McKernan, a member of the Federal Deposit Insurance Corp.'s board of directors, offered measured resistance to Biden-era bank regulation and led on a number of issues including cracking down on the influence of asset managers who hold stakes in FDIC-insured banks.

Virginia and Montana both introduced new bills in the past month, potentially joining several other states in enacting policies that would increase business opportunities for lenders.

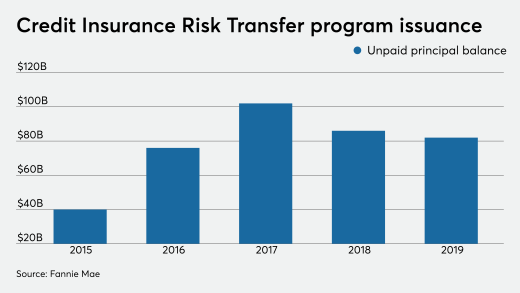

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

The prime jumbo RMBS transaction is collateralized by 402 residential mortgage loans.

The conviction of a fraud ring mastermind highlights growing risks in home equity lines of credit as equity-rich borrowers become prime targets.

-

Perspective homebuyers with work visas, asylum seekers and DACA recipients seeking the government-backed mortgage will be impacted by this sweeping change.

-

The typical homebuyer's monthly mortgage payment reached a record high, up 5.3% year-over-year, but consumers are putting more money down, adding to equity.

-

The most tangible concern is in the commercial real-estate market. But the rating agency's crystal ball is cloudy when it comes to single-family home loans.

-

Dugan is replacing Rich Gagliano, who is moving to executive chairman after 18 months in charge of the now stand-alone mortgage technology provider.

-

The Senate Banking Committee considered the nomination of Paul Atkins to lead the Securities and Exchange Commission, whose track record on deregulation in the lead up to the 2008 financial crisis was questioned by Democratic lawmakers. Lawmakers also considered the nomination of Jonathan Gould to lead the Office of the Comptroller of the Currency and Luke Pettit for a key bank regulatory role at Treasury.

-

Royal Bank of Canada executives said they plan to start originating more mortgages in the United States, and they indicated that they may ditch the City National Bank brand.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Mortgage people need to toe the mark or CFPB may tow it for you.

-

The downfall to new technology is that it can feel much like paving the freeway during rush hourit is very complicated, fraught with risk and susceptible to failure.

-

Although mortgage servicers hire field service companies to preserve these properties, the property will deteriorate without a tenant or occupant no matter how much maintenance work is completed.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland