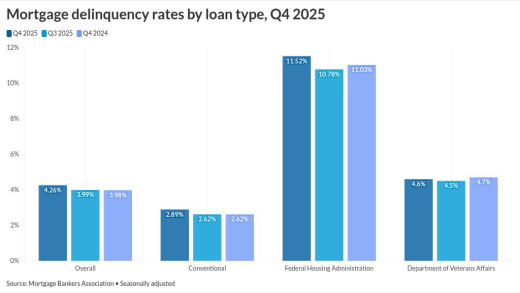

Some market sectors face growing challenges related to a K-shaped economy as servicers play an increasingly important role in keeping customers.

Submit your production volume from last year to be considered among the top in your field. The deadline for submissions is Feb. 27, and the clock is already running.

The agencies' representatives weighed in on the insurance fund's capital ratio and evolving policies at the Mortgage Bankers Association's servicing conference.

-

A White House Council of Economic Advisers report published Tuesday found that the CFPB cost consumers between $237 and $369 billion since its creation, an analysis that consumer advocates and some financial academics say is flawed.

-

The typical homebuyer's down payment in the United States decreased 1.5% year over year to $64,000 in December, Redfin said.

-

Banks and credit unions are pairing AI-driven efficiency with stable staffing and cross-training to scale mortgage production as originations rebound and technology expands capacity.

-

Toll Brothers Inc. fell short of analysts' estimates for quarterly orders, signaling that fewer people are signing contracts to build homes as high prices and economic uncertainty hold some buyers back.

-

Some observers say changes to MSR risk-weighting would have limited near-term impact and are unlikely to prompt banks to rush back.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Treasuries rallied and broke key levels, but stubborn 5-year resistance still caps momentum and rate-cut expectations remain unchanged, the CEO of IF Securities writes.

-

The 5-year yield swung sharply after conflicting BLS jobs and CPI data, with softer inflation boosting rate-cut hopes, according to the CEO of IF Securities.

-

Mortgage tech's speed is undermined by flawed credit data, causing costly fallout. Lenders must treat data accuracy as a pipeline risk, not a peripheral issue, according to the founder of Consumer Attorneys

Big players, Wall Street and tech firms stand to gain. Community lenders call for policymakers to protect g-fee parity and the cash window. Part 5 in a series.

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

- UPCOMING LIVESTREAMThursday, March 19, 20261:00 p.m. / 10:00 a.m.

Sean Snaith, Director of the Institute for Economic Forecasting at the University of Central Florida, will provide insight into the FOMC meeting.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- Partner Insights from Hyland

- Partner Insights from Plaid

-

-