America's real estate meccas aren't what they used to be as COVID-19 revives U.S. mobility.

-

The mortgage industry comes together to address current issues and prepare for a post-COVID marketplace Sept. 14 to 17.

September 4 -

Individuals who received a coronavirus stimulus check earlier this year also qualify for the protection, as do couples who jointly file their taxes and expect to earn less than $198,000.

September 1 -

Gov. Gavin Newsom late Monday signed a stopgap measure to rein in evictions, offering limited protections for tenants and aid to landlords hit financially by the coronavirus pandemic.

September 1 -

America's real estate meccas aren't what they used to be as COVID-19 revives U.S. mobility.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

Tight inventory and unstoppable buyers pushed Bay Area median home prices higher in July, ignoring the economic drag of the pandemic.

August 31 -

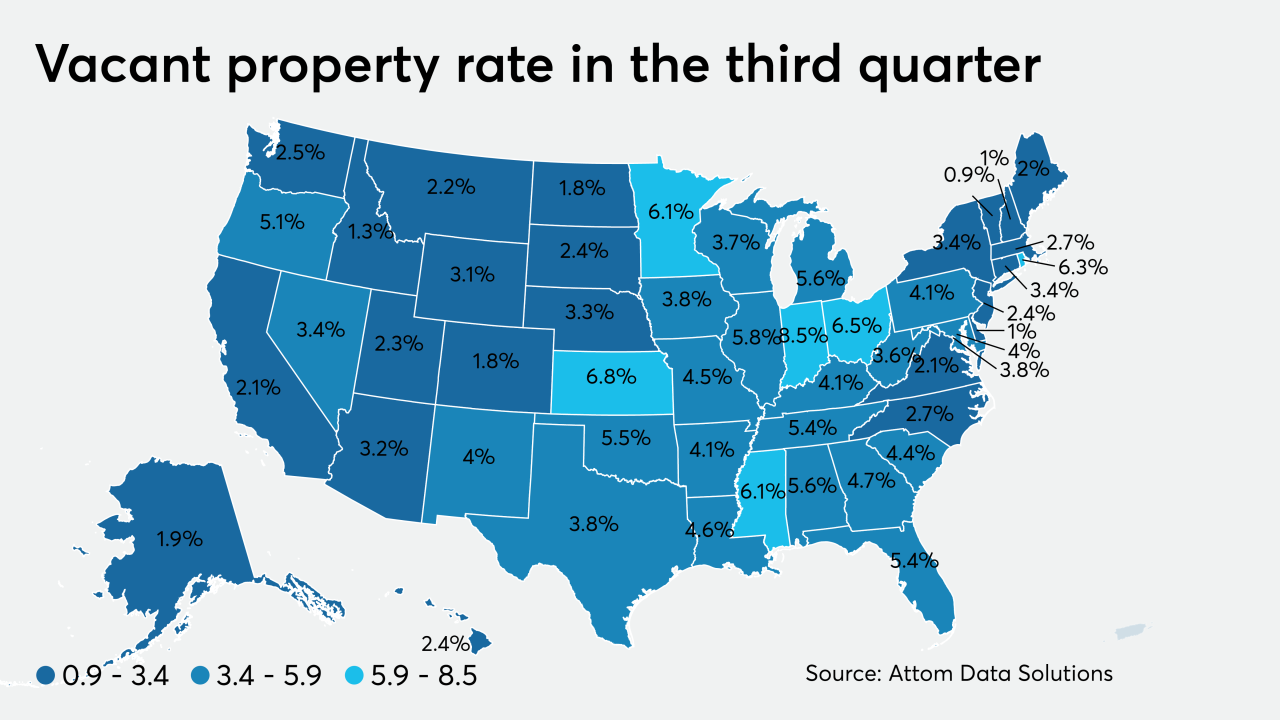

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

Many mortgage companies are hoping to operate remotely through year-end and are asking regulators for relief to that end.

August 27 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

Three non-QM deal issuers in August report varying levels of progress in moving borrowers from expired forbearance programs.

August 27