House Financial Services Committee ranking member Maxine Waters, D-Calif., asked bank regulators to give banks the supervisory clearance to extend lines of credit and modify loan terms for federal employees furloughed after the government shut down last week.

Learn how bridge loans and hard money loans work, their pros and cons, and discover which option suits your needs.

There's temporary leeway on formal compliance with replacement-cost value requirements in order to sort out insurer concerns with a recent re-emphasis on them.

The credit card will provide borrowers points for making their normal monthly mortgage loan payments and for the purchase of home products and services.

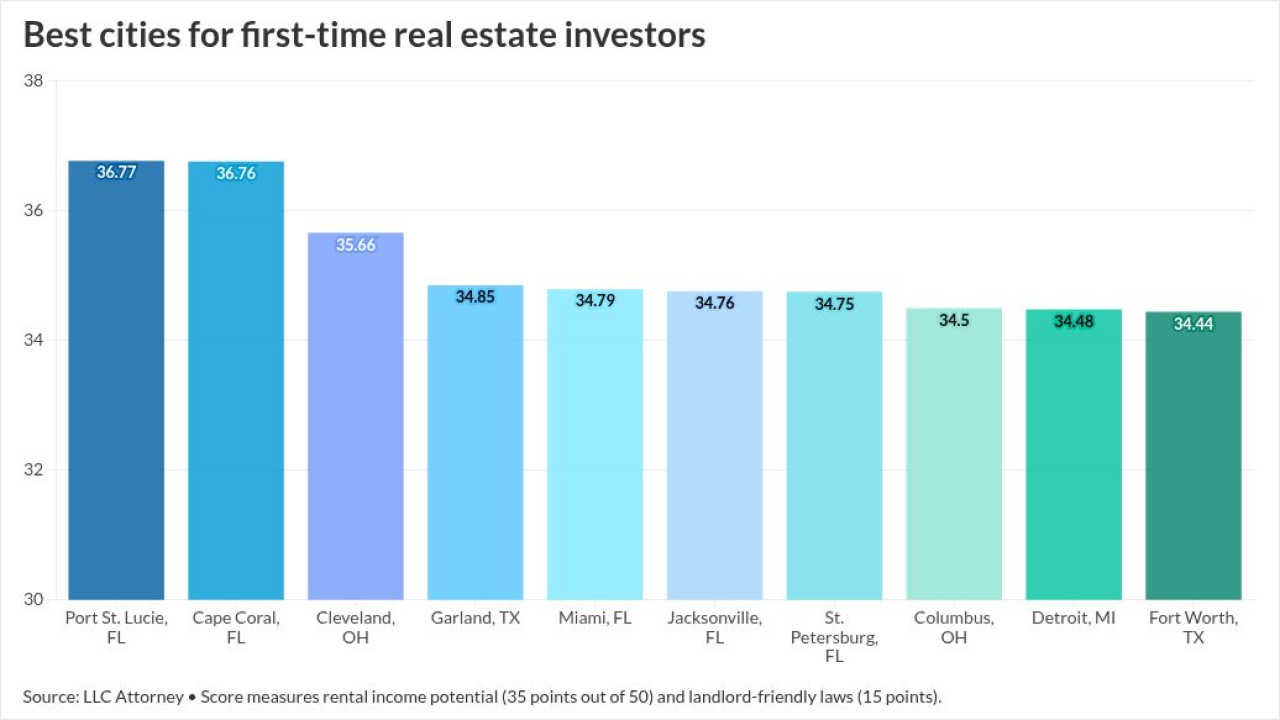

While some international purchasers are reluctant to buy in the U.S. right now, interest in investment properties still abounds, the CEO of Waltz said.

-

While expectations that another federal rate cut is on the way next week, other economic trends may be having a larger influence on mortgage lending.

-

A cohort of more than 100 Republican members of Congress sent a letter to Treasury Secretary Scott Bessent urging the administration to protect and fund a community lending program that has been gutted despite its legal mandate and Bessent's backing.

-

Contract closings increased 1.5% to an annual rate of 4.06 million in September, the highest in seven months, according to National Association of Realtors figures released Thursday.

-

Home loan players are diverting technology budgets to cover back-office operations, after big spending in a downcycle, counter to historical patterns.

-

Decreased homeowner equity corresponds to recent declining prices reported by leading housing researchers, but tappable amounts still sit near record highs.

-

In addition, John Roscoe and Brandon Hamara have been appointed co-presidents at the government-sponsored enterprise, effective immediately.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

While depository mortgage lenders should exercise some caution before welcoming trended data and alternative credit scoring into their process, they must become inclusive or face losing market share to newer industry players like SoFi.

-

While mortgage servicers are prohibited from early compliance with the Consumer Financial Protection Bureau's final servicing rule, there are a few steps they can take now ahead of the rule's effective date.

-

One step the government can take to strengthening housing is to create a unified office dedicated to housing finance and policy, streamlining and making more efficient existing agencies and programs.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland