The mortgage company, even though it is owned by a bank, has been profitable for the last two years, when considering its originations operations, as it does.

Synergy One Lending's CEO, Steve Majerus, is warning recruiters that if they do not stop spreading lies about his firm, the mortgage lender will take action

Those who don't retain MSRs or have a buyer agreement accommodating a recapture strategy will face challenges, one panelist warned at an industry meeting.

Hart, who came over from Ellie Mae, starts in the position of Jan. 1, as Tim Bowler moves to a new role within ICE's Fixed Income and Data Services division.

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

-

Lancaster, Pennsylvania-based Fulton Financial said Monday it will pay $243 million in stock for Blue Foundry Bancorp, which has lost more than $20 million since converting to a public company in 2021.

-

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

-

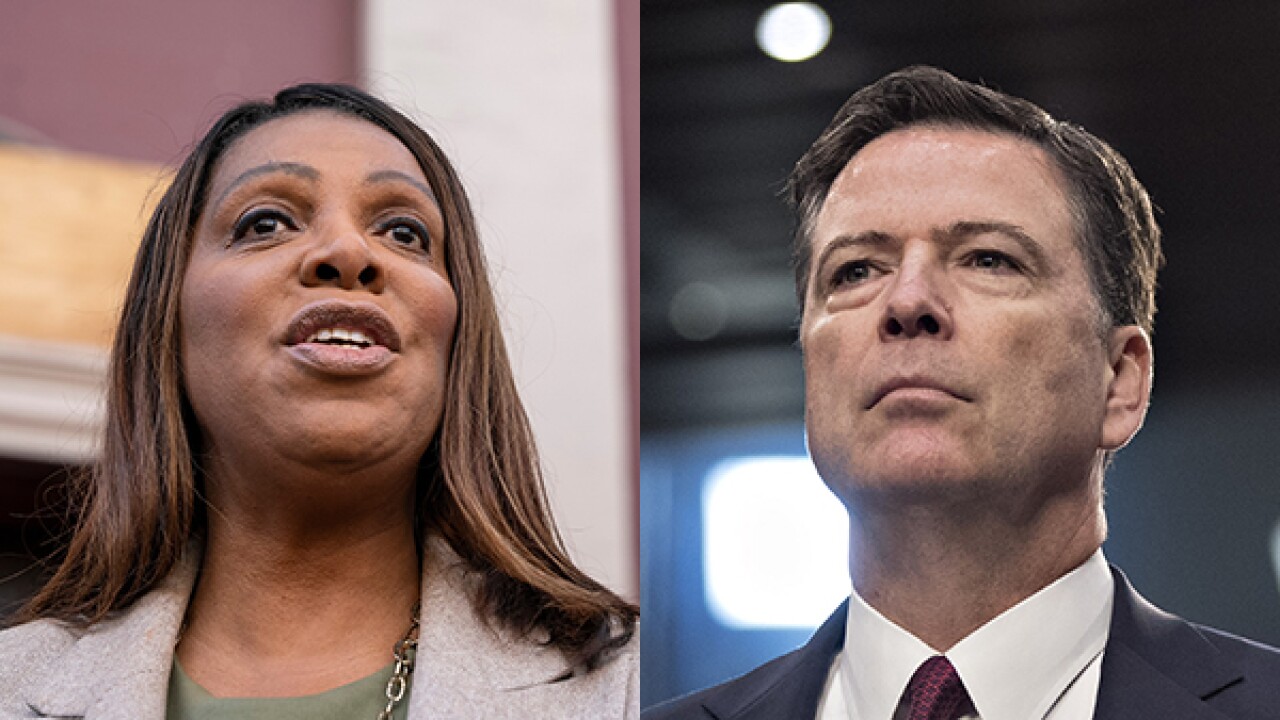

A federal judge threw out the criminal charges against former FBI Director James Comey and New York Attorney General Letitia James, ruling that the prosecutor who brought the cases had been illegally appointed.

-

The government-sponsored enterprise took its first look at what new loan volume might be like in two years and found it could rise closer to pandemic levels.

-

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

-

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Banks need to mitigate potential bias in algorithmic predictive models using artificial intelligence, as regulators are weighing how to oversee the emerging technology.

-

Loan officers' jobs are harder than they need to be because of back-end system inefficiencies, and it adds cost to the process.

-

Lenders looking to keep up with the competition should adopt a digital mortgage process because a key borrower segment and the government-sponsored enterprises increasingly expect them to offer one.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Partner Insights from DataVerify

- Partner Insights from Simplifile

- Partner Insights from ReverseVision

- Partner Insights from DocMagic