Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

The servicer owned by Mr. Cooper agreed to pay a penalty for allegedly failing to provide its clients with clear information on foreclosure and defaults.

March 3 -

With the pandemic’s radical disruption of the housing market, values grew at the highest rate in eight years, according to CoreLogic.

March 2 -

National Mortgage News presents the third annual Best Mortgage Companies to Work For — a survey and awards program dedicated to identifying and recognizing the industry's best employers and providing organizations with valuable employee feedback.

March 1 -

The number of home listings collapsed to the lowest level on record, leaving “nearly all of the shelves empty,” Glenn Kelman said in the company’s latest home sales report.

February 26 -

While foreclosure moratoria keep the overall numbers down, zombie foreclosure rates jumped in the majority of states, according to Attom Data Solutions.

February 25 -

With extreme winter weather about to give way to ballooning insurance and mortgage forbearance claims in Texas, servicers will need to get through their pipelines with urgency while weeding out fraud.

February 25 -

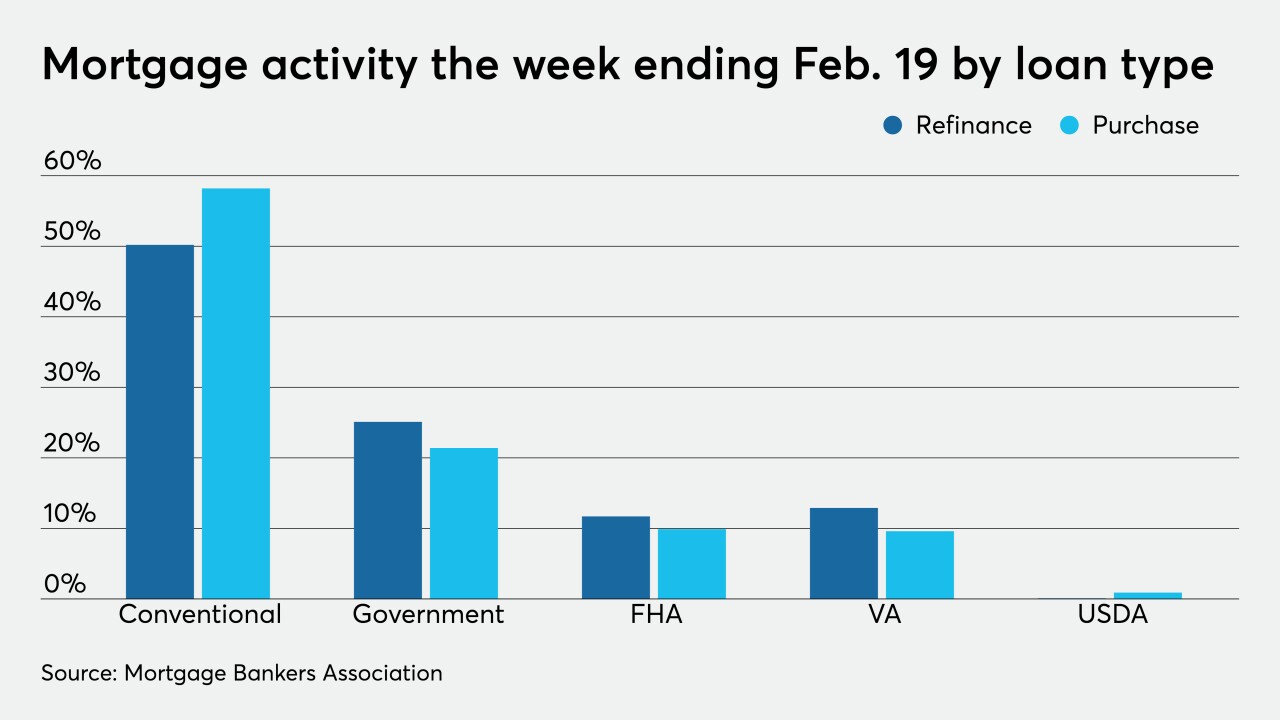

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

As its mortgage origination volume delivered another quarter of strong earnings, Mr. Cooper’s banking on its "enormous backlog" of REO orders to generate further profitability once the foreclosure moratorium is lifted.

February 23 -

Independent mortgage banker recovery drove the weekly decrease in forbearance share, according to the Mortgage Bankers Association.

February 22 -

Moratorium extensions helped drive a weekly increase in forbearances, according to Black Knight.

February 19 -

With the most recent stimulus aiding economic recovery, mortgage lending’s feeding frenzy could be coming to an end.

February 18 -

The acquisition of the mortgage fintech aligns with growing customer expectations surrounding a fully digital homebuying experience.

February 18 -

While sales shot up from the same time last year, inventory reached its lowest level since Remax started its National Housing Report in 2007.

February 17 -

While the Mortgage Bankers Association hailed the move, some experts say it could negatively impact housing inventory.

February 16 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

With President Biden extending the moratorium, foreclosures hit an all-time low at the start of 2021 as millions of delinquent borrowers avoided entering the process, according to Attom Data Solutions.

February 11 -

The visionary co-founded electronic signature company SignOnline in 1999, a year before legislation legalized e-signatures at the federal level.

February 10 -

Gains in consumer financial stability helped to decrease the rates of distressed home loans, but job creation is needed to make recovery sustainable, a CoreLogic report found.

February 9 -

With low mortgage rates billowing demand as homebuying season approaches, consumer confidence for selling jumped in January, according to Fannie Mae.

February 8 -

As 2021 shapes up to be a robust year for mortgage volumes, local lenders discuss the 12 metro areas that are expected to get the most interest from buyers, according to Zillow.

February 8