Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Fannie Mae and Freddie Mac coming out of conservatorship and transitioning into public utilities would be the ideal for small mortgage lenders, according to trade-organization representative Robert Zimmer.

March 10 -

Consumer sentiment for home buying stayed near its record high behind low mortgage rates and a strong job market, though the declining stock markets and COVID-19 concerns may change that soon, according to Fannie Mae.

March 9 -

To help the housing crunch, a growing consensus of economists believe adding homes on lots where one already exists would benefit affordability and incrementally boost supply, according to Zillow.

March 9 -

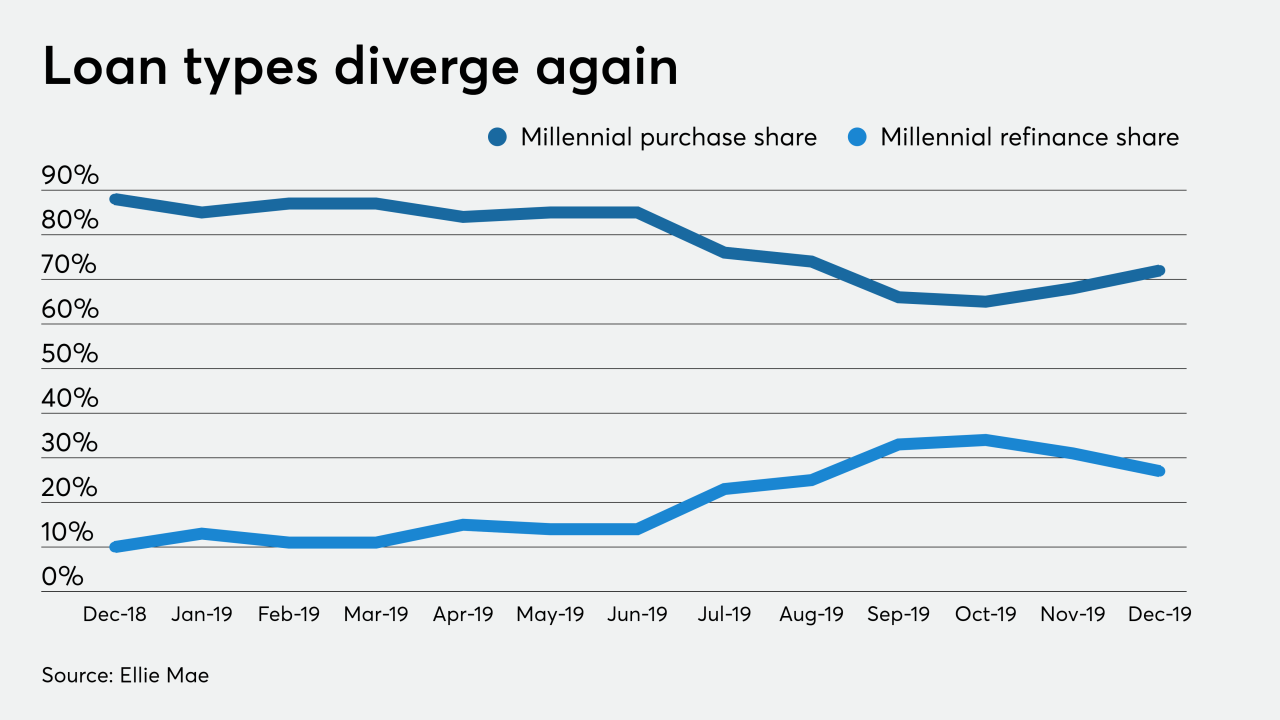

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

Women are becoming more and more empowered in home purchasing, thanks in part to the digitization of the mortgage and real estate industries, according to a report from Compass and Better.com.

March 4 -

While home price appreciation has lost some momentum, tight inventory and low rates could drive housing values further upward this spring if the coronavirus remains contained, according to CoreLogic.

March 3 -

Reduced construction and domestic migration in search of better job markets caused housing supply deficits in over half of the U.S., according to Freddie Mac.

March 2 -

While the overall foreclosure rate fell, the share of zombie properties grew in the first quarter of 2020, according to Attom Data Solutions.

February 28 -

Despite the increased frequency and intensity of natural disasters caused by climate change, just 33% of consumers said it's a major factor in determining when or where to buy or sell a home, according to Redfin.

February 26 -

Overall housing value growth remained steady in the fourth quarter with some states going way above the national average, according to the Federal Housing Finance Agency's Home Price Index.

February 25 -

With inventory tight, roughly 80% of housing markets had purchase bidding competition in January and value appreciation is expected to increase in the coming months.

February 24 -

In nearly half of Opportunity Zones across the country, median home prices rose annually by more than the national average of 9.4% in the fourth quarter, according to Attom Data Solutions.

February 20 -

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

While boosting origination volume for lenders and providing financial benefits for borrowers, the refinance boom could have adverse effects down the road, according to TransUnion.

February 12 -

From the heartland to the desert, here's a look at 10 housing markets where buyers are looking to move — and the high-cost markets they're leaving, according to Redfin.

February 11 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

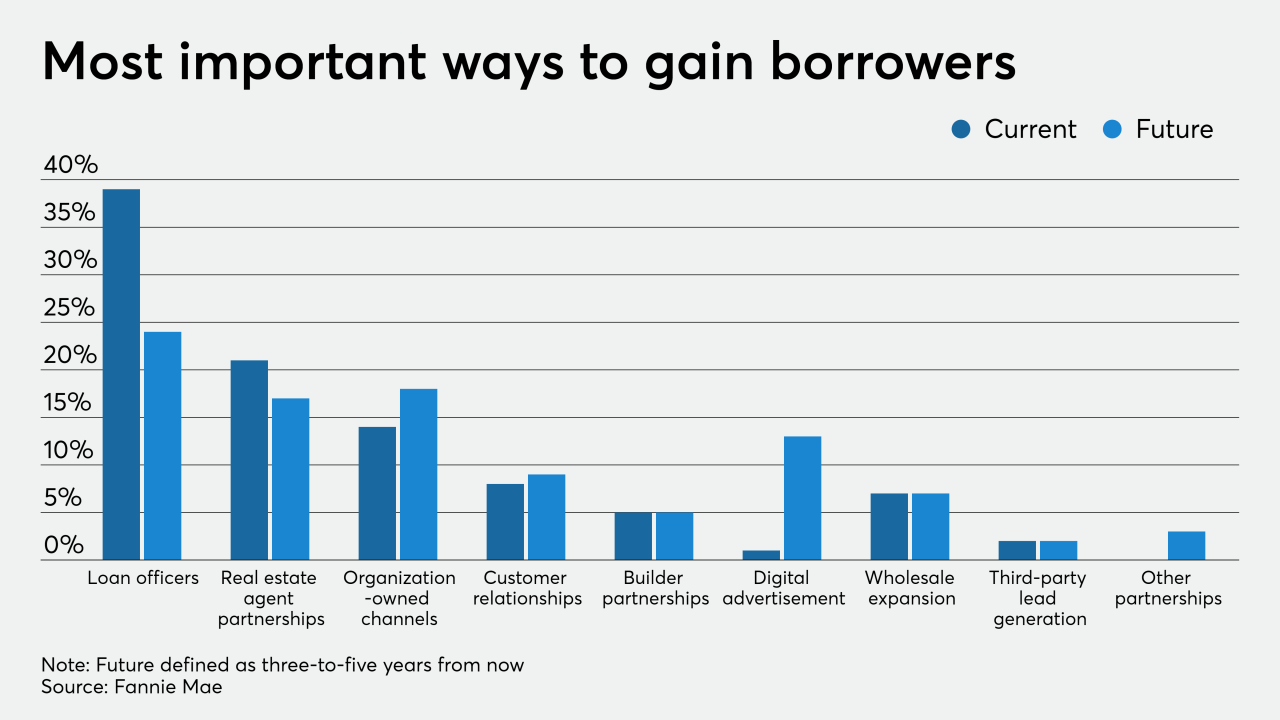

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

While down from the year before, December's housing value appreciation kept churning and should climb in 2020 to a new all-time high, according to CoreLogic.

February 4