-

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

State and local governments are clearing the policy hurdles that stand in the way of mortgage e-closings and that could pave the way for more progress toward this goal.

February 14 -

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14 -

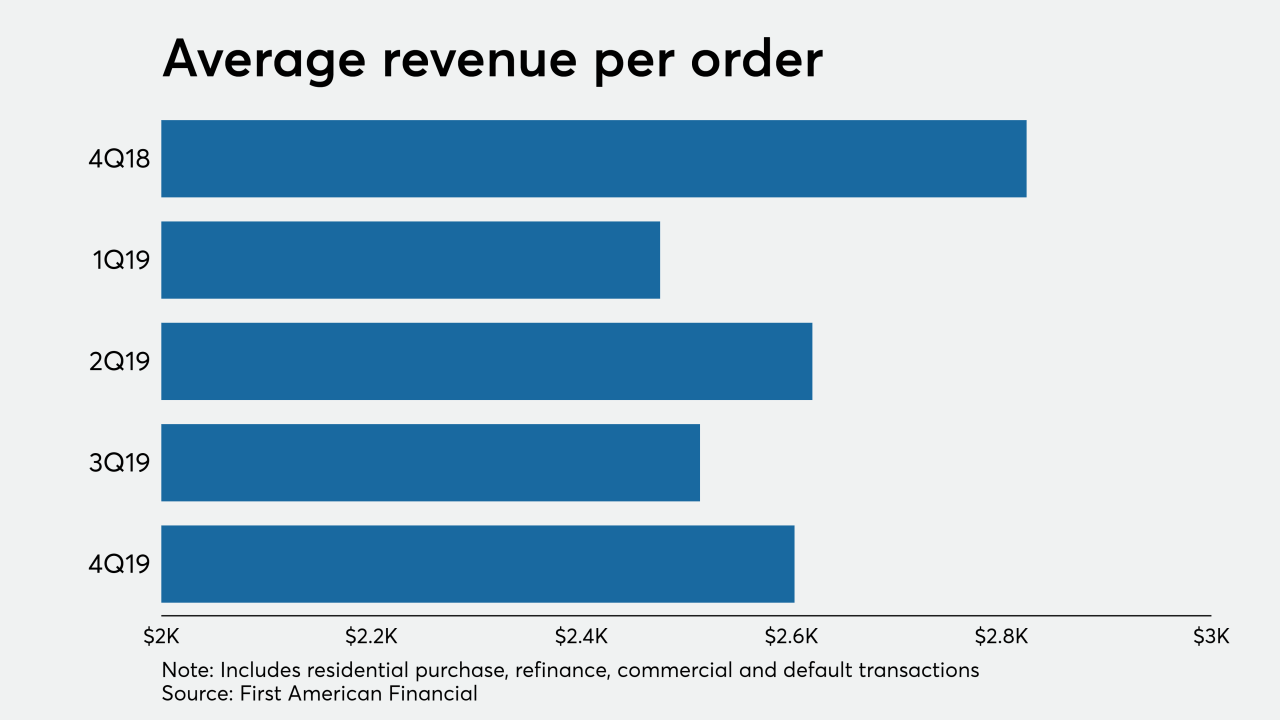

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Digitization presents opportunities for lenders to streamline the mortgage process in ways that benefit them and their borrowers, but three things stand in the path to full adoption.

February 12 Fiserv Inc.

Fiserv Inc. - LIBOR

Federal Reserve Chairman Jerome Powell told senators that the central bank is willing to explore a credit-sensitive interest benchmark in addition to the secured overnight financing rate, which some banks say could cause problems during economic stress.

February 12 -

NMI Holdings saw its insurance-in-force grow 38% over the past year as 90% of its clients used its black box pricing module during the fourth quarter.

February 12 -

PMI Rate Pro lets users compare mortgage insurance premium quotes from all six companies in the market.

February 10 -

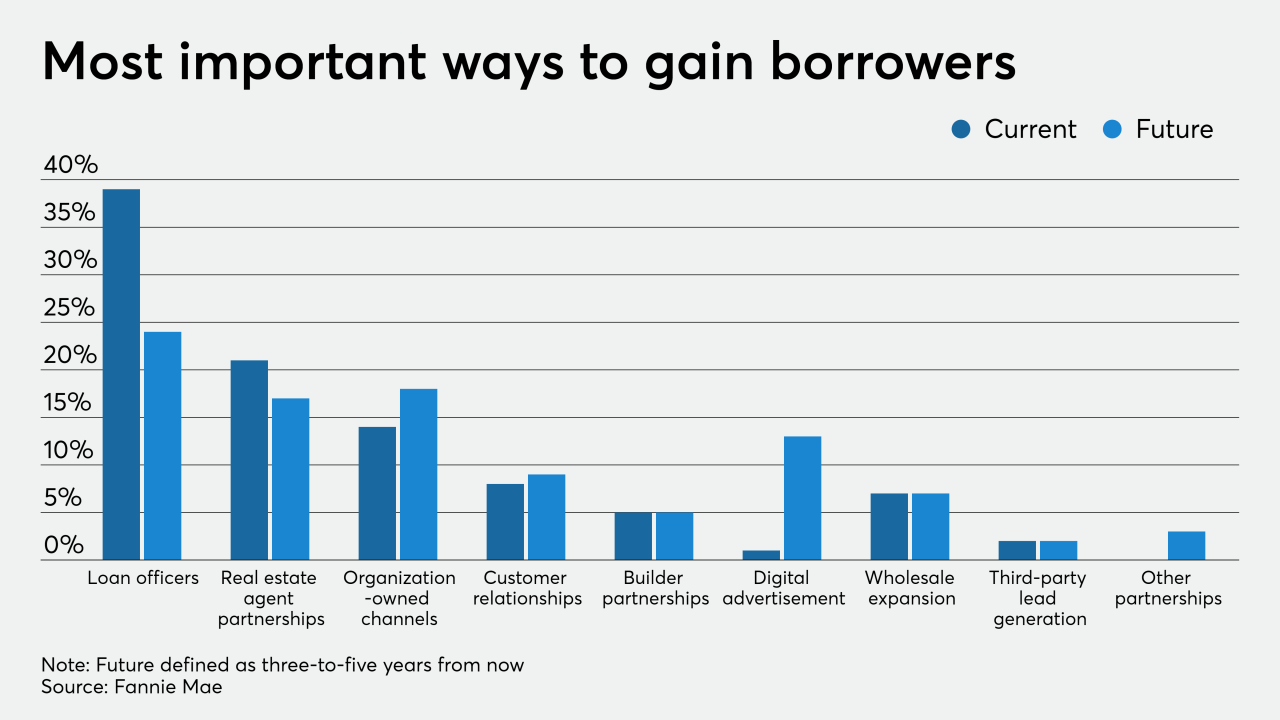

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

The credit union service organization Member Driven Technologies has a laid-back work environment but works hard to translate its internal culture to employees who may be located hundreds of miles from headquarters.

February 4