The transaction combines independent mortgage companies which are based in Strongsville, Ohio (East Coast) and Folsom, California (West Coast).

Ally Financial Inc. will cut jobs, end mortgage originations and consider strategic alternatives for its credit-card business as borrowers have struggled to pay down costly debt.

The judge also sealed a document in the lawsuit the AARP Foundation joined but the defendants still must produce fee codes in the proposed class action.

More profitable companies are weighing deals because they're bullish on their leverage or are simply eying today's big price tags, the expert said.

The wholesale giant hasn't endured setbacks in litigation against five brokerages it's accused of selling loans to rivals Rocket Cos. and Fairway Independent Mortgage.

-

Department officials pushed back on criticism that a banner on its homepage violated a statute meant to curb partisanship in government operations.

-

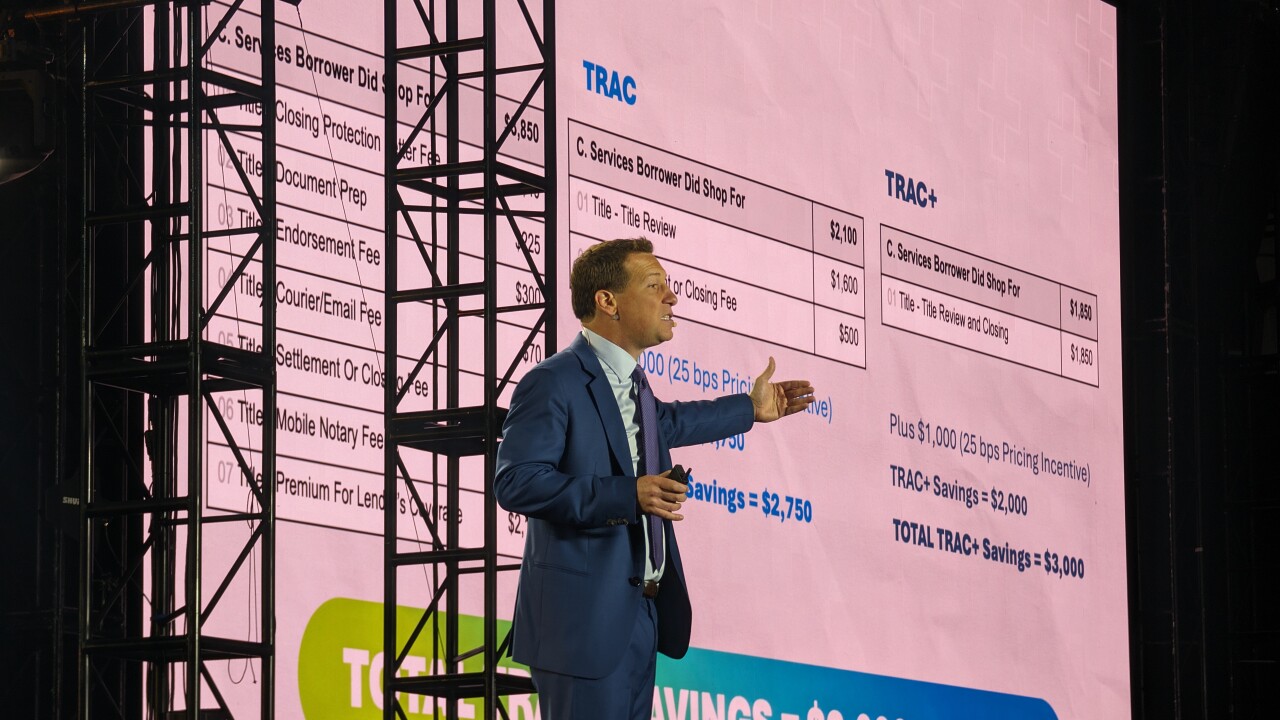

United Wholesale Mortgage dropped the fees for Title Review and Closing plus to as low as $1,295; it also extended its R/T 90 refi promo for another month.

-

The first government shutdown since 2019 will slow flood insurance originations and new Small Business Administration loans, though self-funded banking regulators will continue operating as usual.

-

The Supreme Court said Wednesday that it would defer President Donald Trump's request for a stay until after oral arguments scheduled for January 2026, allowing Federal Reserve Governor Lisa Cook to remain on the board at least until then.

-

The shutdown started with a flight into treasury bonds, putting downward pressure on financing costs, but several other developments slowed mortgage activity.

-

Former Mr. Cooper CEO Jay Bray will become Rocket Mortgage's president and CEO as the $14.2 billion transaction closes in just six months after announcement.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

A proprietary loan origination system is the best way to stay ahead of compliance and organizational growth.

-

What's old is new again, but lenders should heed lessons from the past when re-entering the second-lien originations market.

-

The administration apparently intends to leave office without addressing Fannie Mae and Freddie Mac's capital bases and therefore the tight credit conditions.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland