The 30-year conforming fixed-rate mortgage is at its lowest point since the end of December, as Treasury yields are 29 basis points lower since Feb. 19.

As application volumes increased, loan sizes also surged, with average purchase amounts now at a 2023 high, according to the Mortgage Bankers Association.

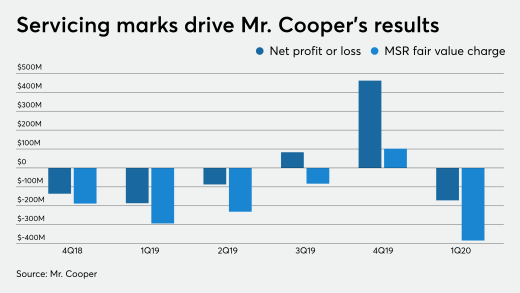

Complaints to the bureau hit an all-time high in April. More than one in five said servicers wouldn't grant deferrals, forced borrowers into forbearance or violated other requirements of the coronavirus relief law.

Most indicators cited by Morningstar DBRS are favorable to a good securitization market the rest of the year, but inflation is one of several challenges.

While Sunbelt markets were more likely to see softening property values, the Northeast saw growth continue, according to Intercontinental Exchange.

-

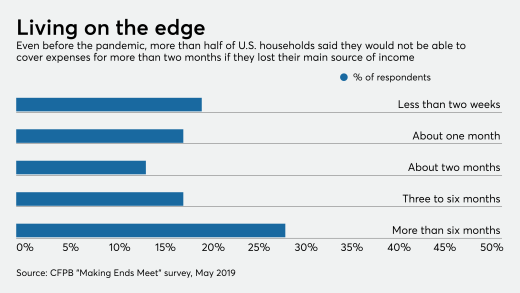

Approximately 9% of current homeowners experience a labor market event that results in a negative credit shock, limiting access to their equity, Point said.

-

Inflation cooled faster than expected last month, giving the Federal Reserve room to ease monetary policy if the economy weakens suddenly. But tariffs and other policy changes still cloud the outlook for monetary policy.

-

The top five subservicers that are depositories had a combined unpaid principal balance of more than $1.8 trillion at the end of Q4 2023.

-

The regulator argues the company is attempting to thwart a pending enforcement action involving an alleged discriminatory appraisal in 2021.

-

The move comes three months after Katie Sweeney, former BAC CEO, announced she would be stepping into an executive advocacy role for Rocket's Pro channel.

-

Lenders and borrowers have taken advantage of the dips in interest rates, but the industry has long-warned of pain for players like home builders.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

If you want to see what a housing recovery looks like on the ground, its time to visit Phoenix.

-

Regulators are increasingly examining institutions vendor risk management processes.

-

We're hearing that industry folks are hoping the Consumer Financial Protection Bureau will just use its regulatory authority to exclude loan originator compensation from the 3% points and fees cap.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland