Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

With the recent acceleration to cloud computing, how can mortgage companies, who constantly deal with sensitive personal information, maintain safety?

May 26 -

As the growth rate in forbearance requests downshifts, a vast stockpile of loans await modifications.

May 22 -

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21 -

From the Midwest to mid-Atlantic, here's a look at 12 housing markets where first-time homebuyers find the most affordability, according to NerdWallet.

May 20 -

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

May 18 -

With the coronavirus impact in full effect, a four-month streak of growth ended in April, according to Remax.

May 18 -

Eligible borrowers can add the forborne payments to the end of their loan term.

May 13 -

If employers maintain flexible working practices after lockdowns get lifted, housing preferences and subsequent property values could greatly change.

May 13 -

After over two years of falling delinquency rates, the burgeoning unemployment following the coronavirus economic shutdown will bring a surge of outstanding mortgages.

May 12 -

The number of mortgages in coronavirus-related forbearance rose by 37 basis points as the unemployment rate soared, according to the Mortgage Bankers Association.

May 11 -

In a study of four metro areas, housing supply and demand gained momentum in the second half of April, even where the COVID-19 curve continued to grow.

May 11 -

After ending 2019 on a high note, Ocwen Financial posted an income loss in the first quarter due to the unexpected costs and volatility created by COVID-19.

May 8 -

Consumer sentiment for home buying fell to its lowest point since November 2011, according to Fannie Mae.

May 7 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

Guild Mortgage's presence in Washington state, the epicenter of the first U.S. outbreak, gave it an early glimpse of the obstacles ahead.

May 5 -

The total coronavirus-related mortgages in forbearance grew by 55 basis points, in lockstep with rising unemployment claims, according to the Mortgage Bankers Association.

May 4 -

With unemployment mounting, new mortgage forbearance requests could sharply increase in early May when payments are due.

May 4 -

As the coronavirus takes a major toll on housing inventory and credit availability, pent-up buyer demand could lead to market recovery, according to Redfin.

May 1 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

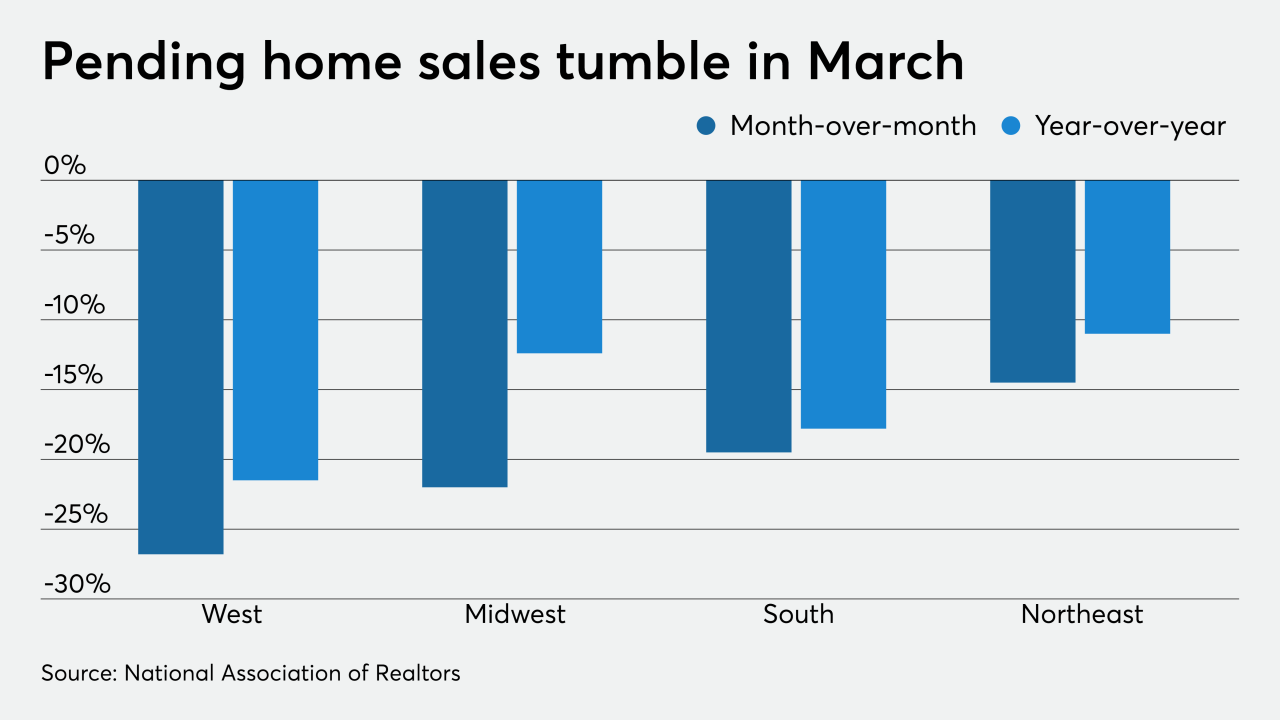

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29