Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

From the gateway to the West to just below the Mason-Dixon Line, here's a look at the 12 housing markets with the highest percentage of homes affordable to millennial purchasers with median incomes.

February 12 -

Stable equity and debt availability should keep multifamily and commercial real estate originations in line with 2017's peak, according to the Mortgage Bankers Association.

February 11 -

Millennials are unfazed by the short supply of starter homes in a competitive market based on the rising share of December's purchase mortgages, according to Ellie Mae.

February 8 -

SunTrust’s merger with BB&T is the largest bank deal since the financial crisis, and mortgages will play a critical role in the execution of this transaction.

February 7 -

As more homeowners decide to age in place, the amount of equity rich properties continues to rise, according to Attom Data Solutions.

February 7 -

Ocwen Financial subsidiary PHH Mortgage will pay a total of $750,000 to six military members and increase employee training to settle Department of Justice allegations that it conducted foreclosures that violated the Servicemembers Civil Relief Act.

February 6 -

Fourth-quarter increases in Fannie Mae and Freddie Mac mortgage origination volume helped Walker & Dunlop reach a new quarterly high in revenue of $215 million.

February 6 -

Inventory deficiency and affordability issues kept sales down and hampered home price growth, according to CoreLogic.

February 5 -

Popular TV shows about house fixers and flippers have sparked consumer interest in remodeling, creating an opportunity for lenders to build a specialty in renovation loans while traditional mortgage lending is weak.

February 4 -

Better credit quality and the influx of refinancing during the low interest rates of the last few years pushed mortgage performance to the highest levels since the turn of the century, according to Black Knight.

February 4 -

Without the clashing fervor of potential homebuyers competing, fewer sellers are fetching above-listing prices on their houses, according to Zillow.

February 1 -

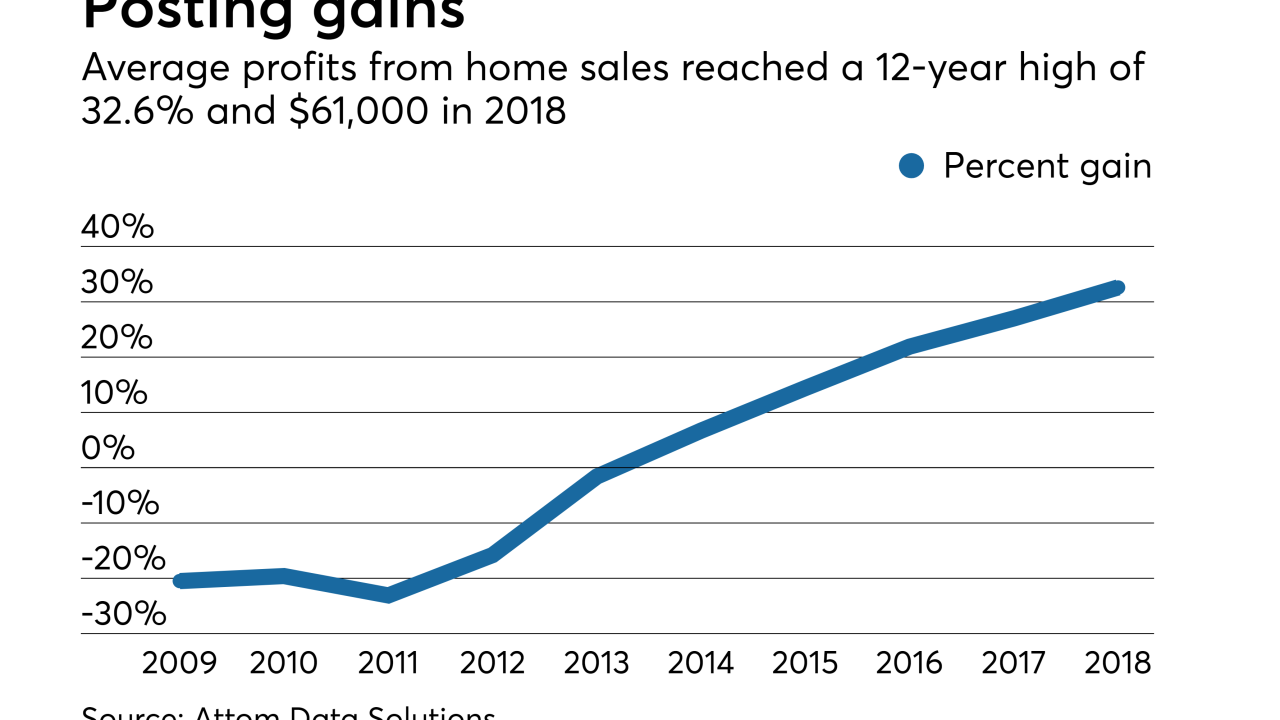

While home sellers gained the most money on their houses since 2006, the fading impact of tax cuts and slow rise of mortgage rates could shorten upcoming margins, according to Attom Data Solutions.

January 31 -

Bay Area adjacency without the exorbitant home prices make Sacramento, Calif., an attractive option for consumers, according to Redfin's migration report.

January 30 -

With its new round of funding, the mortgage fintech company will look to expand its geographic reach and reduce the mortgage closing process to a week in 2019.

January 29 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

While Fannie Mae's multifamily origination volume took a step back from 2017's record high of $67 billion, its delegated underwriting and servicing program provided $65 billion in financing in 2018, led by Wells Fargo.

January 25 -

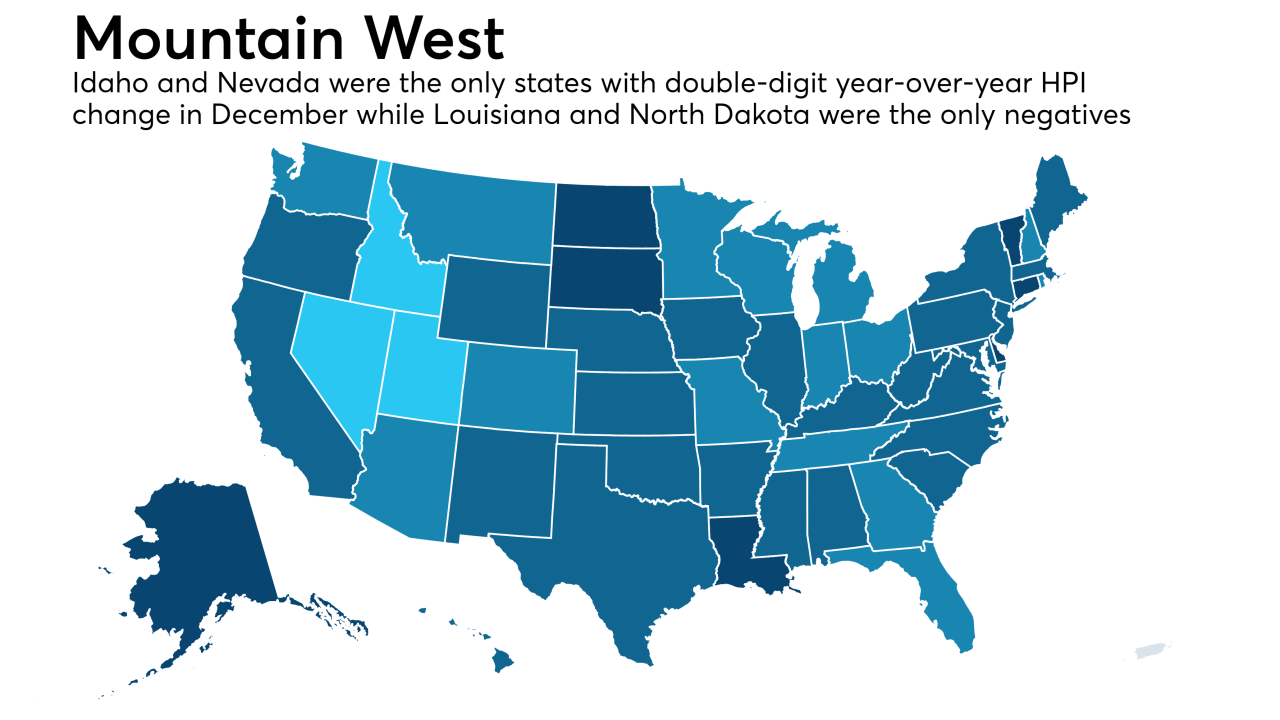

As homebuyers try to get more for their money and flee the expensive coastal housing markets, the largest jumps in annual home appreciation took place all around the country's interior, according to Zillow.

January 24 -

Risk aversion, economic momentum and the multidecade nadir of unemployment rates helped push delinquencies to the lowest year-end measure of the 21st century, according to Black Knight.

January 23 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Fewer houses getting sold helped gains in inventory and brought down the rate of sales price growth to wrap up 2018, according to Redfin.

January 18