-

From a housing market in turmoil and the technology to save it to the myriad new faces in both the industry and Washington, here's a look back at some of the biggest and most read mortgage and housing stories of 2018.

December 21 -

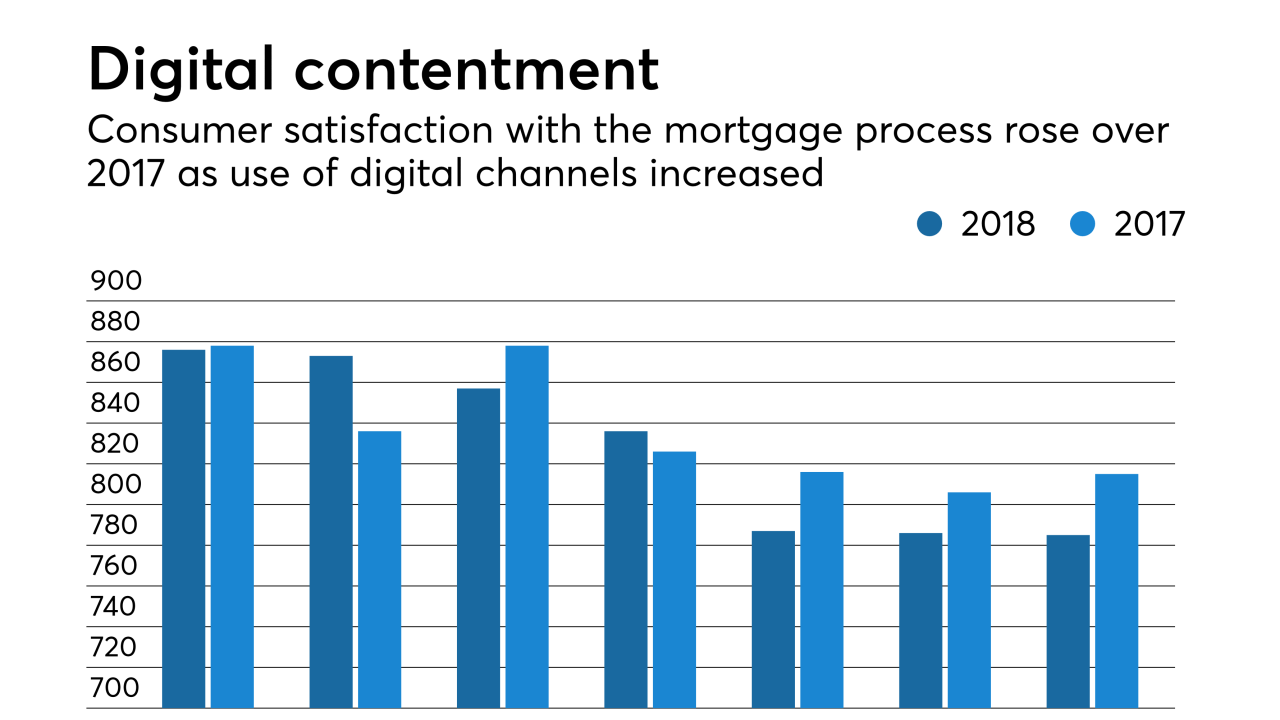

Consumers traditionally pick the lender with the best rate and the lowest payment, but in a competitive marketplace, the customer's digital mortgage experience is often the first tiebreaker.

December 19 Notarize

Notarize -

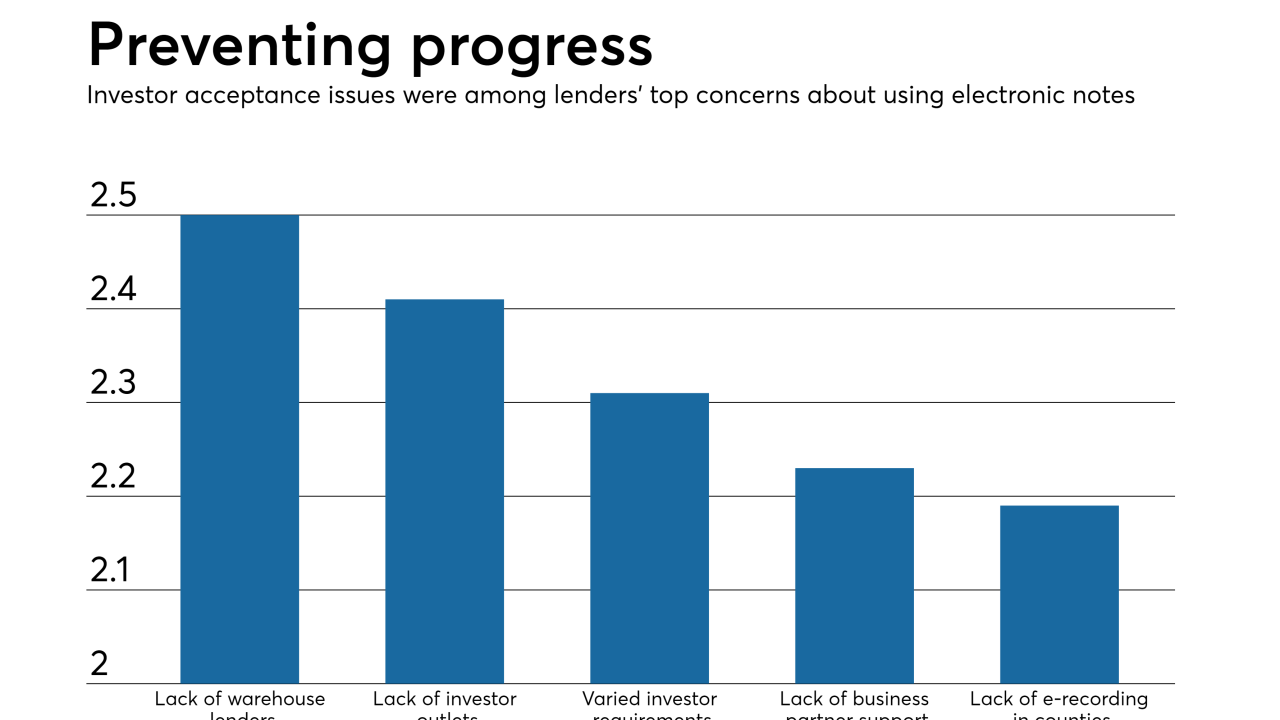

Texas Capital Bank, which already provides warehouse financing for e-mortgages, will now purchase these loans off those lines as it looks to increase liquidity for this product.

December 12 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

Fintech adoption among real estate and title agents is accelerating, though their optimism on the housing market has tanked, according to First American Financial Corp.

November 27 -

Greenway Mortgage, a New Jersey lender that pledges to support charitable causes, is launching a consumer-direct digital mortgage division that will specialize in one-stop shopping for home renovations.

November 27 -

Private mortgage insurers are moving away from traditional rate cards in favor of more granular risk-based pricing to make their products more competitive and efficient for lenders.

November 26 -

Minorities are still charged more for mortgages when all other applicable credit factors are equal — both in person and online, according to a new study by the University of California, Berkeley.

November 26 -

Ellie Mae plans to more quickly adapt to an evolving digital mortgage landscape with Amazon's help rebuilding from the inside-out.

November 26 -

In the latest example of how companies that control a significant portion of the home buying process can weave digital innovations throughout the customer experience, online real estate and mortgage company Redfin will implement electronic closing technology from Notarize.

November 15 -

Mortgage fintech LoanSnap launched VA Smart Loans, which will provide personalized options to current and former service members applying for a Veterans Affairs-guaranteed mortgage.

November 15 -

Online personal lending pioneer Prosper is developing a home equity line of credit product that it will offer in partnership with banks. The embrace of traditional depositories marks a departure from fintech lenders that typically seek to disrupt and displace legacy institutions.

November 14 -

-

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

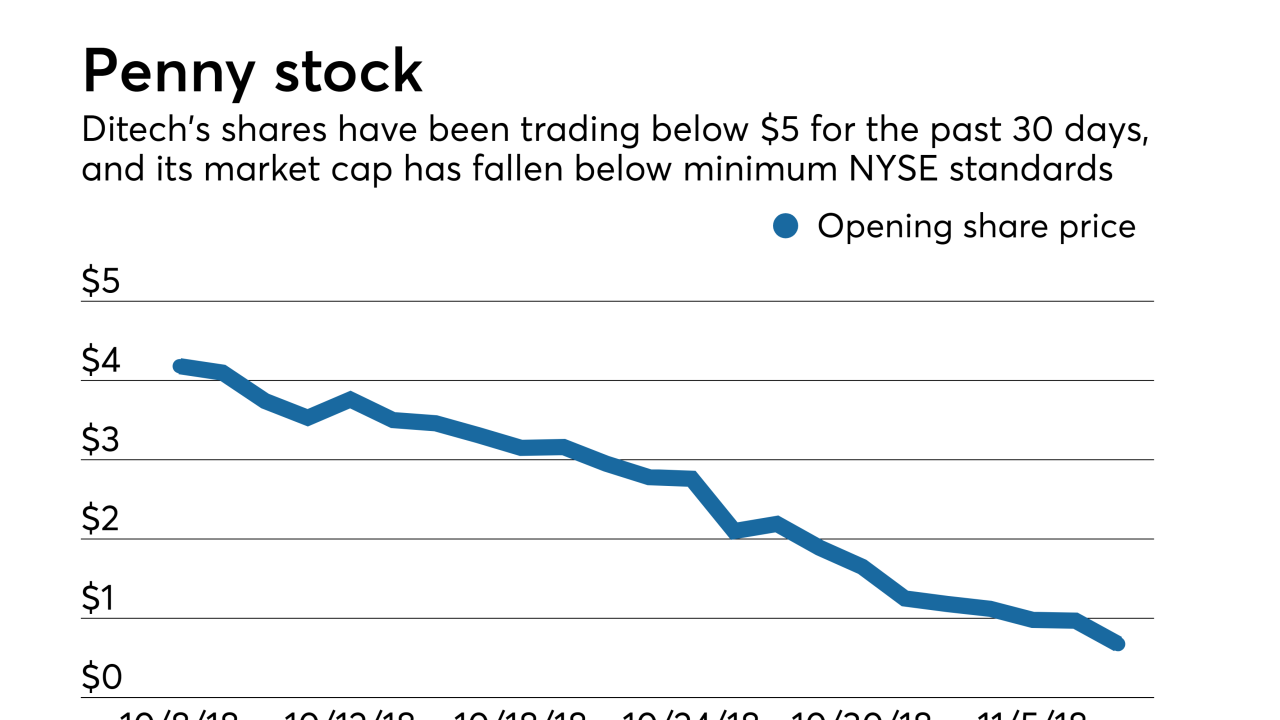

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Texas is expected to be the tipping point in online closing adoption, and title companies predict that e-closings will soon be standard operating procedure.

November 6 NotaryCam

NotaryCam -

-

-

QRL Financial Services, the mortgage outsourcing division of First Federal Bank of Florida, is the latest investor to seek out better secondary market execution by purchasing electronic notes from correspondents.

October 29 -

Larger mortgage companies are paying less than other creditors when fraud occurs, but the expense is still detracting enough from their revenue to cause concern.

October 23