Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

With limited plan removals due to the holidays, mortgages in coronavirus-related forbearance rose by 15,000, according to Black Knight.

January 4 -

Remote online notarization helped originators close loans amid social distancing measures, but complex local laws remain a barrier to its widespread use.

December 30 -

The agency's request for input will shape how mortgages underwritten by Fannie Mae and Freddie Mac handle appraisals and curb risk.

December 29 -

Despite intensified demand and plummeting inventory, consumer home purchasing power made gains behind falling interest rates in October, according to First American.

December 28 -

High property value growth can be locked in through proximity to one of the top amenities an area can have: grocery stores.

December 23 -

About 4,400 loans started the foreclosure process in November, alongside 176,000 mortgages in active foreclosure.

December 22 -

The forbearance rate rose behind slowed economic recovery, according to the Mortgage Bankers Association.

December 21 -

The new bill ordering $600 stimulus checks and $25 billion in emergency rental assistance won't be enough to help millions of Americans struggling to make housing payments, according to industry watchers.

December 21 -

With infection rates rising and unemployment claims increasing since Thanksgiving, mortgages in coronavirus-related forbearance rose by 37,000 last week, according to Black Knight.

December 18 -

The boom continues, with refinances making up a 61% share of all mortgage loans issued that month, according to Ellie Mae.

December 17 -

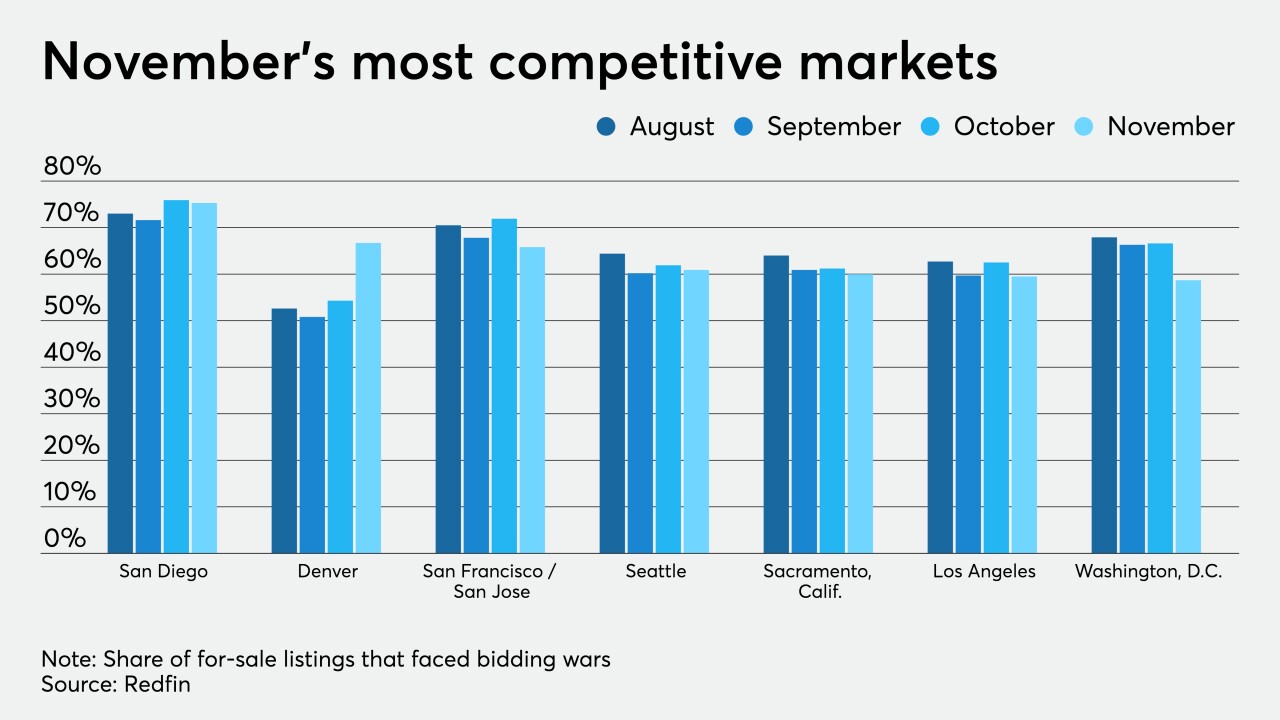

While the haggling tapered off slightly alongside the housing market’s seasonal slowdown, home sales remained five times more competitive than the year before, according to Redfin.

December 16 -

With coronavirus inoculations underway and government stimulus likely to come, the outlook for next year’s housing market and lending environment grew more optimistic in December.

December 15 -

The forbearance rate continued its improvement, but the surge of COVID-19 cases could lead to more borrowers needing mortgage relief, according to the Mortgage Bankers Association.

December 14 -

The largest concerns are with pandemic risk and defaults, along with business resilience and adaptability, according to a Wolters Kluwer survey.

December 14 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

The November foreclosure rate represented an 80% decline from the year before, according to Attom Data Solutions.

December 10 -

Borrowers who exit CARES Act-related forbearance in the spring and have stacks of other bills to attend to may be in search of liquidity via such products, the company predicts.

December 10 -

Clear HOI — an encrypted, cloud-based tool that automates homeowners insurance underwriting — is getting released to the broader market by Rocket Mortgage’s sister company Nexsys Technologies.

December 9 -

While distressed mortgage rates crept down overall, serious delinquencies still tripled year-ago rates in September, according to CoreLogic.

December 8 -

The surge of COVID-19 cases slowed economic recovery and hampered improvements in the forbearance rate, according to the Mortgage Bankers Association.

December 7