Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

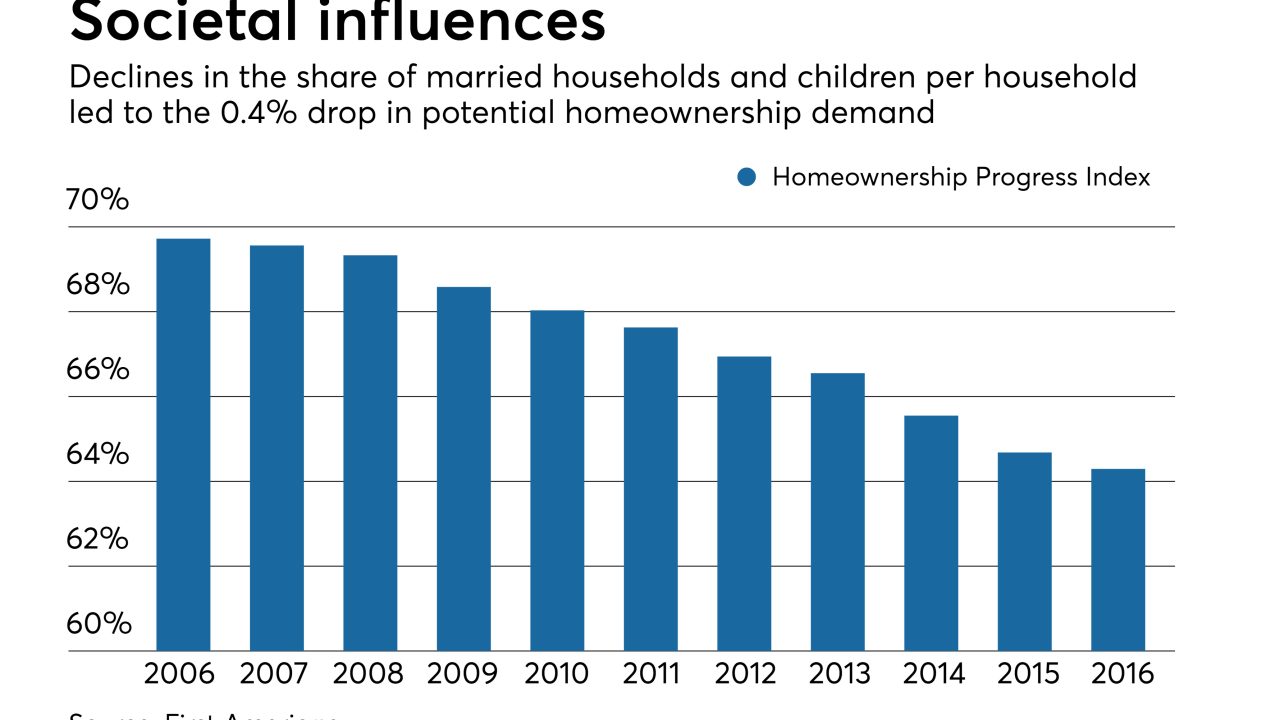

Though potential homeownership demand declined moderately between 2015 and 2016, the underlying fundamentals for demand remained positive.

August 18 -

The number of U.S. properties that were equity rich in the second quarter grew by 1.6 million properties from a year ago.

August 17 -

Affordability issues along with a lack of knowledge about home buying are holding millennials back from pursuing homeownership, according to a survey from loanDepot.

August 16 -

Despite rising home prices and a market where many older homeowners are loath to sell, home equity line of credit lending remains muted in all but one corner of the industry: credit unions.

August 14 -

Housing affordability dipped as rising home prices offset a quarter-point drop in mortgage interest rates.

August 14 -

Newly constructed home purchase mortgage applications were down by 12% compared with June, but the data indicates housing starts won't drop as much as expected.

August 11 -

FHA loans made to millennial home buyers have been steadily decreasing the past four months, indicating they may be able to afford more at the moment.

August 10 -

With condominium lending rising, CoreLogic is now offering lenders self-service access to its condominium project review data service.

August 9 -

The mortgage delinquency rate reached its lowest point in nearly a decade in May due to tighter underwriting, according to CoreLogic.

August 9 -

Homeowners continue to view their property value higher than appraisers do, while homeowners in areas experiencing rapid growth may be more likely to underestimate their home's worth.

August 8 -

Low-down-payment purchases are on the rise, but not necessarily with the same pre-crisis practices and risk factors.

August 8 -

Essent Group reported second-quarter net income of $72.1 million, an improvement from the $52.3 million of the same period last year.

August 4 -

After launching construction lending support via Encompass in February, Ellie Mae sees shrinking construction loan closing times and increased volume.

August 3 -

Flagstar Bank has hired Kristy Fercho, former senior vice president and customer delivery executive for Fannie Mae, to lead its mortgage division.

August 2 -

Fiserv has acquired the assets of PCLender, a mortgage loan origination system vendor based in Reno, Nev.

August 1 -

Garden State Home Loans has launched a 1% down payment program for first-time buyers, opening the door for millennial purchasers.

August 1 -

CoreLogic will fully integrate its 4506-T income verification product in August with Fannie Mae's Desktop Underwriter platform to provide Day 1 Certainty service.

July 31 -

Loan officers are joining the increasing number of real estate agents telling daily “stories” on Snapchat and Instagram to build name recognition, increase referrals and reach more core customers.

July 28 -

A decline in overall customer brand perception has stalled mortgage servicer satisfaction, ending a multiyear trend of steady improvements, according to J.D. Power.

July 27 -

FNF Group has acquired Real Geeks to target single real estate agents unaffiliated with a team.

July 27