Rising mortgage interest rates not only will continue to constrain banks' once-robust revenue from this business, they will also affect existing borrower credit quality, a report from Moody's said.

The average for the 30-year fixed rate mortgage

Those higher rates have not only reduced origination volume as the market shifted from refinance to purchase, they have also resulted in lower gain-on-sale margins for those originations that are sold into the secondary market.

"Reduced

Through the first nine months of this year,

Until recently, Wells Fargo was the nation's leading mortgage originator. Loan production during the third quarter was $13 billion lower than the year prior, at $46 billion.

Chase is not as large in its mortgage operations, with $22.5 billion in volume, down by $4.1 billion from one year prior.

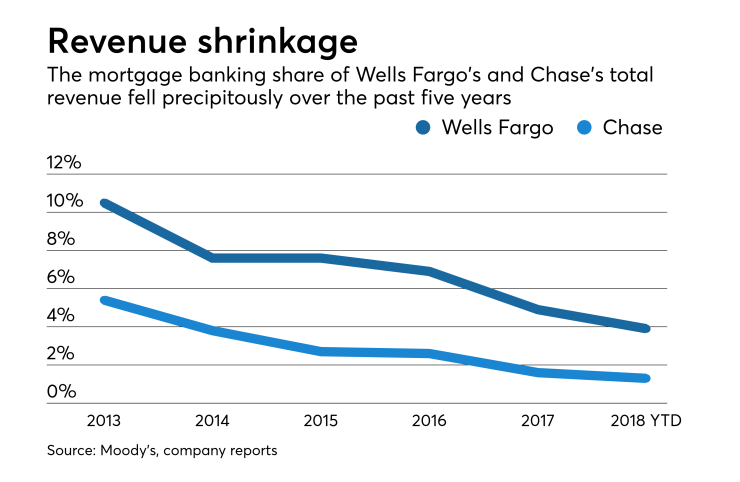

Mortgage banking revenue made up a lower percentage of the total, 1.3% in the third quarter, down from 5.4% for 2013.

"The recent rise in mortgage interest rates makes it unlikely that U.S. banks' mortgage banking volumes and revenues can rebound materially in the next few quarters," Tischler said. "However, given that mortgage banking has long been a cyclical business, the banks can improve their profitability by reducing capacity, as they have done in prior periods of lower volumes."

That is already happening at both companies, he noted. Wells Fargo announced plans

"We believe both firms' recent performance and response are representative of the wider industry trend," Tischler added.

On the servicing side, higher interest rates increase the potential for some customers to have trouble paying their mortgage loans. In turn, that translates into weaker credit quality for the banks, he said.

"However, the U.S. economy remains robust and the banks' latest earnings reports show continued strong credit quality, an indication that higher rates have not yet undermined existing loan performance," Tischler concluded.