Remote work helped fuel migration and erased the loss of rural residents that occurred in the decade prior to the arrival of Covid, Harvard researchers found.

Washington, D.C. and Denver lead the country with the largest share of mortgaged households, and will likely soon see a shift in buyer demand, Realtor.com said.

In April 2025, the bank admitted that it may have made a mistake in denying the plaintiff forbearance.

Largely strong credit qualities were offset because by loans on single-family homes in the pool dropping by 0.5%, and that the percentage of loans that received due diligence decreased by 0.4%.

-

The national mortgage delinquency rate jumped to 3.85% in November, up 15% month over month and 2.79% year over year, according to ICE Mortgage Technology.

-

A California judge dismissed 13 claims against United Wholesale Mortgage that alleged the lender disclosed personal information to third parties.

-

AI tools like ChatGPT are reshaping mortgage marketing, forcing lenders to rethink SEO, brand authority and how they show up as consumers turn to generative search for answers.

-

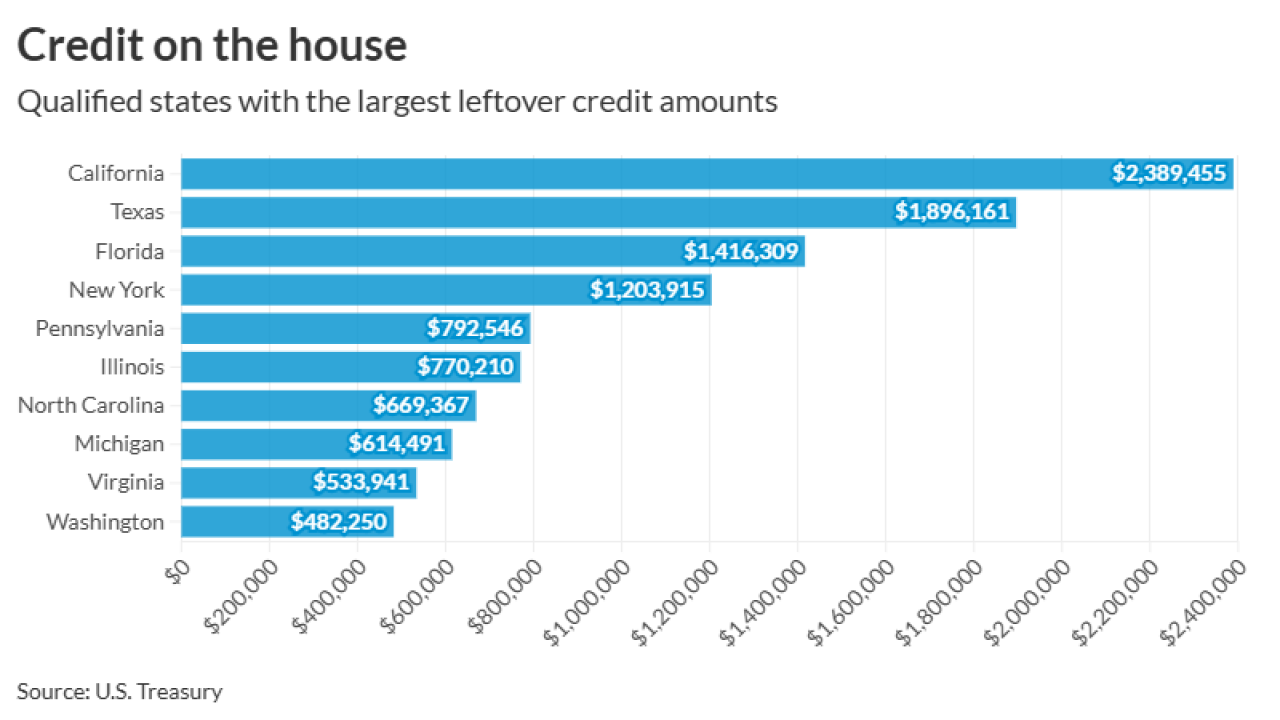

The carryovers range from some $2.4 million in California and some $1.9 million in Texas to $44,851 in Alaska and $39,297 in Vermont.

-

Proxy advisory firm Institutional Shareholder Services recommended approval of Fifth Third's $10.9 billion proposed acquisition of Comerica.

-

The judge's order allows potentially thousands of consumers to join the lawsuit against the company, similar to other fights between borrowers and servicers.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Reviving a long-dormant loan guarantee program could go a long way toward restocking the supply of starter homes and helping households of modest means create wealth, writes the President and CEO of University Bank.

-

The CFPB missives are an early and unmistakable warning that the era of COVID-19 flexibility is over, write two partners and a law clerk from Buckley LLP.

-

There is a persistent undersupply of moderately-priced homes, which continues to push affordability and the dream of homeownership further into the future for millions of potential first-time minority homeowners, writes the president of mortgage for Radian Group Inc.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.