Technology

Technology

-

The company also acquired the maker of the ResWare title and escrow software.

December 22 -

Join Jim McKelvey, co-founder of Square as he offers his insights into where the Fintech industry is headed next year. Will a Biden administration insist on greater regulation? What will happen in the cryptocurrency markets? What will be the big IPOs in the sector? Will GooglePlex make a big splash? What new technologies or applications should we be expecting?

-

The key to preparation today lies in process automation that far surpasses pre-pandemic solutions for default servicing, Clarifire CEO Jane Mason says.

December 16 -

Clear HOI — an encrypted, cloud-based tool that automates homeowners insurance underwriting — is getting released to the broader market by Rocket Mortgage’s sister company Nexsys Technologies.

December 9 -

Jeff McGuiness is stepping into an organization that just had its best quarter ever in origination volume.

December 7 -

The company’s proprietary platform is aimed at helping borrowers apply for home loans in as little as 15 minutes by automating immediate validation of bank information used in qualification.

December 2 -

Startups Home Lending Pal, RealKey and Stavvy will get access to experienced mentors and potential customers over three months as a part of the program.

December 1 -

As today’s borrowers are more tech-savvy than ever, it is critical for lenders to partner with a strong digital point-of-sale company, EXOS Technologies’ Mikhail Cook says.

November 30 -

Experts in the field predict how some aspects of the market will develop in the coming year.

November 30 -

Bee Mortgage App will use blockchain and automation provided by Elphi to create "a COVID tool for real estate agents" to get fully digital mortgage approval in under three minutes.

November 25 -

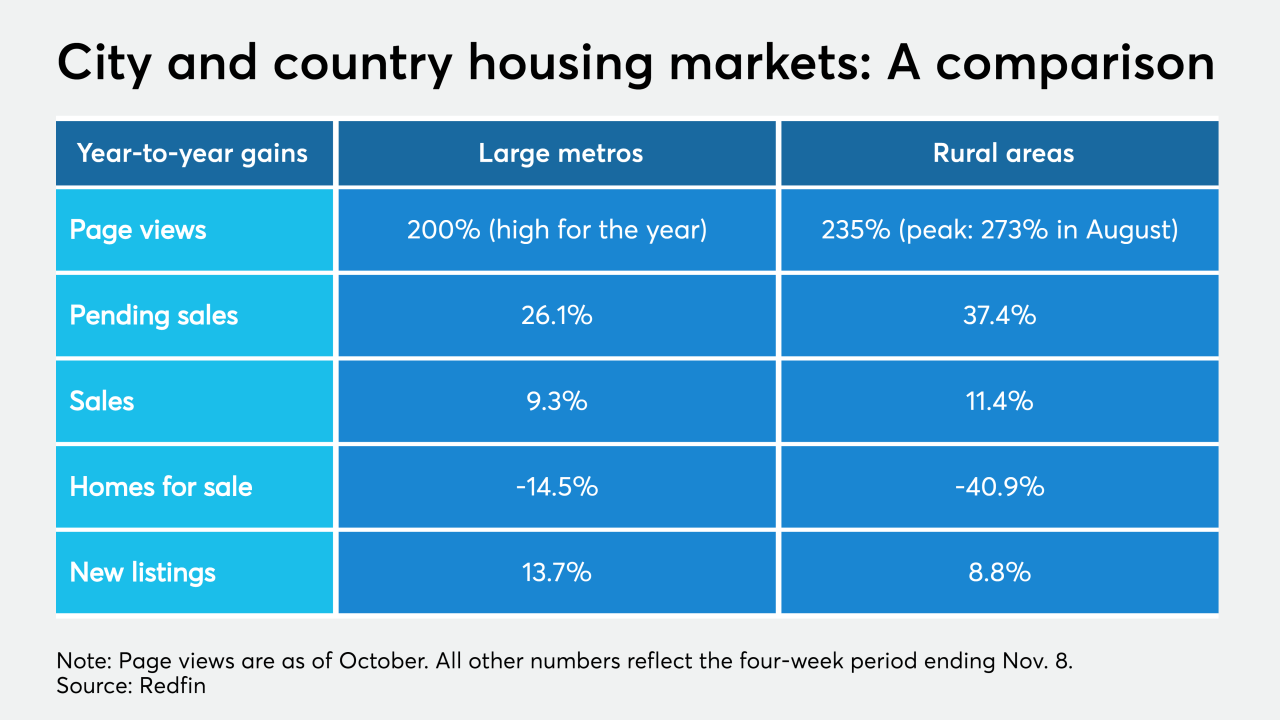

The year-over-year increase in monthly page views for properties hit a high for the year in large metropolitan areas as gains in rural locations decelerated.

November 25 -

In an open letter, industry veteran Thomas Vartanian outlines the steps the administration can take to encourage innovation, better detect cyber threats and modernize regulation.

November 23 -

To truly manage risk, banks must invest in more sophisticated modeling, reporting and analytics to track market movements and ultimately maximize profitability, Vice Capital Markets’ Christopher Bennett says.

November 19 -

The move follows a report last year that the government-sponsored enterprise was looking into working with the provider of artificial intelligence-driven credit-risk models.

November 19 -

Use of mortgage technology was fast-tracked due to coronavirus lockdowns and kept the lending industry humming, laying the foundation for a greater share of digital closings in 2021.

November 19 -

After ending their hostile bid, the two investors continued their push for greater control of the mortgage technology company.

November 17 -

Corporate breaches facilitated by employees — often accidentally — rose significantly this year, and banks have been particularly hard hit. Here's why.

November 16 -

The substantial Series D fundraise fuels speculation on whether Better.com will be the next mortgage company to hop on the IPO trend.

November 13 -

As it attempts to craft policy on access to consumers’ financial account information, the agency is wading into a battle between those who want data to flow more freely and those who prioritize security.

November 12 -

The draft IPO filing for its Class A shares follows speculation that it would follow the lead of Rocket Cos. and other nonbank lenders in going public.

November 11