-

A deep understanding of the history of racial discrimination in both lending and technology is a prerequisite to the development of new technologies, panelists said.

September 16 -

Electronic notes did come in handy this year given the mortgage industry's need to operate remotely, but they also increase the government-sponsored enterprises' responsibility for monitoring the risk of multiple counterparties.

September 15 -

Any roadmaps for client service that existed before the pandemic have changed, according speakers at DigMo2020.

September 15 -

The government-sponsored enterprise’s seller/servicer guide is now integrated into the online portal. Freddie also improved the readability of loan-level reporting it provides, and has further changes in the works.

September 15 -

Quicken Loans president and COO, Bob Walters, provided the first keynote of the 2020 Digital Mortgage Conference and gave insight into how this year changed the industry.

September 15 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

Many states currently have temporary work-from-home guidance for licensed mortgage professionals that extends through at least Dec. 31, but some have fall expiration dates.

September 14 -

Jonathan Corr's departure from the nation's largest loan origination system company follows the completion of its sale to Intercontinental Exchange.

September 11 -

From an increased interest in outdoor space to a need for a dedicated home office, the pandemic has created new drivers for refinancing, moving and other housing decisions, TD Bank found.

September 11 -

The company's remote online notarization provider, Notarize, says it's on track to close $100 billion in mortgage volume over the next 12 months.

September 10 -

The final version of the amended rule, like the original proposal, makes fair lending claims tougher to prove; but it does soften language that otherwise might have allowed mortgage companies to use algorithms to prove nondiscrimination.

September 9 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

Today there are 1 million fewer Americans in forbearance than there were at the peak in May, according to Black Knight.

September 4 -

The mortgage industry comes together to address current issues and prepare for a post-COVID marketplace Sept. 14 to 17.

September 4 -

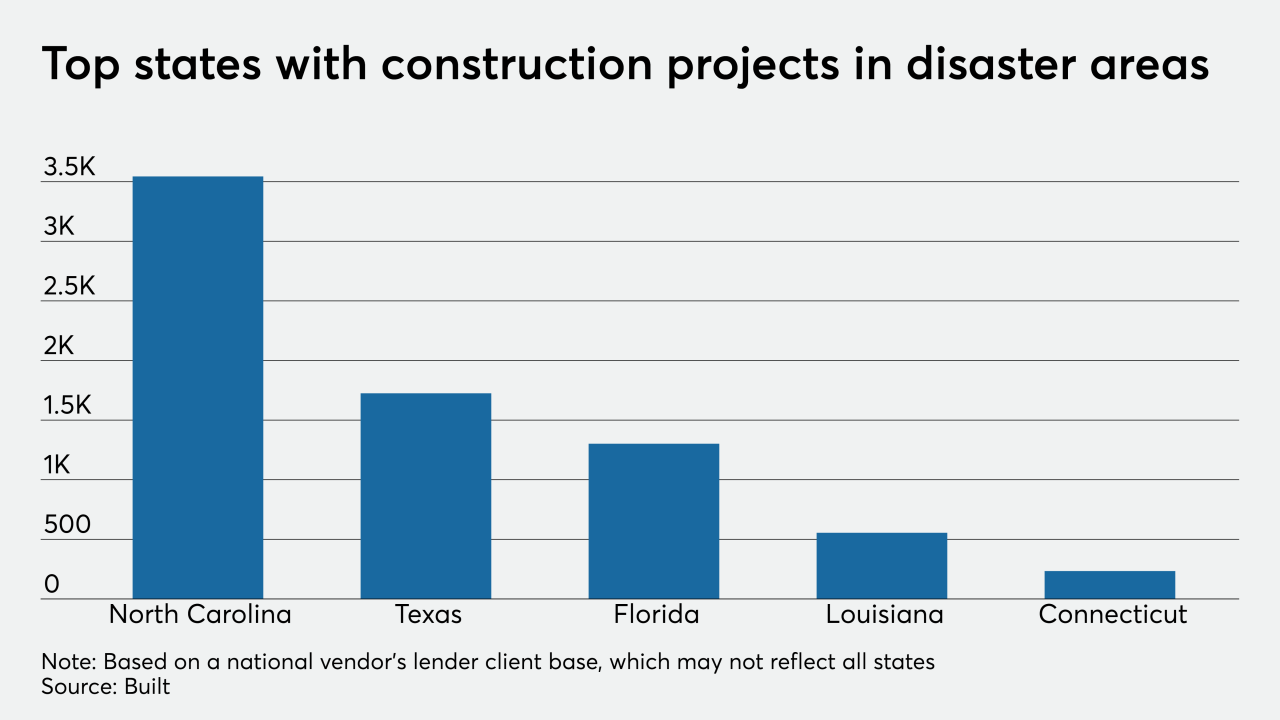

The technology company arrived at this percentage by mapping federally declared disaster areas to the projects it helps lenders manage.

September 3 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

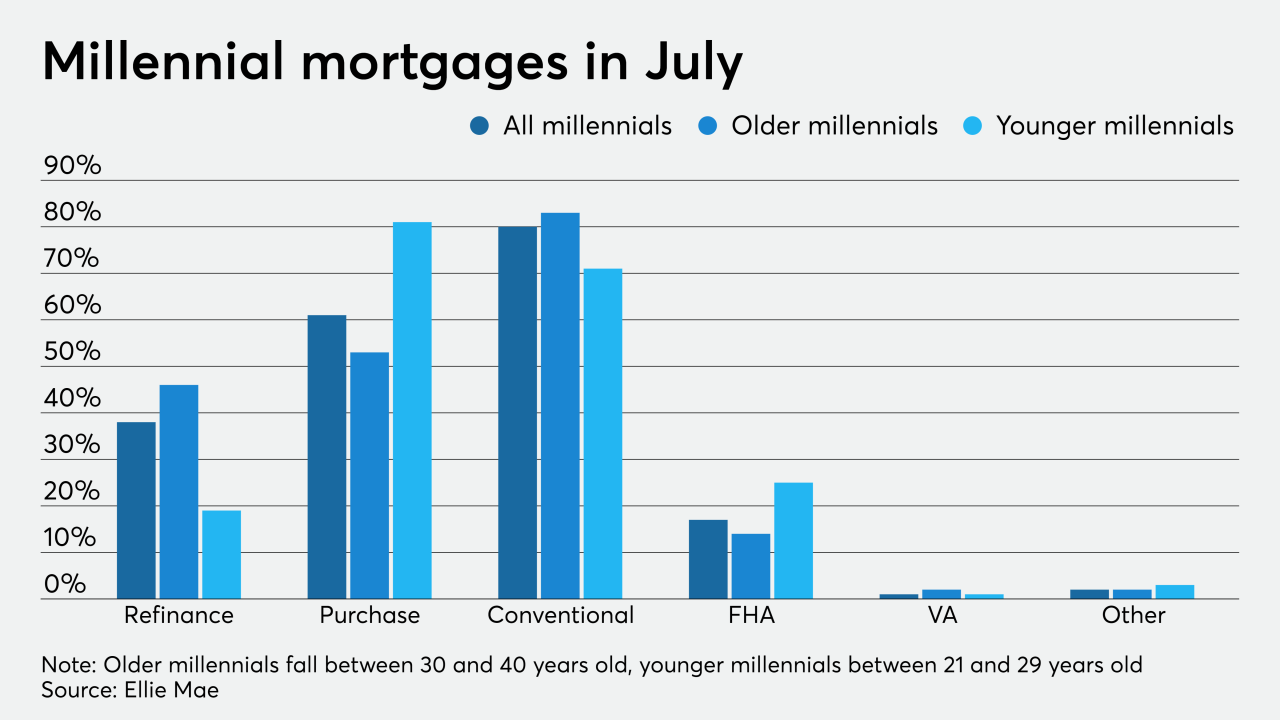

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

The decision is the latest development in an ongoing dispute between the shuttered company and its regulator.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

Cannae and Senator said they are looking to stop CoreLogic from unilaterally cancelling a vote on changing the members of its board.

August 31