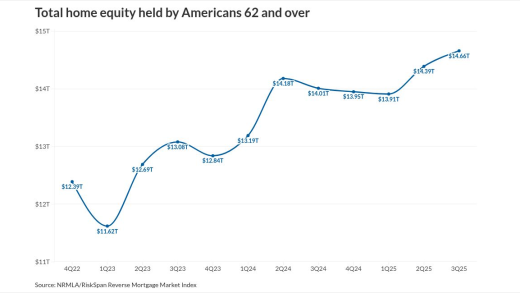

A record amount of equity is now held by property owners 62 and older, with a growing share transferring homes to their heirs and not putting them up for sale.

The additional research Secretary Scott Turner acknowledged would be required should include a cost-benefit analysis, mortgage professionals suggested.

Third-quarter mortgage earnings revealed swings in profitability, but the real story, according to the Chairman of Whalen Global Advisors, is that hedging MSRs is unnecessary for well-managed lenders.

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

-

The regulator, in an audit with the Department of Homeland Security, found almost 6,000 ineligible non-American tenants in the units it supports.

-

The estimated range for net income to common shareholders at the company formerly known as Ocwen rose in part due to a deferred tax asset valuation.

-

A record amount of equity is now held by property owners 62 and older, with a growing share transferring homes to their heirs and not putting them up for sale.

-

The government mortgage securitization guarantor flagged the goal back during the first Trump administration, warning then that it would be a long-term project.

-

On Jan. 26, use of the new Uniform Residential Appraisal Report shifts from limited production to the optional phase, giving lenders 10 months to get ready.

-

Prepayment speeds approached recent highs last month, but distressed borrower data paints a mixed picture about the current housing market, according to ICE.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Using AI inferences to sensitive questions based on limited data within the mortgage industry could easily result in fair servicing violations if they, for example, prompted repeated outreach attempts to borrowers based on protected characteristics, writes the

-

Subsidies for first-time homebuyers, such as the one proposed by Democratic Presidential nominee Kamala Harris, will only stoke demand and exacerbate the crisis, writes the chairman of Whalen Global Advisors.

-

Two former staff members for the House Financial Services Committee at the time when the Housing and Economic Recovery Act legislation was developed and adopted reflect on its impact.

-

As the crisis in the Ukraine unfolds, markets have been upended creating a volatile environment for all asset classes, including the municipal market.

- ON-DEMAND VIDEO

As risk management becomes a major driver for banks, we discuss how to approach these questions in a different way

-

-

- Partner Insights from Freddie Mac Single Family

- Sponsored by Blend