The Supreme Court Wednesday appeared skeptical of the Justice Department's argument that removal of a Federal Reserve governor is unreviewable or that the president's preference for Fed governors outweighs the harm to the Fed from curbing the central bank's political independence.

Remote work helped fuel migration and erased the loss of rural residents that occurred in the decade prior to the arrival of Covid, Harvard researchers found.

Decreased homeowner equity corresponds to recent declining prices reported by leading housing researchers, but tappable amounts still sit near record highs.

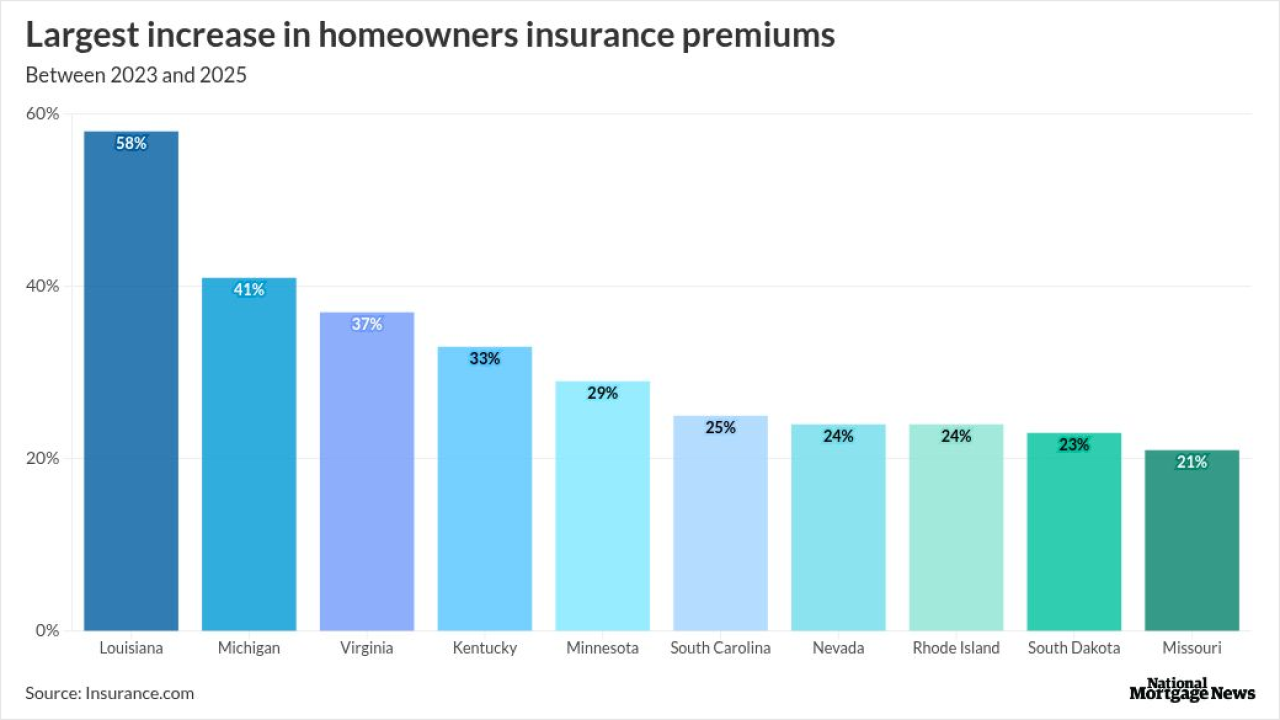

Rates actually declined or remained flat over a two-year period in 15 states, including Florida, with natural disasters and tariffs affecting 2026's movements.

-

The wholesale giant, fully entangled in the legal fight over a six-figure bonus, emphasized it's only the title sponsor of the broker trade group.

-

The $13 billion auction was awarded at 4.846%, about a basis point lower than its yield in trading just before 1 p.m.

-

A retail channel veteran, Promisco has spoken frequently about the potential of AI to bring efficiency and lower costs in the loan origination process.

-

Executives surveyed by American Banker said companies vying to wrestle market share from banks are a major threat to operations in the coming year.

-

The Supreme Court Wednesday appeared skeptical of the Justice Department's argument that removal of a Federal Reserve governor is unreviewable or that the president's preference for Fed governors outweighs the harm to the Fed from curbing the central bank's political independence.

-

An index of contract signings decreased 9.3% to 71.8 last month, according to data released Wednesday by the National Association of Realtors.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Large U.S. companies with global footprints, including many in the financial services space, have developed their privacy practices to comply with the EU's Global Data Protection Regulation. Many observers expect this will be the case with AI as well, writes the Senior Regulatory Counsel at Covius Compliance.

-

Continued failure to bring Fannie Mae and Freddie Mac out of conservatorship will lead to see-saw mortgage policy every time the White House changes hands, which is against the intent of the GSE statutes that indicate a desire for stable secondary markets, writes the Principal at public affairs firm TVDC.

-

Until Congress addresses the federal deficit, the tendency will be for higher long-term interest rates regardless of what the Fed does with the short end of the yield curve, writes the Chairman of Whalen Global Advisors.

- ON-DEMAND VIDEO

Neobanks and Fintechs have raised the bar in terms of client experience and expectations, forcing incumbents to break free and innovate. Now they are coming after the next generation, launching next-gen youth-focused offerings. Europe is leading this charge with nearly half of the startups based in the region. With the increased popularity and competition how are these neobanks finding different ways to market and monetize? In this session hear from Taylor Burton, co-founder of Till Financial on why there is a race to capture the next generation and how Fintechs like Till Financial is turning is a popular trend into a profitable business.

- ON-DEMAND VIDEO

Hopes that the pandemic has been curbed have dimmed as infections and hospitalizations are on the rise again due to the introduction of the extremely dangerous Delta strain. For some companies, this has disrupted their plans to bring remote employees back to their offices or institute a "hybrid" arrangement.

- ON-DEMAND VIDEO

Dave banking app originally created to do away with overdraft charges has taken the industry by storm. It's on a mission to advance financial opportunities for all Americans. Join Penny Crosman, Executive Editor of American Banker and Jason Wilk, CEO and Co-Founder of Dave as they talk about how this app is changing the way people manage their money and what’s in store for the future of one-stop-shops for finances.