Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Lenders and servicers' biggest pandemic challenges revolve around clarity for loan eligibility and understanding options for their borrowers once the forbearance period ends.

July 1 -

The number of loans going into coronavirus-related forbearance edged down slightly, with the growth rate dipping 1 basis point between June 15 and June 21, according to the Mortgage Bankers Association.

June 29 -

From Southern California to the Great Lakes, here's a look at 12 housing markets with the biggest annual declines in pending sales, according to CoreLogic.

June 29 -

Compared with the week prior, approximately 83,000 more loans from all investor types became forborne.

June 26 -

The Mortgage Bankers Association points to better lender diversity and a stronger housing finance network as reasons for its support.

June 25 -

With more real estate and mortgage companies moving to a digital process, volume expectations in the face of coronavirus restrictions shot way up in May compared to April.

June 23 -

The number of loans going into coronavirus-related forbearance dropped, with the growth rate falling 7 basis points between June 8 and June 14, according to the Mortgage Bankers Association.

June 22 -

With the average borrower needing over two decades to save a 20% down payment for the median-priced home, private-mortgage-insured loans experienced major growth in 2019.

June 22 -

While home-buying season was on hold due to the coronavirus, a dearth in supply could hamper any big rebound in sales.

June 22 -

How the mortgage and housing industries react to the current civil rights moment could shape policies and bridge the homeownership divide for the Black community.

June 19 -

The coronavirus put a dent in May's home sales and inventory, but some indicators offer hope for a turnaround on the horizon.

June 18 -

The report by Unison also advised investors to focus on "diversified residential real estate" over traditional retail and office spaces.

June 17 -

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

Though outlawed by the Fair Housing Act in 1968, the racist housing practice perpetuated a wealth gap for Black people still widening today.

June 12 -

The coronavirus pandemic brought more attention to the affordable housing issue and illuminated already vulnerable, low-income populations.

June 12 -

Borrowers gained over $6 trillion in home equity since the Great Recession ended and the relative health of the housing market should stave off a coronavirus-induced collapse, according to CoreLogic.

June 11 -

Looming economic uncertainties forced mortgage lenders to tighten underwriting standards in May.

June 9 -

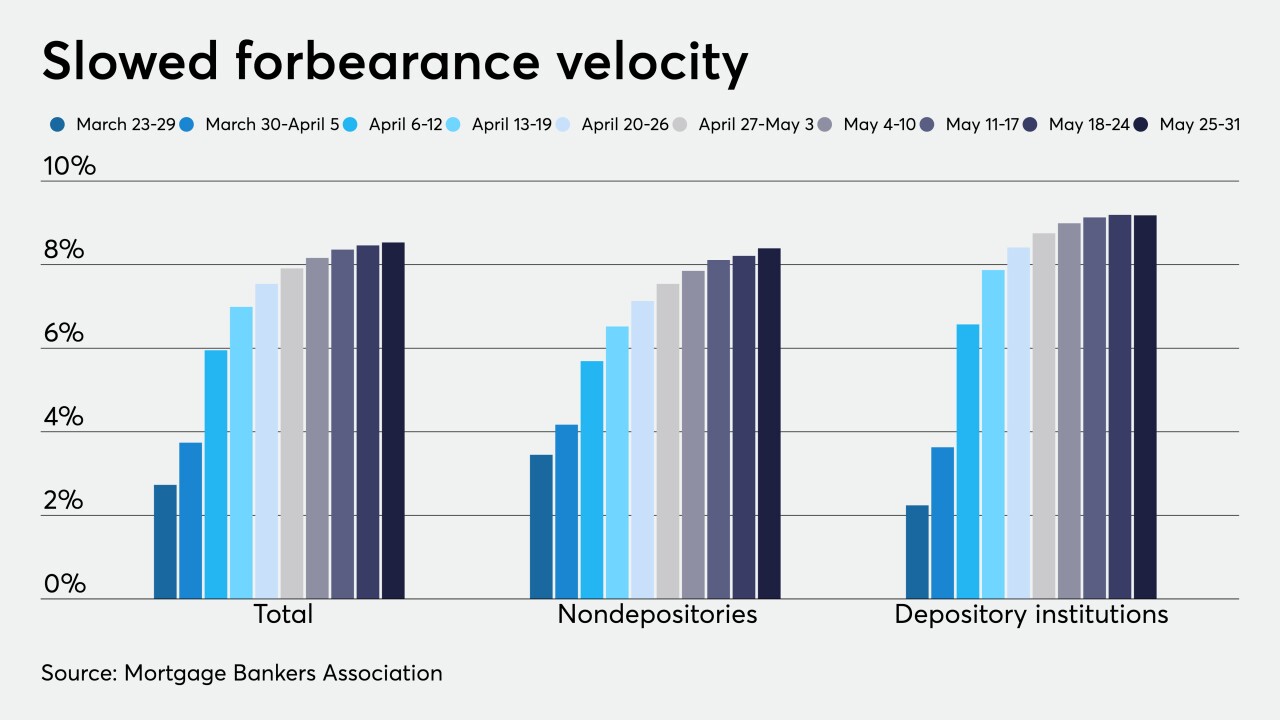

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

After bottoming out at a 10-year low in April, consumer sentiment for home buying rebounded in May, according to Fannie Mae.

June 8 -

With the impacts of the coronavirus in full bore, housing market experts predict home prices to fall in 2020.

June 8