-

Flagstar Bank expects to recover $1 million of its loan to defunct reverse mortgage lender Live Well Financial following the sale of the collateral that secured it.

September 19 -

Seven real estate companies are now facing age-discrimination complaints over allegations they used advertisements posted on Facebook to filter out potential clients over a certain age.

September 19 -

The agency put to rest speculation that it might take the database offline, yet new disclosure statements are meant to combat the notion that a complaint proves a company’s guilt.

September 18 -

The agency's director told congressional leaders and staff that she backs a Supreme Court challenge to the bureau's leadership structure.

September 17 -

Senate Democrats are warning the Consumer Financial Protection Bureau to be careful as it considers changes to its mortgage underwriting rules.

September 17 -

Lower rates and signs that more affordable housing inventory is being built drove Fannie Mae's 2019 origination numbers higher in its latest forecast.

September 17 -

The FHFA can go beyond a recent Trump administration report to level the playing field between the private sector and Fannie Mae and Freddie Mac.

September 17 American Enterprise Institute Housing Center

American Enterprise Institute Housing Center -

It would cost nearly $30 billion to rebuild the tens of thousands of homes that are most vulnerable to wildfires in the Sacramento metropolitan area, a projection that ranks California's capital region fourth highest in the nation for wildfire risk, according to CoreLogic.

September 17 -

With the qualified mortgage patch expiring and a recession likely, wealth inequities that have hurt black and millennial homeownership could worsen, according to the National Association of Real Estate Brokers.

September 16 -

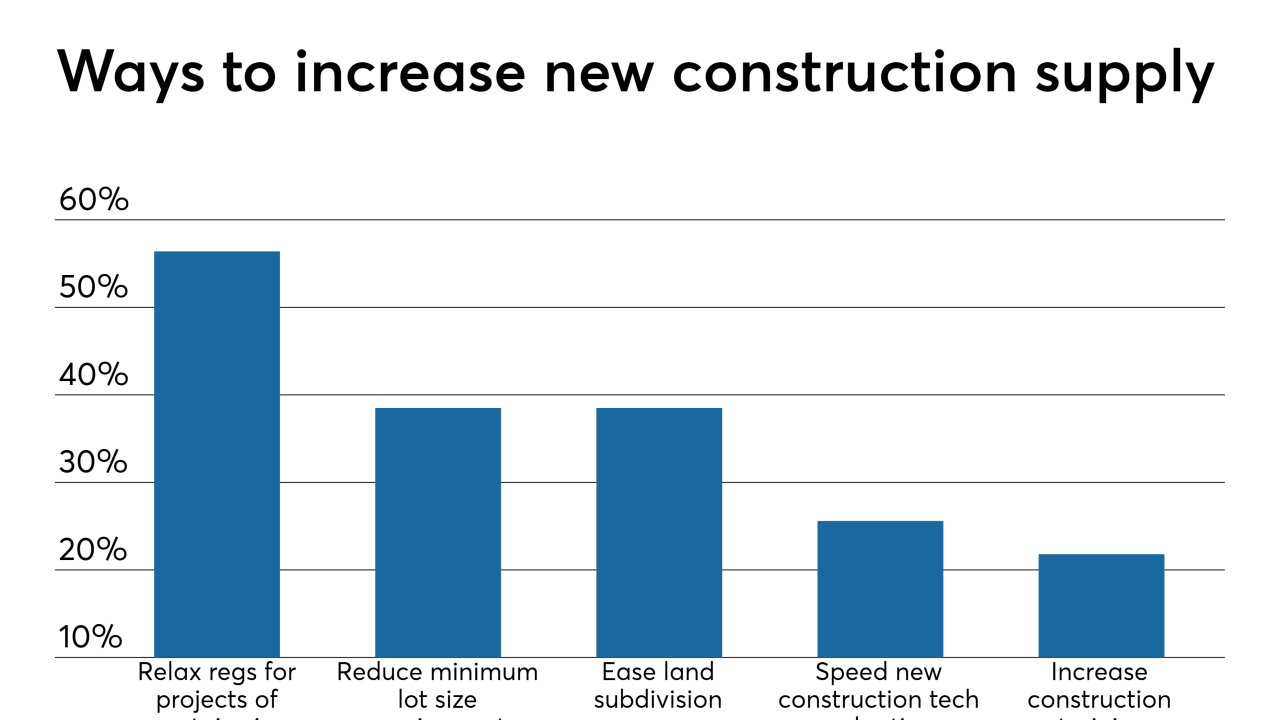

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16