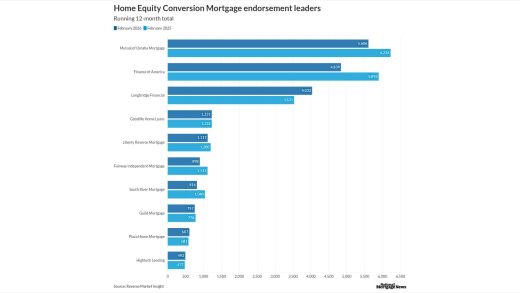

Mutual of Omaha, Finance of America and Longbridge Financial rank at the top of HECM endorsements over the past 12 months, Reverse Market Insight reported.

Technology centered on addressing certain key mortgage priorities stand to attract the greatest attention from venture capitalists and other investors.

The merger adds strengths of Direct Mortgage's conventional and government segments to the Lendermac platform, supporting the latter's growth ambitions.

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

This year 40 companies had what it takes to land on the Best Mortgage Companies to Work For list.

The top employers in home lending value business partners with a large market share and reach but they also need to differentiate themselves.

-

Markets were bracing for the chaos of a regional war; banks may be the target of sophisticated cyberattacks, experts warn.

-

MBS numbers at both soared in January, when Trump directed the enterprises to accumulate more bonds, but a decline in loans shrunk Freddie's total number.

-

New York is seeking $21 billion in federal grants for a construction project at Sunnyside Yard, which would allow the city to build 12,000 new affordable homes.

-

Mortgage One is accused of using an artificial intelligence voice agent for outbound solicitations, recommending a cash-out refi to the plaintiff in the case.

-

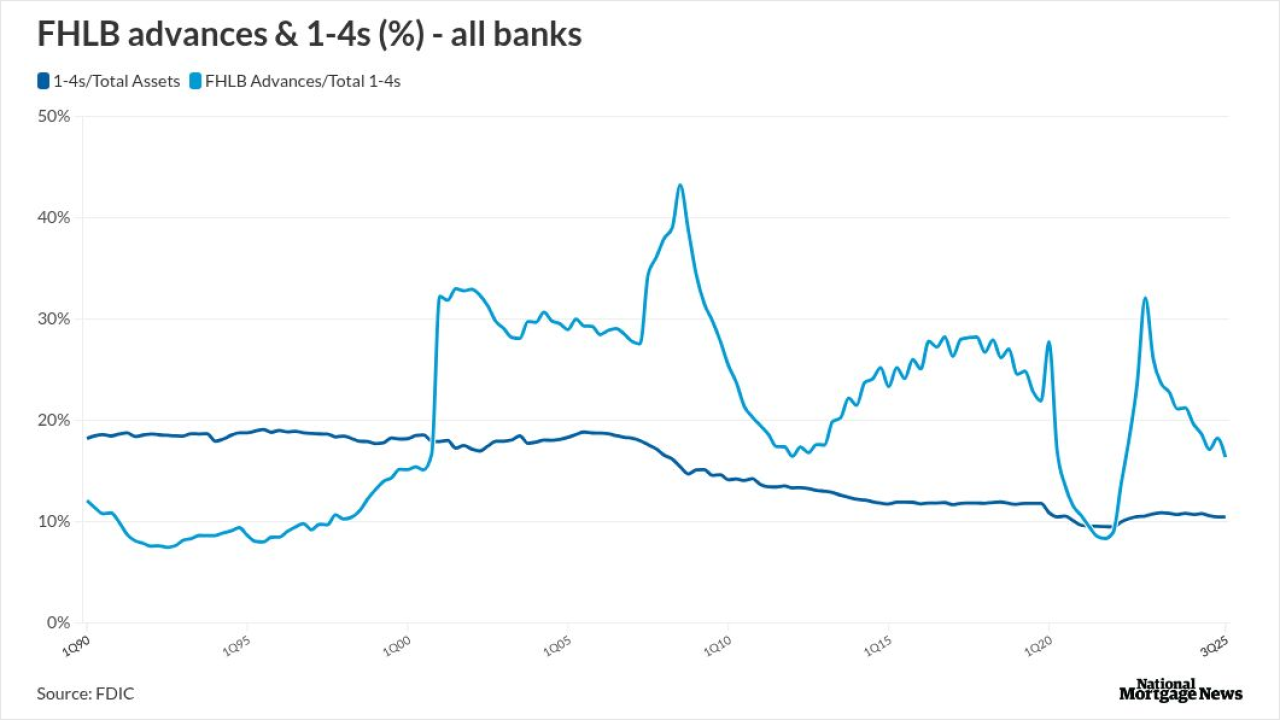

Though changes to bank capital rules previewed by Federal Reserve Vice Chair for Supervision Michelle Bowman in February are being viewed as welcome, experts say other more significant hurdles — not all of them regulatory — are keeping banks on the sidelines of mortgage servicing and lending.

-

Not all borrower scenarios are equal. When it comes to evaluating the risk of small landlords, lenders need to focus on a few specific factors.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Treasuries sold off sharply after reports Danish pension funds are exiting, steepening the yield curve as stocks fell and gold surged, according to the CEO of IF Securities.

-

AI can accelerate onboarding by providing recruits with real-time feedback, support compliance by flagging documentation issues, and close the confidence gap by offering reliable answers on the spot writes the CEO of Friday Harbor

-

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

- ON-DEMAND VIDEO

Ziggy Jonsson, SVP of engineering at Better, talks about the shop's technology and what the future holds for AI innovation.

- ON-DEMAND VIDEO

Cybersecurity incidents at vendors often expose their business partners to significant risk. What are the threats lenders face, and how can they strengthen their defenses?

- ON-DEMAND VIDEO

Gary Quinzel, vice president of portfolio consulting at Wealth Enhancement Group, gives his views about monetary policy and offers his opinion on the FOMC statement and Fed Chair Jerome Powell's press conference.