Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

Here’s a look at 10 housing markets where buyers are looking to move — and the high-cost markets they're fleeing.

December 3 -

Equifax is supporting mortgage lender customer retention efforts with a new tool that predicts the likelihood that a lead will apply for a loan within the coming months.

November 29 -

Here's a look at 12 cities with slower home price appreciation and more favorable mortgage rate and wage conditions, offering purchasing power advantages to consumers.

November 28 -

Guaranteed Rate is gearing up to acquire certain assets of Honolulu HomeLoans and Hawaii Lending Alliance and expand its existing footprint in a growing Hawaii housing market.

November 28 -

Fintech adoption among real estate and title agents is accelerating, though their optimism on the housing market has tanked, according to First American Financial Corp.

November 27 -

Ellie Mae plans to more quickly adapt to an evolving digital mortgage landscape with Amazon's help rebuilding from the inside-out.

November 26 -

From Provo, Utah, to Dallas, here's a look at 10 housing markets with the youngest average consumer age.

November 21 -

Average credit scores for mortgage borrowers remain at a 2018 high, a sign that lenders aren't easing standards despite refinance candidates already falling off on higher rates, according to Ellie Mae.

November 21 -

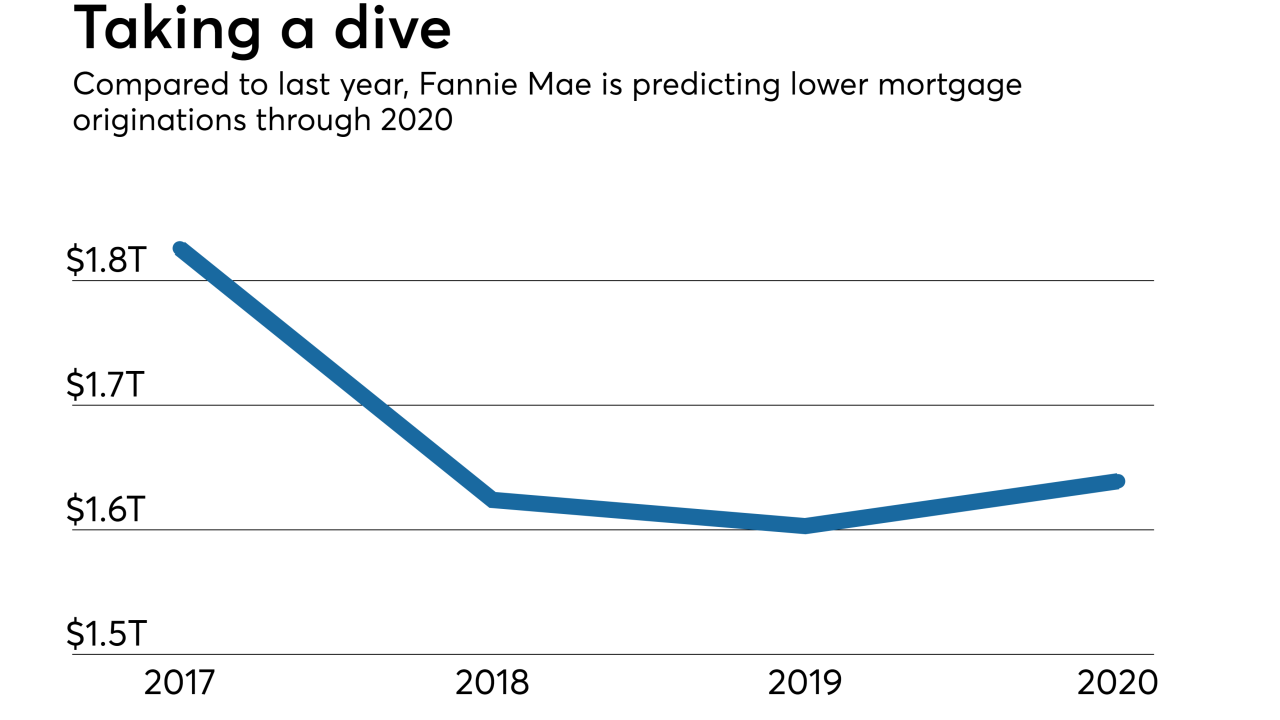

Fannie Mae's economic growth forecast for 2018 inched up slightly, but a strong labor market won't mean the same positive results for housing.

November 20 -

The share of homes for sale with a price cut hit its highest level since 2010, but homebuyers are still reacting to rising prices and interest rates, according to Redfin.

November 19 -

In the latest example of how companies that control a significant portion of the home buying process can weave digital innovations throughout the customer experience, online real estate and mortgage company Redfin will implement electronic closing technology from Notarize.

November 15 -

Mortgage fintech LoanSnap launched VA Smart Loans, which will provide personalized options to current and former service members applying for a Veterans Affairs-guaranteed mortgage.

November 15 -

The 48,390 homes dubbed at extreme or high risk from the California wildfires burning through the state could cost $18 billion in reconstruction, according to a CoreLogic analysis.

November 14 -

Consumers blame speculative home flippers and wealthy out-of-towners for soaring home prices, but the blame may be misplaced, given many economists' views about the broader factors at play.

November 13 -

Most millennials are purchasing fixer-uppers in order to afford a house, with 75% planning to finance renovations by tapping the equity in their home, according to a Chase Home Lending report conducted with Pinterest.

November 12 -

More veterans are turning to Department of Veterans Affairs loans to buy a house as the number of purchase mortgages shot up 59% compared to five years ago.

November 9 -

The housing market slows down for winter, but it doesn't stop. Here's a look at 12 cities where price cuts, rent appreciation and affordability conditions will give house hunters more negotiating power going into the new year.

November 8 -

Mortgage delinquencies inched up, in part from natural disasters hindering homeowner performance, but a stronger economy is still keeping defaults low, according to the Mortgage Bankers Association.

November 8 -

Real estate and mortgage industry groups outspent proponents 3-to-1 to defeat Proposition 10, a measure to allow California municipalities to set local rent control laws.

November 7 -

Mortgage industry executives claim sparse affordable housing supply is the most impactful hurdle for first-time homebuyers entering the market in 2019, but the majority don't think regulatory policy will help the cause.

November 6