-

loanDepot has invested $80 million in a three-part digital lending platform called mello and is opening a 65,000-square-foot technology campus in Irvine, Calif.

March 31 -

In a speech, Consumer Financial Protection Bureau Director Richard Cordray said the agency enforces “with the principle of equal justice” so enforcement actions don’t seem random.

March 31 -

Lenders can track the effectiveness of product pricing changes on a real-time basis using a new market share analytics tool from Optimal Blue.

March 30 -

From blockchain to digital labor, here's a recap of the best moments and insights from the Mortgage Bankers Association's 2017 technology conference.

March 30 -

The industry expects to lean on technological efficiencies this year as higher rates and dwindling refinances test their businesses.

March 28 -

Fintech could cut the closing times on the simplest home loans by more than 50%, but the mortgage business' complexity means there are limits to how much time and money can be saved.

March 28 -

Here's an early look at what technology developers will be doing to dazzle and impress lenders and servicers during the Mortgage Bankers Association's technology conference in Chicago.

March 24 -

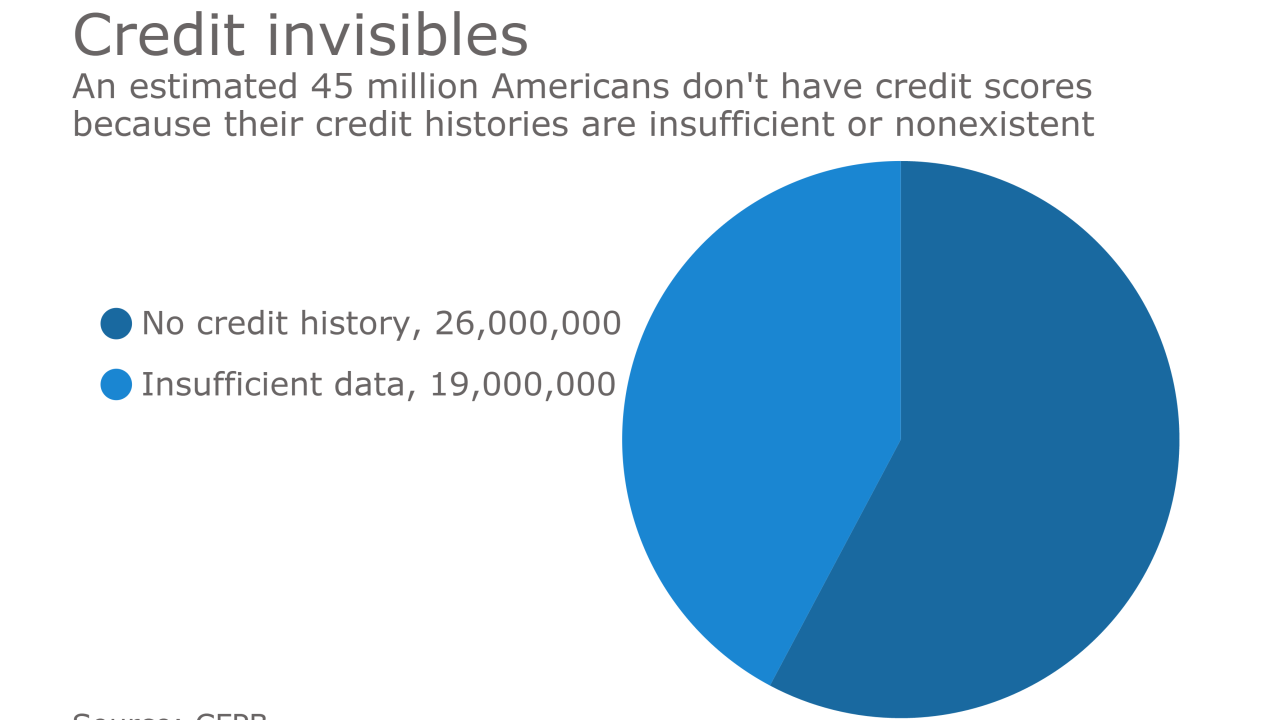

Freddie Mac will soon allow automated underwriting of borrowers who lack scores but have other financial records.

March 23 -

Experian and Finicity have released a product that aims to speed up decisions on mortgage applications, using financial data aggregation technology.

March 20 -

A startup lender is catering to tech-savvy, do-it-yourself borrowers by using online and mobile tools to replace the upfront sales and marketing work of salespeople.

March 17