Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

October's loan delinquencies, especially those in serious delinquency, got much healthier after improving from the fallout of the last two hurricane seasons, according to Black Knight.

November 27 -

While a downturn is expected to come for the housing market, it could be more of a side-step than falling off a cliff, according to the latest Barclays Global Economics Weekly report.

November 26 -

While the housing market perennially decelerates in the winter, it can be a wonderland for potential homebuyers, according to Attom Data Solutions.

November 21 -

As inflating home prices hampered sales in recent years, housing inventory finally shows signs of bouncing back, according to Zillow.

November 21 -

While it's normally a time the market slows down for mortgage lenders relative to the rest of the year, this winter shouldn't be used to hibernate, according to Attom Data Solutions.

November 20 -

October's rise in the supply of homes for sale could signal the housing market is getting closer to equal footing for buyers and sellers, according to Remax.

November 19 -

Borrowers buying new homes produced fewer loan applications than they did a year earlier due to October's rising interest rates.

November 16 -

After last week's surge of 11 basis points, mortgage rates held steady due to a dip in energy costs, even with continued stock market volatility, according to Freddie Mac.

November 15 -

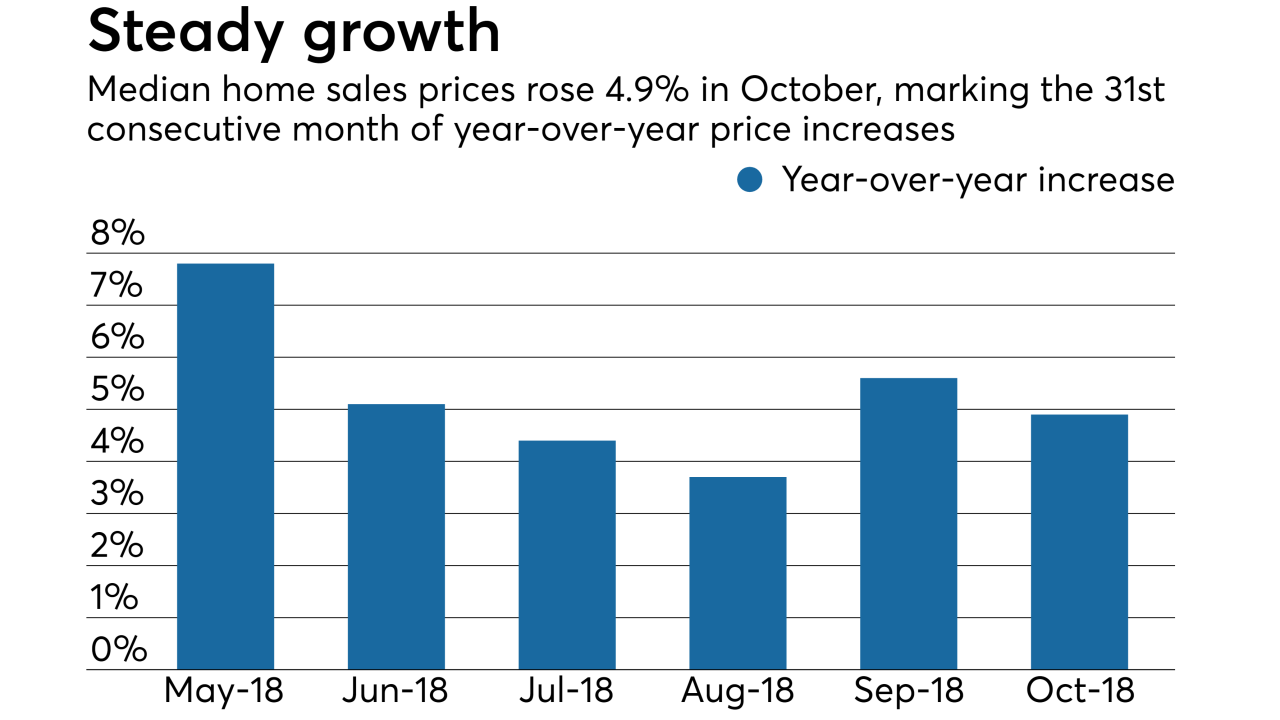

The decelerating pace of home price growth in October is helping offset the rise in mortgage rates, according to Quicken Loans.

November 14 -

The mortgage delinquency rate dipped to a 12-year low, but overvalued housing markets and eventual reversal in the unemployment rate present risk for future delinquencies, according to CoreLogic.

November 13 -

American Financial Resources, a Parsippany, N.J.-based mortgage lender, will pay any required agent fees for U.S. Department of Veterans Affairs loans for its brokers and correspondents on all AFR-related VA loan submissions starting Veterans Day.

November 12 -

Rising home prices and climbing mortgage rates pulled down affordability to the lowest point since before the housing market crash.

November 9 -

Continued diversification of its business lines and better margins in its securitization activities helped Redwood Trust overcome steep mortgage origination declines and post nearly 14% annual growth in net income during the third quarter.

November 8 -

The prospect of growing mortgage rates took a negative hit on consumer perception of home buying and selling during October, according to Fannie Mae.

November 7 -

Eighty percent of millennials said they plan on moving within the next five years, while nearly three-quarters claim affordability as their biggest hurdle in the buying a home.

November 6 -

Excellent credit quality and strong performance of post-housing-crisis originations resulted in a steep decline in foreclosure starts in September, according to Black Knight.

November 5 -

Hiring by nonbank mortgage lenders and brokers ebbed in September as the housing market prepares to pack it in for the colder months.

November 2 -

Having children not only forces people to buy a home, but to find a more affordable home, according to Zillow and Census data.

November 1 -

A combination of moderate rises in mortgage rates and dipping growth in home prices are projected to boost existing and new housing sales through 2020, according to Freddie Mac.

October 31 -

As potential homebuyers anticipate mortgage rates to keep rising, September was a strong month for housing demand, according to Redfin.

October 30