The state bill would also mandate third-party appraisal of properties and offer a three-day window for consumers to withdraw from agreements.

The change allows for more accessible financing options for a greater number of listings, but not all of those potential buyers qualify for conforming mortgages, Zillow said.

Consumer attorneys are filing more Telephone Consumer Protection Act lawsuits than ever and if a piece of follow-up legislation becomes law, the peril to mortgage lenders will grow.

The digital bank is returning to crypto trading, a service it first offered in 2019 but had to shelve due to regulatory compliance concerns.

The decision to relocate HUD headquarters comes after its current location had been included on a Trump administration cost-cutting list earlier this year.

-

The Connecticut bank said its newly minted president, Steven Sugarman, successfully led a private placement and signed a long-term employment agreement that makes him a potential CEO. David Lowery, current chief executive of Patriot, plans to step down in April.

-

Kind Lending has big plans to grow its retail channel and is signaling this by putting industry veteran Tammy Richards in charge of the operations.

-

The bipartisan co-chairs of the Community Financial Development Institution caucus sent a letter urging the Trump administration to continue supporting the CDFI Fund after it was slated for cuts in a recent executive order.

-

The Fed's wait-and-see approach on what will happen to the U.S. economy, while not directly impacting mortgages, will likely keep those rates elevated.

-

ICE Mortgage Technology announced additions for its Encompass LOS, while Mortgage Cadence is bringing out a new version of MCP aimed at mid-sized depositories.

-

The top five banks had a combined unpaid principal balance of more than $26 billion at the end of Q4 2024.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Before asking for a bid, verify that every contractor you're considering has the proper surety bond and licensing in place.

-

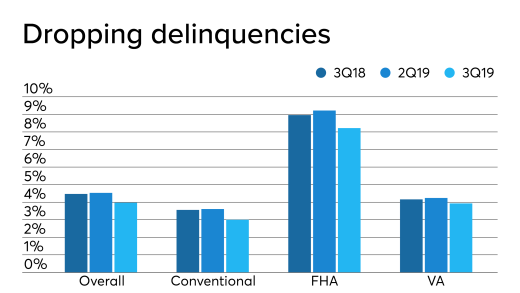

It would appear that FHA's days of being known as 'the government's subprime lender' are just about over.

-

The CFPB and FTC have issued joint warnings about misleading advertising. While these warnings generally address apparent shortcomings (e.g. misrepresenting government affiliation), they signal to lenders the importance of reviewing advertising from a compliance rather than merely marketing perspective. In particular, advertisers should review not only the substance of a marketing piece but rather the entirety of a marketing campaign. For instance, a lender should review the likely audience and whether the particular product being advertised is appropriate for that audience. Lenders should take special care when it comes to marketing campaigns that may utilize media outlets that strongly favor one particular racial ethnic gender or age group, or if different products are being advertised to different media outlets strongly associated particular socioeconomic groups

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland