The title industry sustained improvement first seen last year, with second-quarter premium totals up on both a quarterly and annual basis, ALTA said.

On a GAAP basis, Intercontinental Exchange's mortgage business has lost money for nine quarters, but a metric that includes Black Knight makes it profitable.

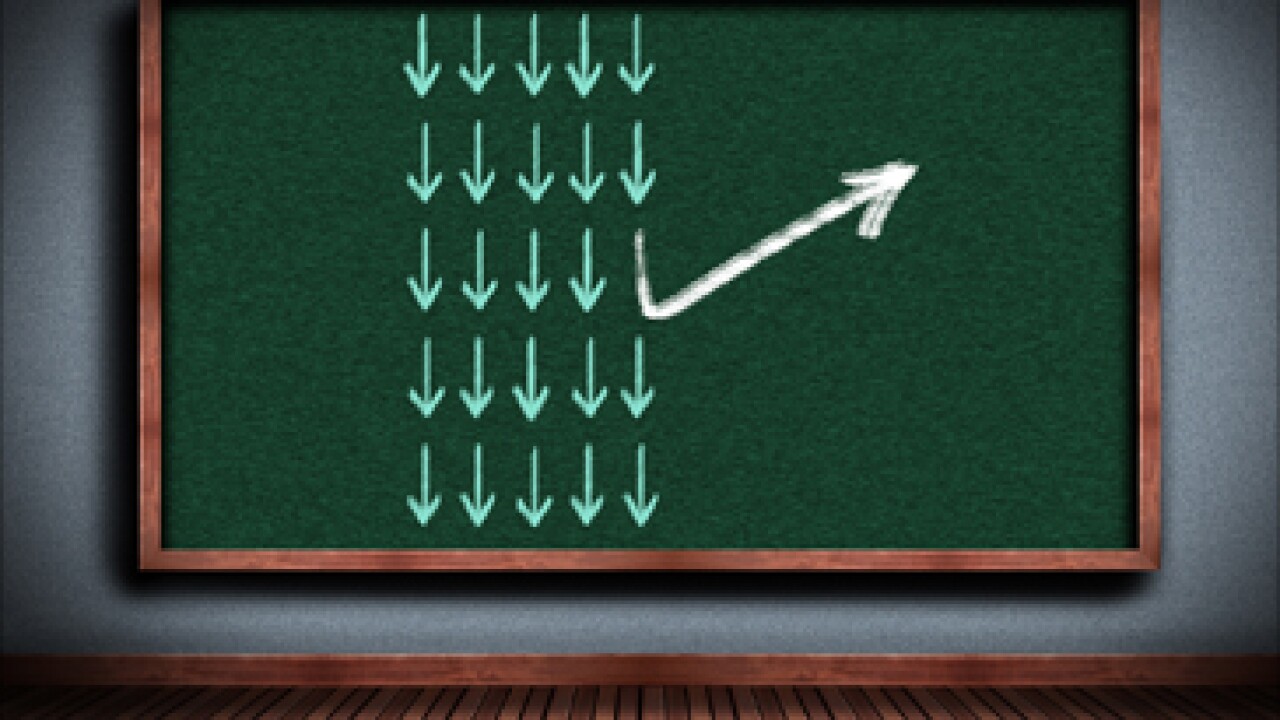

As the book of business written during the 2020 to 2022 period enters peak delinquency years, default notices are expected to rise, fourth quarter earnings comments revealed.

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

-

The Consumer Financial Protection Bureau has announced job openings for attorney-advisors to represent the agency in defensive and appellate litigation.

-

While technology has become an important channel for information among homebuyers, many still see real estate agents as smarter than any other resource.

-

James was charged with one count of alleged bank fraud and one count of making false statements to a financial institution. The indictment made public on Thursday follows allegations from Trump administration officials that James engaged in mortgage fraud.

-

Onity adds former Meta exec as director, Click n' Close taps industry veteran as president while banks and credit unions boost their mortgage teams.

-

The regulator recently nixed Obama and Biden-era guidance for the Office of Fair Housing and Equal Opportunity and apparently reduced staff.

-

Total mortgage origination volume is forecasted to barely eclipse $2 trillion by the end of the year for the first time since 2022, iEmergent said.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

The Consumer Financial Protection Bureau's pending rule hinging on excessive document collection, when the focus should be on prohibitive privacy laws.

-

Land title insurers using mobile devices for business often misunderstand how much sensitive personal information they're holding, posing a big data security and regulatory problem.

-

Hint: businesses should be focused on data strategy and security, from the individual up to the enterprise level.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland