Government-backed lending drove an increase in purchase mortgages for a second straight week, even as interest rates failed to drive refinance activity.

But scarce housing inventory has helped to bring home equity values back upward, offsetting some of the losses of late 2022.

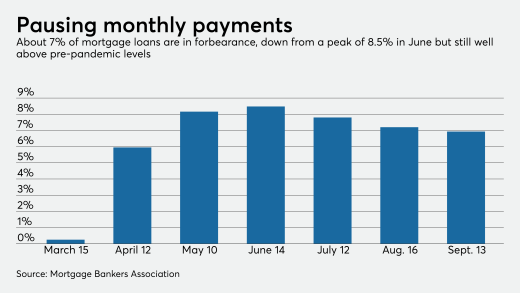

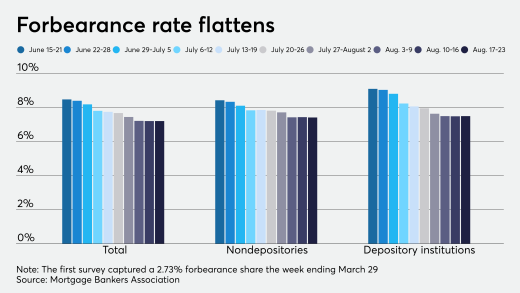

Some homeowners who sought relief as a result of COVID-19 may owe a lump sum when their forbearance period ends, according to a report from the Committee for Better Banks. The group is calling on banks to instead extend the repayment periods for affected customers.

The leading lenders have hinted at more serious accusations in the lawsuit focusing on the departure of nearly two dozen employees earlier this year.

Mortgage tech firms are seeking to take advantage of the expected growth of HELOCs with new platform integrations and enhancements of existing tools.

-

The administration is pitching a $26.7 billion reduction to the regulator's funding for rental assistance, public housing and elderly and disability housing.

-

Even though Motto Mortgage has 8% fewer open offices than a year ago, executives touted franchise renewals with owners committing to another seven years.

-

The tool's launch comes as various sources report growth in both serious borrower delinquencies and foreclosure activity over the first few months of 2025.

-

Industry payrolls wavered in a tepid buying season in which total employment has been better than expected given government cuts.

-

Fitch says large nonbank lenders are positioned to gain share as they manage debt maturities and outlast smaller rivals hit harder by market volatility.

-

In a recent interview, Bill Pulte claimed he's signed 80 orders for the agency, although only a dozen have been made public via his social media feed.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Collectively, credit unions originated more than $100 billion in loans last year for the first time.

-

If you originate under the qualified mortgage rule, courts must presume that you followed the eight underwriting guidelines found in ability to repay.

-

When it comes to appraisals, different lenders have different needs, depending on lending strategies, business models and areas served.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland