-

Vista Equity Partners is considering the potential sale of a stake in Finastra in a deal that could value the financial technology company at more than $10 billion including debt, people familiar with the matter said.

October 7 -

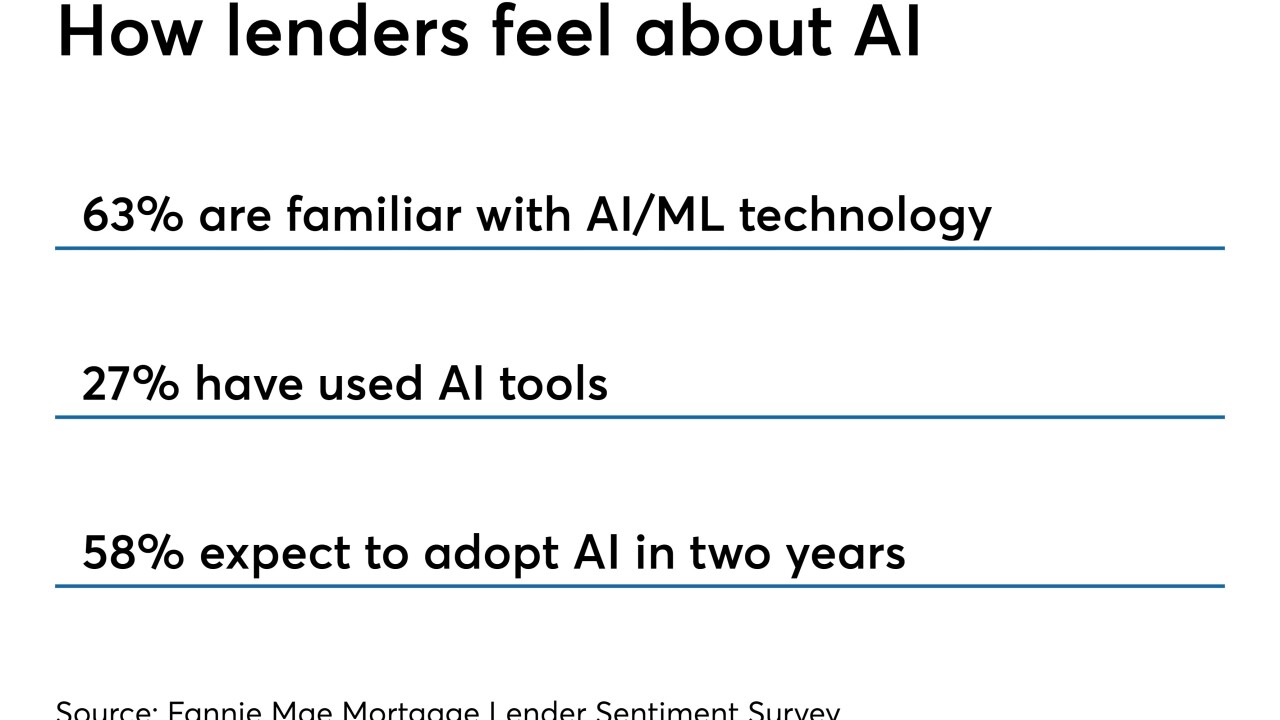

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

Freddie Mac is increasing the number of companies offering merged reports from the credit bureaus through integrations with its Loan Product Advisor automated underwriting system.

September 30 -

Although they still lag behind the rest of the mortgage industry, brokers are embracing advancements in technology in ways that could help build their business.

September 25 -

From its greatest potential to adoption challenges, here’s a look at what attendees at the Digital Mortgage Conference 2019 had to say about artificial intelligence.

September 24 -

By joining forces, Cloudvirga will integrate its digital mortgage software with Exos' cloud technology to enhance customers' desire for self-service during the transaction.

September 24 -

Business intelligence software from a compensation management technology provider and an auto-fulfillment service for disclosures were among new offerings introduced by companies at Digital Mortgage.

September 24 -

A mortgage company's dispute with Connecticut over what tasks a licensed loan officer needs to handle points to a potential compliance concern for direct and digital lenders seeking to maximize efficiencies.

September 24 -

With the mortgage industry inching closer to full digitization, lenders need to strike the right balance of man-versus-machine as borrowers still look to leverage human interaction during the origination process.

September 20 -

The most successful mortgage originators will use artificial intelligence and machine learning to enhance and enable their people to have better, more meaningful engagements with customers.

September 20 Total Expert

Total Expert -

Self-service technology gives borrowers the control, speed and convenience they desire, while providing lenders with higher origination volume.

September 18 Finastra

Finastra -

Freddie Mac is partnering with Finicity to give lenders access to a new automated process that advances efforts to consolidate borrower-authorized data validation checks used in the secondary market underwriting process.

September 18 -

The Digital Mortgage Conference is heading back to Las Vegas on Sept. 23-24 to tackle technology across all sectors of the market. From a live demo competition to innovative insights, here's what to expect at this year's event.

September 12 -

Digital mortgage strategies do more to support loan officers than some people think, according to Tom Wind, executive vice president of consumer lending at U.S. Bank.

September 12 -

A new company called Simplist is brokering mortgages using a mix of data, analytics and processes designed to help render quick, cost-effective decisions on a wide range of loans.

September 11 -

With more rate-and-term refinancing in the mix, home lenders did a better job of retaining borrowers in the second quarter, but there's still room for improvement.

September 9 -

Like many regional banking companies, Huntington Bancshares casts itself as a community bank, albeit one with more than $100 billion in assets.

September 9 -

The Mortgage Industry Standards Maintenance Organization has released a dataset designed to prepare lenders for a new mortgage application and automated underwriting system upgrades at Fannie Mae and Freddie Mac.

September 5 -

A final rule on residential appraisals published this month could save depositories time and money in the short term, but potentially increase collateral risk.

August 30 -

From consumers straying from certain cities to regulations dictating how homes are built, here’s a look at how climate change is shaping the housing market.

August 29