The Financial Technology Association will now defend the Consumer Financial Protection Bureau's open banking rule after the Trump administration sided with banks that sued the agency.

Analysts predict more modest job cuts over the winter after expenses rose 1% between the second and third quarters this year.

Around 432,000 homeowners exited their pandemic-related payment suspensions in the first 19 days of October and more than 280,000 plans have month-end review dates, but the number of private-loan plans increased.

US Treasuries retained most of their recent gains as anticipation of Federal Reserve interest rate cuts held firm after the central bank's preferred gauge of inflation matched economist estimates.

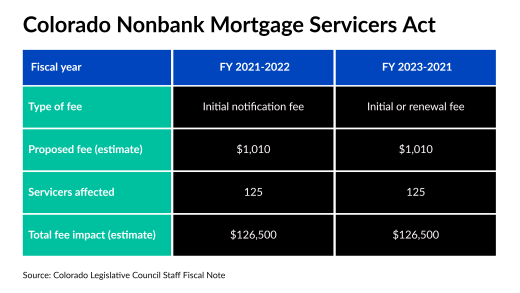

Mortgage lenders with servicing operations will have more access to automation that cancels surety bonds soon and will need a new registration to accommodate it.

-

Sprout's ex-CEO Michael Strauss, who has avoided the legal proceedings, has been accused of money laundering and is facing two foreclosures in New York.

-

Federal Reserve Chair Jerome Powell said the changes could touch the central bank's quarterly economic forecasts. He also discussed downsizing at the Fed and his tenure on the board of governors.

-

The Senate version includes restoration of the mortgage interest deduction, but a tax code revision likely would stifle foreign investment in real estate.

-

The department's head pointed out that manufactured housing is the most affordable non-subsidized option for building homes.

-

Bill Pulte's social media posts saying inflation has fallen far enough added to intensified political pressure on the independent Federal Reserve chairman.

-

Previous predictions of a "silver tsunami" that might add essential housing supply are ebbing as senior citizens see benefits of aging in place, Redfin said.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

While the housing market is slowly picking up steam, there is still a very large inventory of distressed loans that pose a potential risk to the mortgage industry.

-

Servicers are still finding ways to cope with heightened regulatory scrutiny and continue to evaluate options to increase efficiencies while maintaining legal compliance.

-

Tighter underwriting standards, strong farm income and relatively low loan-to-value ratios should provide a cushion if a downturn occurs.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland