimize your bank's approach to CX to improve customer satisfaction and earn higher net promoter scores.

-

The $146 million deal could indicate that volume in the asset class has gotten large enough to support programmatic activity in the pricey housing market.

October 12