Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Student debt continues to weigh down potential homebuyers, as the share of first-timers decreased for the third-consecutive year, according to the National Association of Realtors.

October 29 -

While the average down payment percentage of purchase price stayed mostly flat, the average dollar amount dropped 10% from the previous quarter, according to LendingTree.

October 26 -

High property values and low mortgage rates pushed commercial and multifamily originations beyond their projected totals in 2017 to a new market peak, according to the Mortgage Bankers Association.

October 25 -

After falling to its lowest level in over 12 years, servicers expected September's surge in delinquencies following the damage of Hurricane Florence, according to Black Knight.

October 24 -

With home values nearly doubling income growth in the last 20 years, it's now taking homebuyers 7.2 years to put together a down payment, according to Zillow.

October 23 -

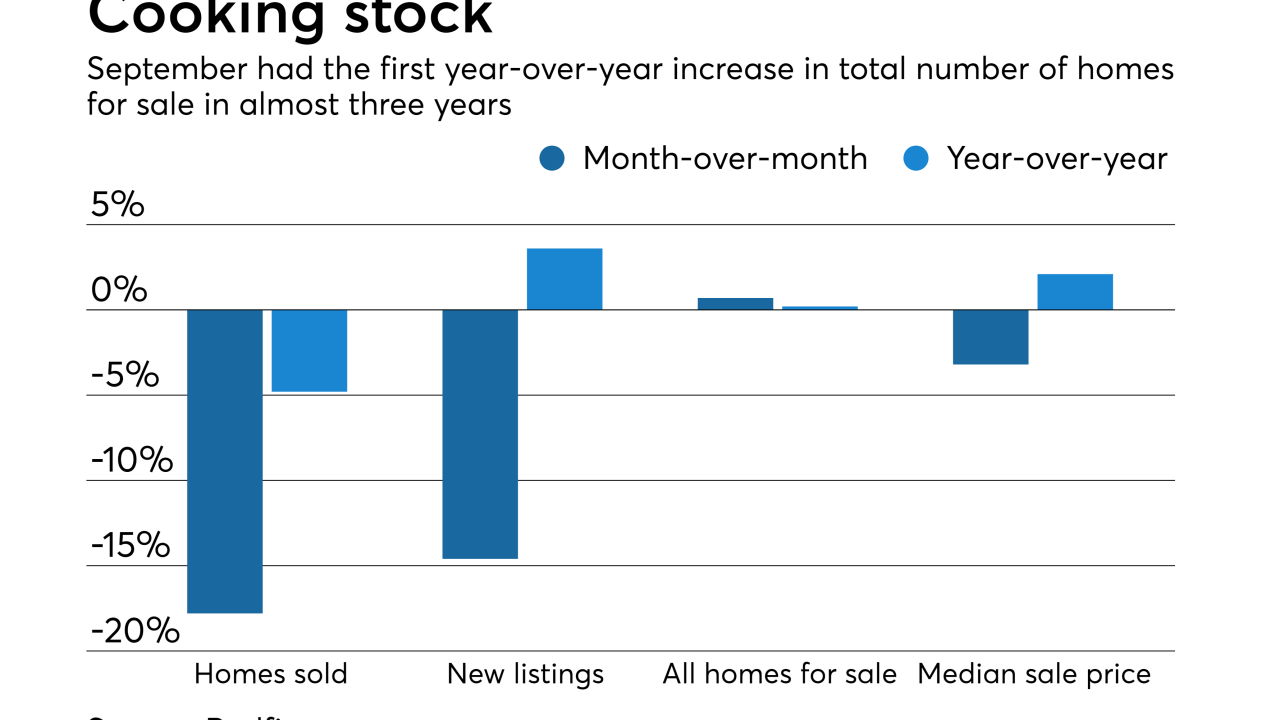

Declining home sales and high mortgage rates led to a year-over-year increase in housing stock in September, according to Redfin.

October 22 -

As mortgage rates recently hit their highest point in seven years, closed refinances fell back to their low point of 2018, according to Ellie Mae.

October 19 -

Despite mortgage rates at a seven-year high and rising home prices and low inventory that are keeping consumers from buying homes, rental prices are declining in many markets.

October 18 -

Former Chair Janet Yellen defended the Fed, expressed worry for the economy and gave advice to women on the rise at the MBA Annual Convention this week.

October 17 -

It's a critical time in Washington, with many key institutions in the mortgage and housing industries getting new leaders. At the Mortgage Bankers Association, there's a renewed focus on maintaining effective influence with decision makers on initiatives like housing finance reform, innovation and the evolving needs of home buyers.

October 14 -

From discussing the future of mortgage tech to debating the shifting sands of political policies, here's a preview of the big issues, topics and ideas when the industry gathers in the nation's capital for the Mortgage Bankers Association's Annual Convention & Expo.

October 12 -

Total Expert will use its new $20 million venture capital investment — led by Emergence Capital — to build out its Marketing Operating System, designed for the future of financial services.

October 11 -

While September had a steady yearly rise in home prices, the month-to-month growth is slowing down, according to Quicken Loans.

October 10 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

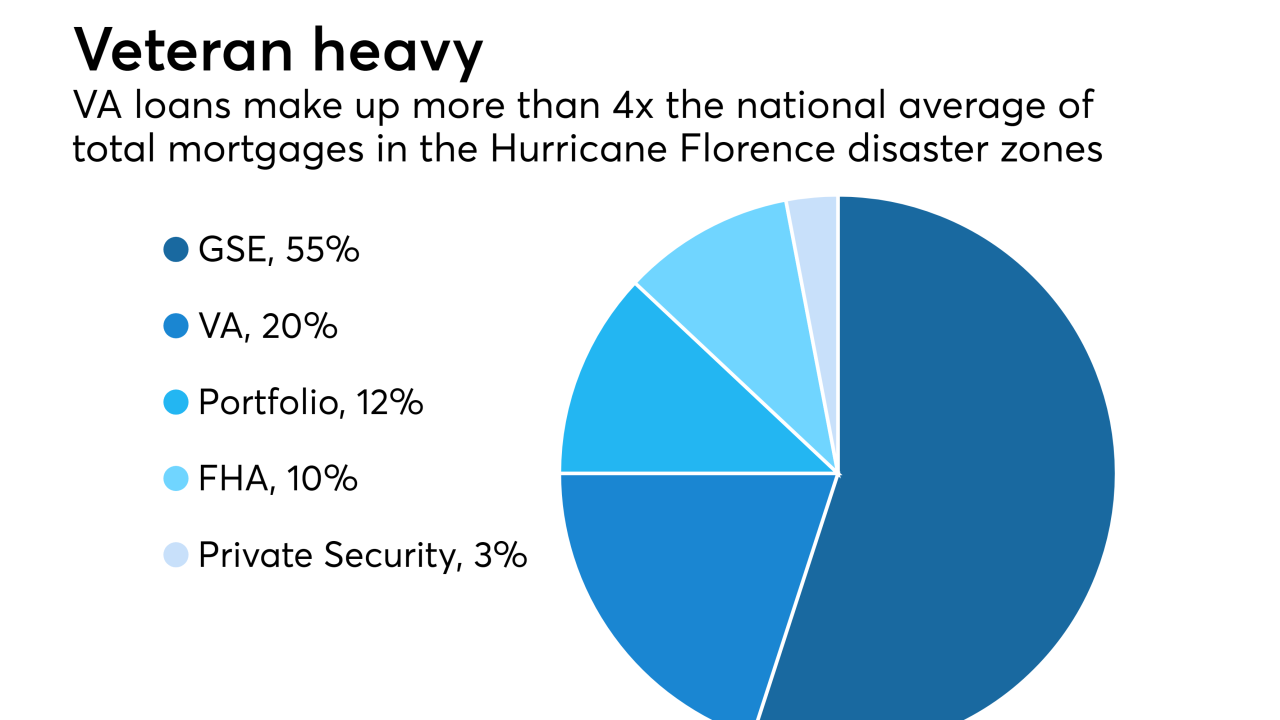

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

Here's a look at the 12 cities with the biggest gap between the current wages needed to buy a home and the historical average, a sign a housing bubble might be brewing.

October 4 -

While digital expansion of the mortgage application process increases convenience, it inherently comes with the downside of heightened fraud risk.

October 3 -

If California voters approve Proposition 10 in November, the ramifications will be felt on the state's affordable housing, according to the Mortgage Bankers Association.

October 2 -

As more sellers lower their asking prices and competition eases, the share of homes sold above their listing keeps declining, according to Redfin.

October 1 -

Rising home prices and the depleted housing inventory led to another drop in pending home sales, according to the National Association of Realtors.

September 28