The loss mitigation directives place limits on options and include a long ramp-up period that could accommodate future change from new leadership in Washington.

While mass firings abound, the employment situation is not moribund for those with certain skills sets in demand.

Foreclosure activity fell 21% in July compared to a year ago and rose 6% from June after twelve consecutive months of declines, according to Attom Data Solutions.

Privatizing Fannie Mae and Freddie Mac risks a return to the kind of perilous mortgages that helped cause the global financial crisis unless regulatory safeguards are kept in place, an affordable housing nonprofit said in a paper on Tuesday.

The closed meeting between the Federal Housing Finance Agency, the Treasury, and the Securities and Exchange Commission is the first publicized in some time.

-

Independent monetary policymakers have resisted President Trump's call to lower financing costs but could find it harder to ignore employment losses.

-

Origination volume at the San Diego-based company rose 57% to $24 billion in 2024.

-

Hsieh stepped down from a day-to-day operational role following a contentious proxy battle for board leadership in 2023 but remained a director.

-

Federal Reserve Gov. Christopher Waller said the Founding Fathers supported independent money management and undoing it now would be a mistake.

-

The company first entered the Canadian market in 2020 through an investment in an Ontario-based brokerage, which later rebranded to Rocket Mortgage Canada.

-

For the four weeks ended March 2, pending sales were down 6.4% annually as prices continued to rise, pushing borrower monthly payments near their all-time high.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

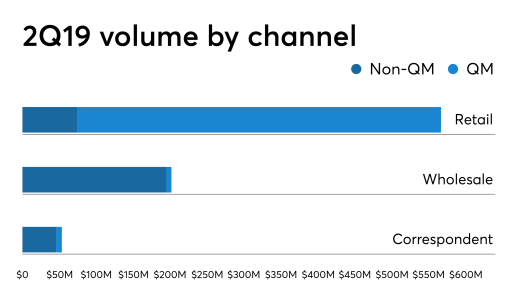

We're seeing a rise in the willingness of lenders to make home mortgages to business owners who cannot always verify income.

-

The Department of Justice suit against Bank of America shows that beyond enforcement through regulators, lawsuits are increasingly focusing on the systems lenders use.

-

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland