As the lock-in effect deters many current homeowners from buying, the housing market is seeing younger clients stepping in, often with government-backed loans.

The digital lender's product comes amid soaring expenses for homeowner's coverage.

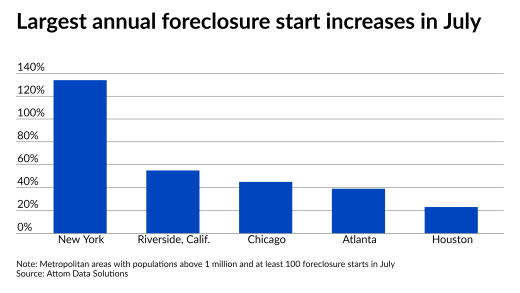

The end of many COVID relief plans in September have the industry holding its breath, with outcomes potentially foreshadowing the months to come.

Contract signings on new single-family homes ticked down to a 652,000 annualized rate, with the strongest demand in the West, according to a government report issued Monday.

A Redfin survey found that no matter what age demographic, owners are in a better situation to make their payments compared to renters.

-

Real estate players disclosed losses in 12% of incidents, and the average financial hit was $16,829, according to data from the past decade.

-

The trade group, whose industry has come under attack by the growth of title insurance alternatives, cited Morton's lobbying expertise for his promotion.

-

Like the current HUD secretary, Andrew Hughes holds close ties to former department head Ben Carson, actively supporting his past presidential ambitions.

-

The government measure of inflation for May ticked up modestly, adding to the signals that the Federal Reserve is unlikely to move on interest rates when it meets next month.

-

The Trump administration's plan to fire 90% of the staff at the Consumer Financial Protection Bureau has raised constitutional questions about whether courts can decide whether a president is taking "care that the Laws be faithfully executed."

-

The deal is secured by a portfolio dominated by mortgage loans considered non-qualified or exempt from ability to repay rules.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Put your energy into developing a branch manager comp plan that is compliant. The alternative is simply not worth the risk.

-

Getting all of the financing pieces for affordable housing is difficult because nonprofit developers usually have to tap multiple sources of capital.

-

If the consumer pays a loan originator organization, the organization is allowed to pay a commission to the individual LO who originated the transaction.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland